Yesterday, we shared our view that despite being down by over 460 pips this month, a bullish reversal can be expected in EURAUD around 1.5500. Now, we are going to take a look at EUR/NZD, which lost even more in November. The pair plunged from 1.7359 to 1.6515 in the last thirty days, following a decline from 1.7929 in October.

In other words, EUR/NZD bears caused a selloff of over 1400 pips in the last two months alone. Should we expect more of the same going into December? Let’s take a look at the pair’s collapse through the prism of the Elliott Wave Principle on the 2-hour chart below.

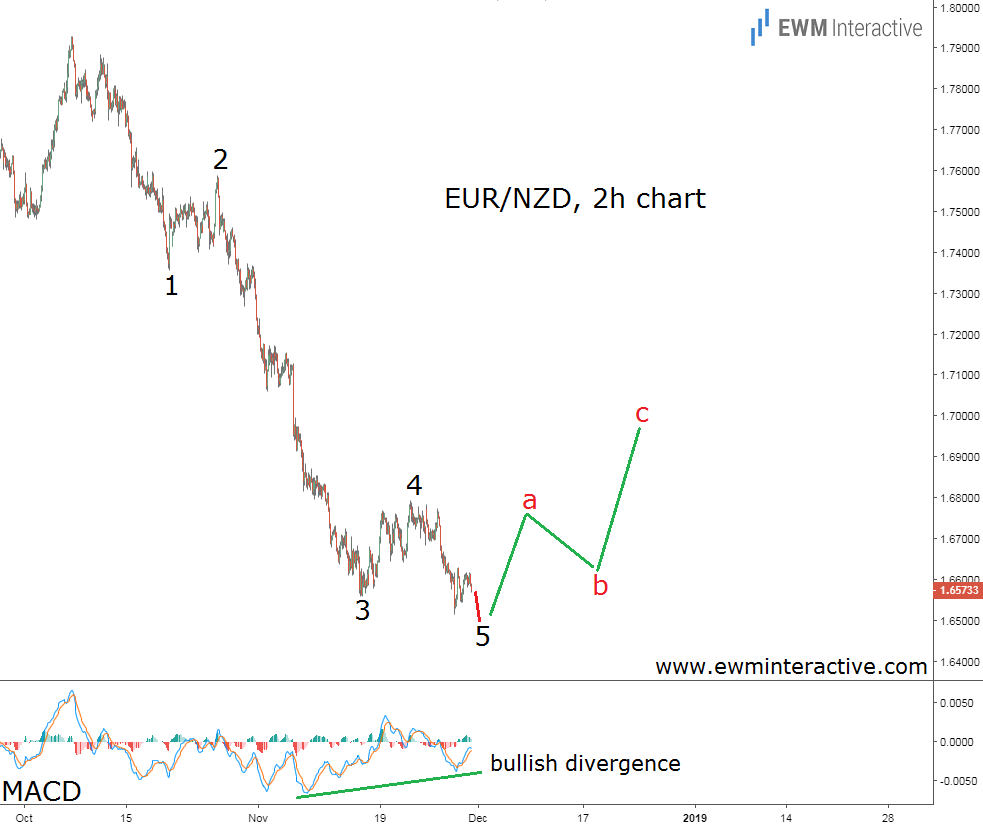

The 2h chart visualizes EUR/NZD’s entire crash from 1.7929 on October 8th to 1.6515 on November 28th. As visible, it has taken the shape of a five-wave impulse, labeled 1-2-3-4-5. The Elliott Wave theory states that a three-wave correction follows every impulse. Unfortunately for traders relying on the downtrend to continue, this means a change EUR/NZD’s direction should soon occur.

The MACD indicator also supports the positive outlook. It shows a bullish divergence between waves 3 and 5 – a strong sign that the bears’ strength is diminishing. The pair recently breached the low of wave 3 and many breakout traders probably saw this as a reason to keep shorting the Euro against the New Zealand dollar. According to the analysis so far, that is a dangerous thing to do.

If this count is correct, EUR/NZD is in a high-risk reversal territory. It is too early to buy and too late to sell, so staying aside is the best thing to do right now. Once the U-turn actually occurs, 1.7000 is going to be within the bulls’ reach going forward.