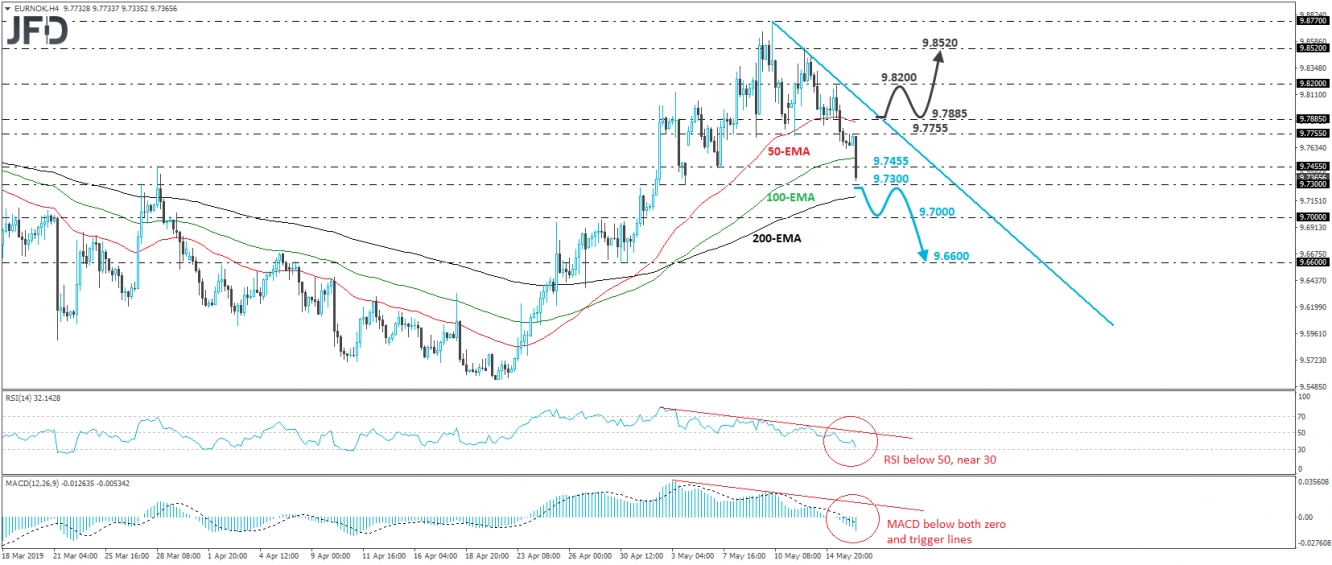

EUR/NOK came under strong selling interest during the European morning Thursday, after it hit resistance near the 9.7755 barrier. After it peaked on May 10th, this pair has been printing lower peaks and lower troughs below a new downside resistance line and thus, we would consider the short-term picture to have turned negative.

At the time of writing, the rate looks to be heading towards the 9.7300 support, defined by the low of May 3rd, which if broken may encourage the bears to drive the battle towards the psychological zone of 9.7000 fractionally above the inside swing highs of April 29th and 30th. If that area fails to halt the slide, its break may set the stage for more downside extensions, perhaps towards the low of April 30th, at around 9.6600.

Both the RSI and the MACD detect strong downside momentum and corroborate the case for this exchange rate to continue drifting lower for a while more. The RSI has been in a sliding mode and could challenge its 30 line soon. The MACD lies below both its zero and trigger lines, pointing south as well.

On the upside, we would like to see a break above 9.7885 before we abandon the bearish case. This could bring the rate above the aforementioned downside line drawn from the high of May 10th and may allow the recovery to continue towards the high of May 15th, near 9.8200. Another break, above 9.8200, may encourage the bulls to put the 9.8520 resistance on their radars. That level stopped the rate from moving higher on May 13th.