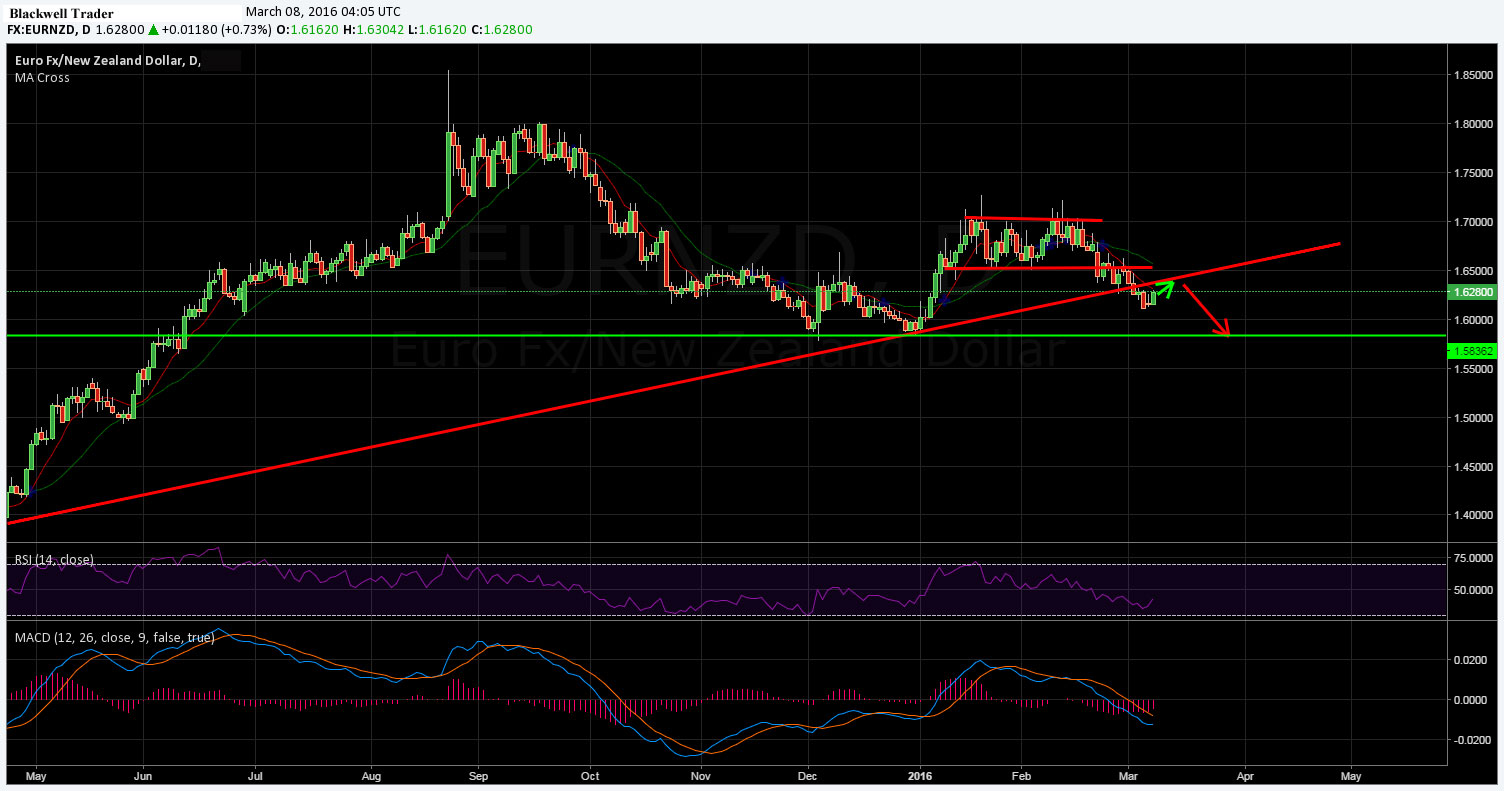

The EUR/NZD currency pair has been relatively quiet of late as price action has been constrained by a corrective structure. However, early March saw the structure break down, as price dropped rapidly through both the channel and the bullish trend line. Subsequently, there is a real chance that price will continue to break down in the coming days, thereby lending itself to short selling.

Taking a look at the pair’s technical indicators demonstrates a currency which is highly biased to the short side. The 12 and 30 EMAs are both indicating bearishness as they rapidly decline, in line with the price action. In fact, the end of February actually saw both price action and the EMAs declining sharply below the 100-day moving average.

The strongest signal of a short play in progress is the breakdown of the long run bullish trend line. Last week saw prices convincingly breach the bullish trend line from April of 2015 which strongly predisposes the currency for further downside moves. Given price action’s current location, a move towards the next major support level at 1.5834 is therefore likely in the coming week.

However, it should be noted that the RSI Oscillator appears to have reached relatively low within neutral territory and may require a small retracement to provide room for any large short pushes. Subsequently, look for price to retrace back towards the trend line, and the 12 EMA, before recommencing a tumble towards our target around the 1.5834 level.

Ultimately, given the strong risk/reward percentage, any potential short play in the EURNZD could reap significant benefits for keen traders. However, do monitor the EUR GDP figures, due shortly, as a surprise result could buoy the currency.