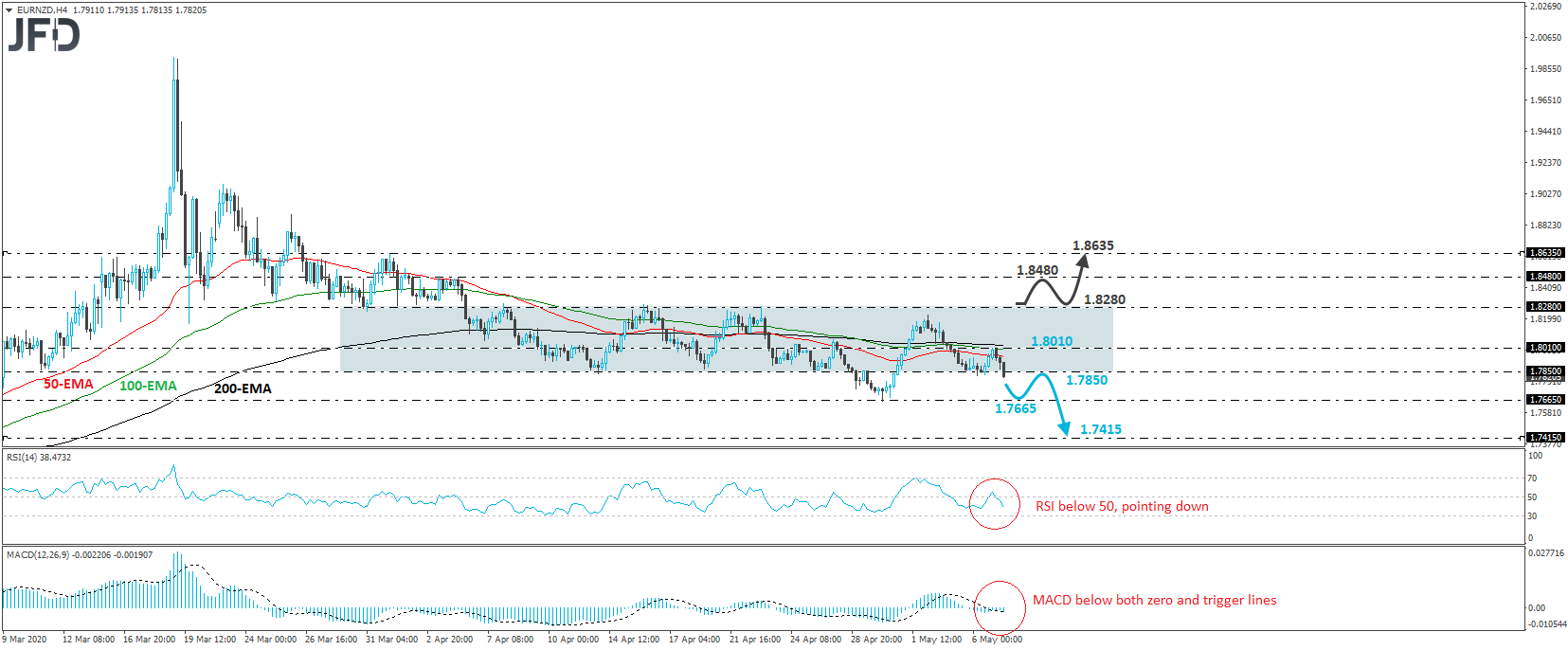

EUR/NZD traded lower on Thursday, breaking below the key support barrier of 1.7850, which also acted as the lower bound of the sideways range that contained most of the price action since April 6th. In our view, the break below the lower end of the range has turned the short-term outlook somewhat to the downside and thus, we will adopt a bearish stance for now.

The break below 1.7850 may have opened the way towards our next support, at 1.7665, marked by the low of April 30th. If the bears are not willing to hit the brakes near that zone either, then we may see the slide extending towards the 1.7415 area, marked as a near-term support by the low of February 28th.

Looking at our short-term oscillators, we see that the RSI dipped back below its 50 line and now points to the downside, while the MACD, already negative, has just ticked below its trigger line. Both indicators suggest that the rate may have started picking up negative momentum and support the notion for some further near-term declines.

On the upside, we would like to see a strong rebound above 1.8280, the upper end of the range, before we start examining whether the outlook has changed to a positive one. The bulls may get encouraged to climb towards the highs of April 3rd and 6th, at around 1.8480, the break of which may allow advances towards the 1.8635 zone, defined as a resistance by the peak of April 1st.