Key Points:

- Daily timeframe showing consolidation.

- RSI and Stochastic Oscillators nearing oversold status.

- Additional bullish impulse wave probable.

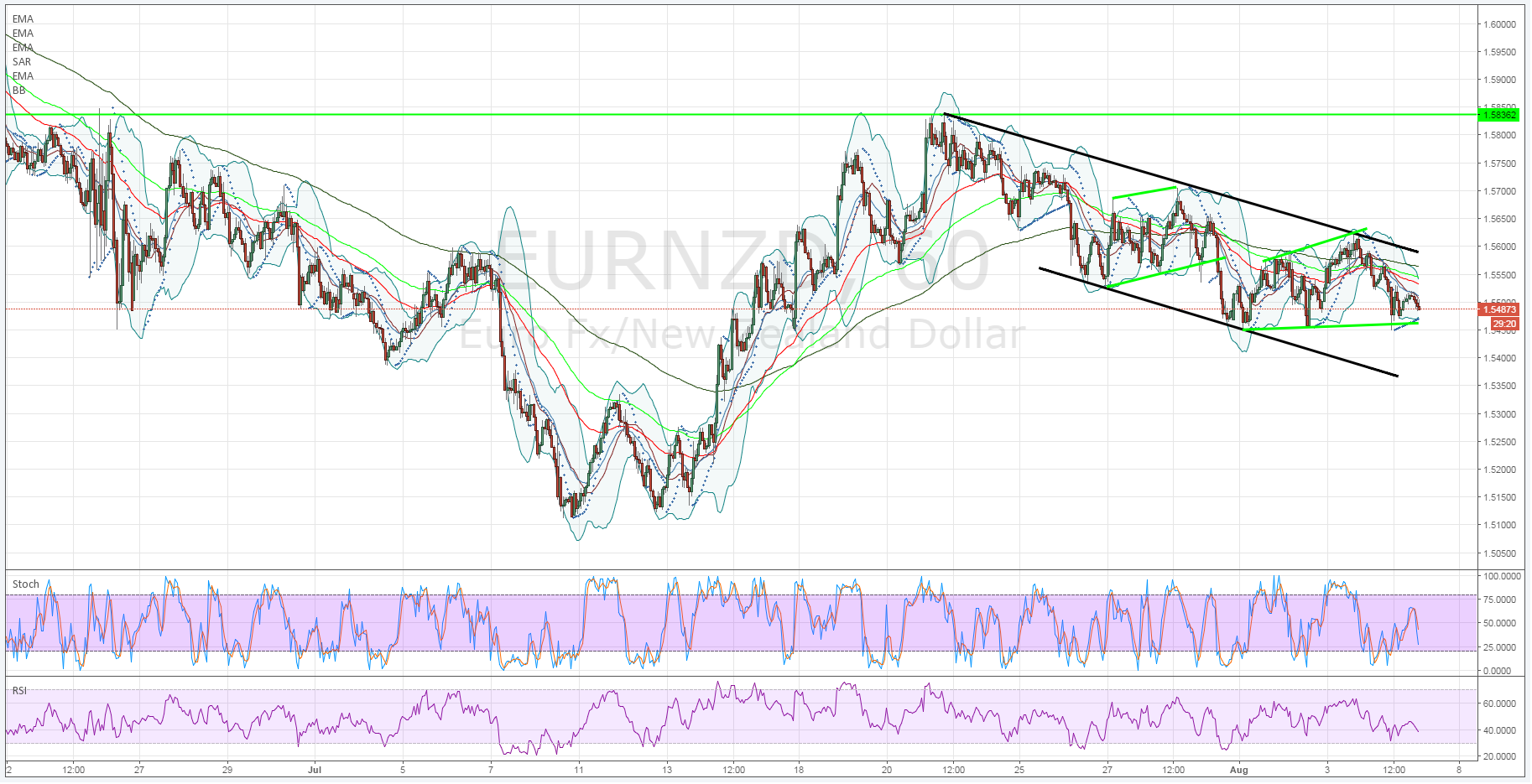

The EUR/NZD has been on a rollercoaster the past few weeks as the pair has reacted to a range of changing fundamental and technical trading conditions. In particular, the pairhas been trending lower, within a descending channel on the hourly chart, as price action has continued to move in an impulse fashion.

However, the daily timeframe has entered a consolidation phase and we may be in the early stages of seeing another bullish leg and potential channel breakout.

Subsequently, a cursory review of the technical indicators and chart patterns clearly demonstrates the descending channel which has been constraining price action. In addition, it becomes abundantly clear that price has been trending lower in an impulse wave fashion whilst remaining within the channel.

Currently, the RSI and Stochastic Oscillators are also nearing oversold territory on the hourly chart which means we are likely to see an additional bullish impulse wave towards the top of the upper constraint. In addition, price action is facing a relatively strong level of support around the 1.5450 level that is likely to cap any further downside moves in the near term.

Subsequently, given the relative closeness of oversold levels, and the fact that the daily timeframe is showing a consolidation phase, it is reasonable to conclude that a bullish impulse wave is next probable event to occur. A strong move would likely take the pair back towards the top of the channel at 1.5574 and any subsequent breach of this level would see the pair invalidating the current bearish trend.

However, there is a fundamental risk event looming in the near term with the Reserve Bank of New Zealand scheduled to decide upon their monetary policy Wednesday next week (21:00 GMT 10/08/16). The overall forecast is for the central bank to cut the official cash rate by 25bps to 2.00% which would likely lead to a NZD depreciation and further support the bullish contention.

Ultimately, the pair is setting up for a sharp change in direction in the short term evidenced by the daily consolidation and oversold oscillators. Subsequently, watch the pair closely for a break above 1.5519, to confirm a bullish impulse wave towards the upper channel constraint, but watch for possible volatility around the RBNZ’s interest rate decision.