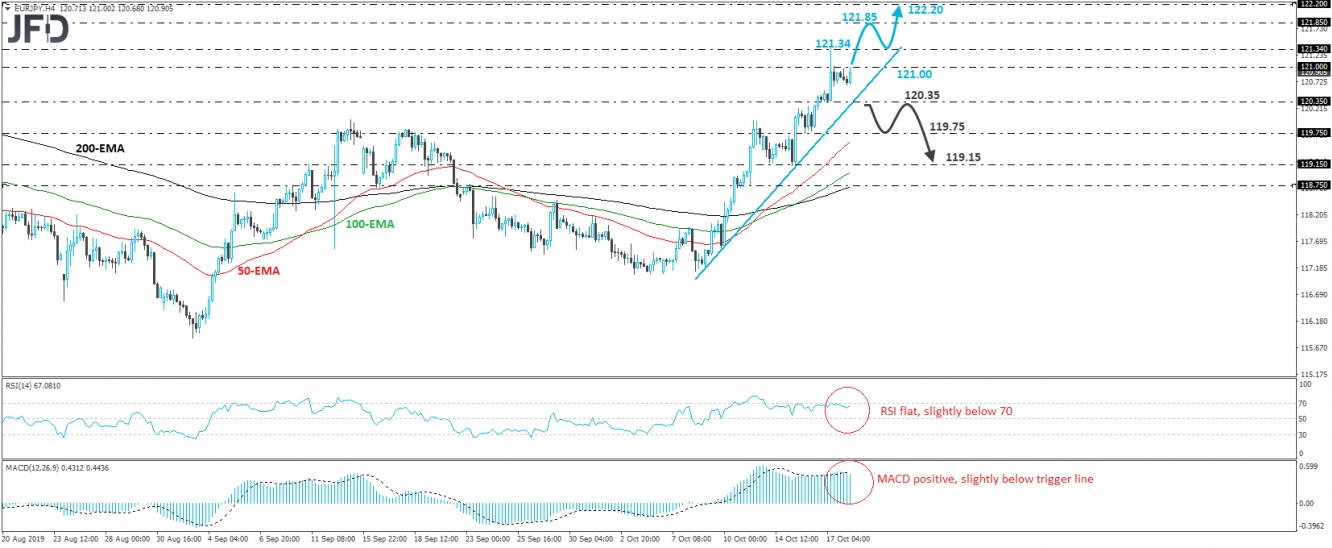

EUR/JPY traded in a consolidative manner today, staying slightly below the 121.00 barrier. Overall, the rate is trading above a short-term upside support line drawn from the low of October 9th, as well as above all three of our moving averages. Thus, we would consider the short-term outlook to be positive for now.

If the bulls are strong enough to overcome the 121.00 level, then we may see them initially aiming for yesterday’s high, at around 121.34. Another break, above 121.34, could carry larger bullish implications and could perhaps see scope for extensions towards the 121.85 zone, marked by the high of July 15th, or the 122.20 area, near the peak of July 12th.

Taking a look at our short-term oscillators, we see that the RSI runs flat slightly below its 70 line, while the MACD, although at extreme positive levels, lies slightly below its trigger line. Both indicators detect positive momentum, but their slowdown suggests that a small pullback may be in the works soon, perhaps for the rate to test again the aforementioned upside support line.

However, in order to abandon the bullish case and start examining the likelihood of a short-term negative reversal, we would like to see a clear break below 120.35. Such a move would also bring the rate below the upside line and may allow declines towards the 119.75 zone, marked by Wednesday’s low. If the bears are not willing to stop near that area either, we could see them pushing for the 119.15 hurdle, which is near the lows of Monday and Tuesday.