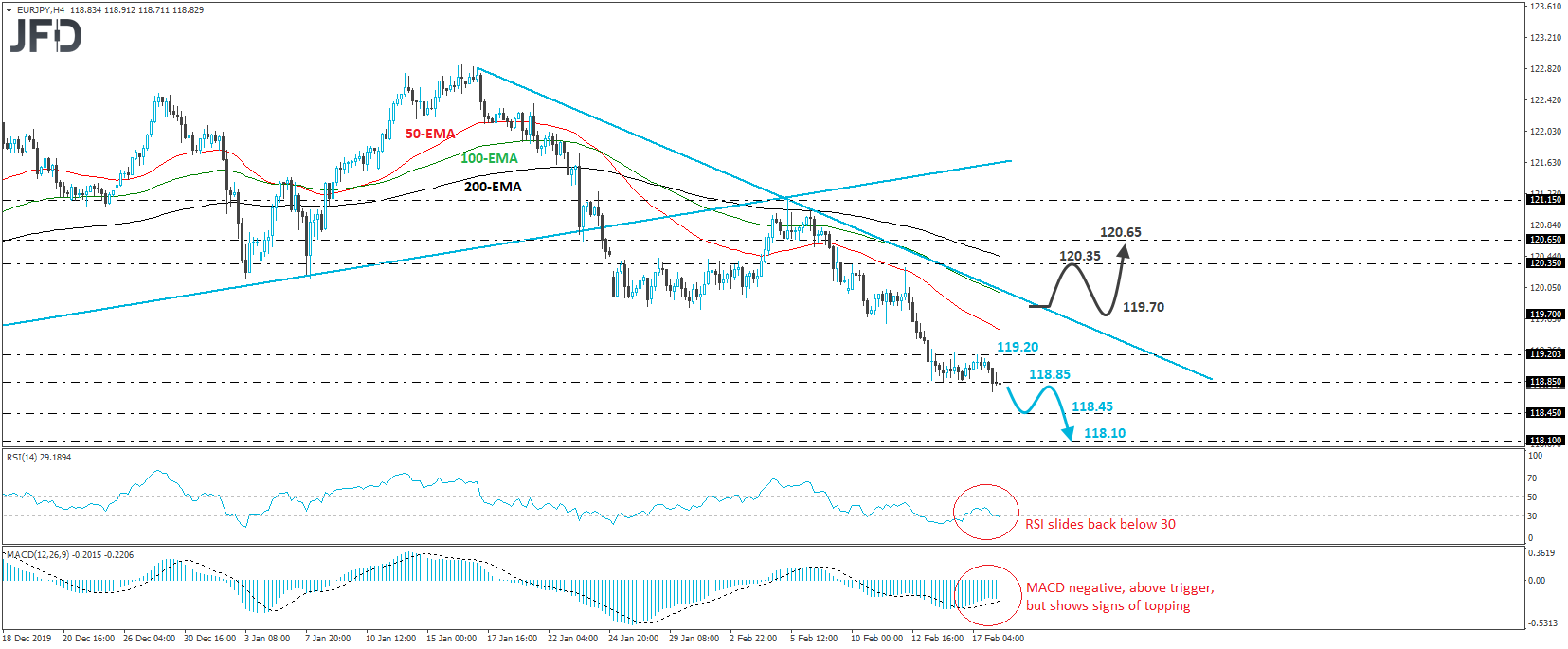

EUR/JPY had been trading in a consolidative manner, between 118.85 and 119.20, since February 13th. Today, the rate dipped slightly below 118.85, but rebounded to oscillate around that zone. Overall, EUR/JPY is trading below the downside resistance line drawn from the high of January 17th, as well as below the prior medium-term upside one taken from the low of September 3rd. So, having all these technical signs in mind, we would consider the short-term picture to be negative.

If the bears manage to distance themselves from the 118.85 hurdle, we could see them diving towards the 118.45 area, defined as a support by the inside swing peak of September 27th. If they are not willing to throw their swords away and push below that level as well, the slide may get extended towards the 118.10 territory, marked by the inside swing high of October 9th.

Taking a look at our short-term oscillators, we see that the RSI turned down and touched its toe back below the 30 line, while the MACD, although above its trigger line, shows signs of topping within its negative territory. Both indicators suggest that the rate may start picking strong downside speed again, which enhances our view for some further near-term declines.

On the upside, we would like to see a strong recovery above the downside line drawn from the high of January 17th before we start examining whether the bulls have gained the upper hand. Such a break may see scope for extensions towards the high of February 10th, at around 120.35. The bulls may decide to take a break after hitting that zone, and thereby allow a setback. Nonetheless, as long as such a potential setback stays limited above the pre-mentioned downside line, we would expect the bulls to charge again and push above the 120.35 zone, perhaps targeting the 120.65 obstacle, marked by the peak of February 5th.