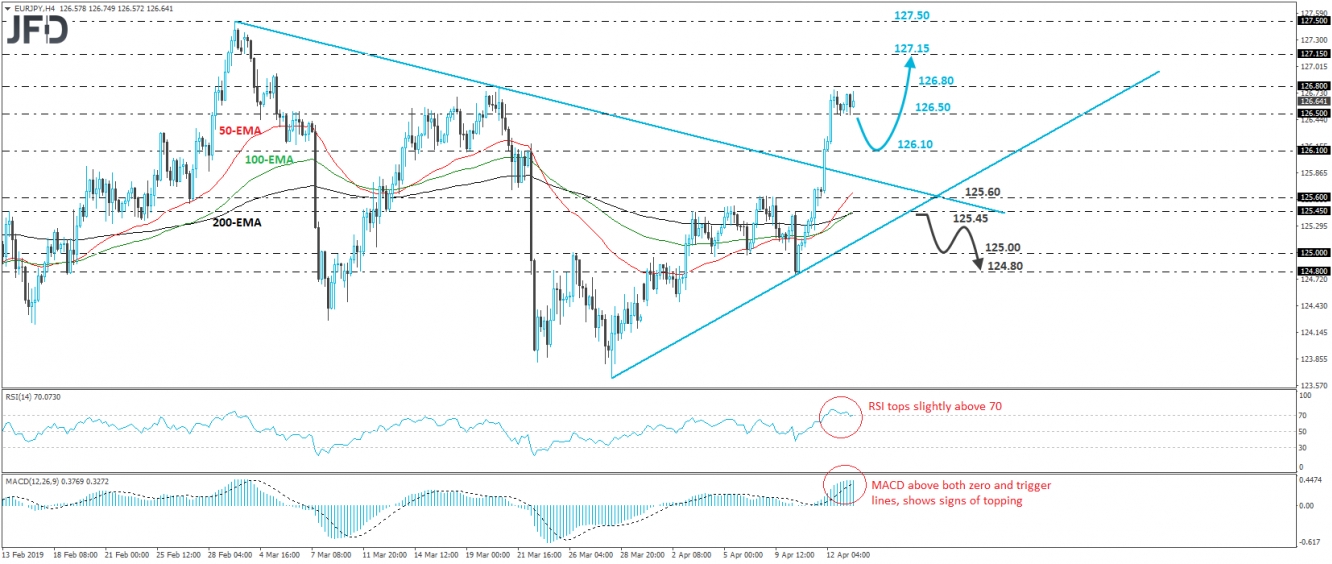

EUR/JPY skyrocketed on Friday, breaking above the downside resistance line drawn from the high of March 1st. That said, the rally was stopped slightly below the 126.80 resistance zone, marked by the peak of March 20th, and today, the rate has been oscillating between that resistance and the 126.50 level. The pair is also trading above a tentative upside support line drawn from the low of March 28th, as well as above all three of our moving averages. So, having all that in mind, we would consider the near-term picture to be positive.

A clear break above 126.80 could confirm the case for further advances and may initially pave the way towards the 127.15 level, marked by an intraday swing low formed on March 4th. If the bulls are not willing to hit the brakes near that zone, then we may see them putting the 127.50 hurdle on their radars, defined by the high of March 1st. That said, bearing in mind that last week’s rally appears overstretched, a corrective retreat may be on the cards before the next positive leg. A dip below 126.50 could confirm the notion and perhaps open the door towards the 126.10 level from where the bulls could jump in again an drive the battle higher.

The case for a corrective setback is also supported by our short-term oscillators. The RSI has topped within its above-70 territory, while the MACD, although above both its zero and trigger lines, shows signs of topping as well.

In order to start examining whether the bears have gained the upper hand though, we prefer to wait for a break below 125.45, a support defined by the inside swing peak of April 10th. Such a dip would bring the rate back below both the aforementioned diagonal lines and could set the stage for the psychological number of 125.00. If that obstacle fails to halt the slide, then we could see extensions towards 124.80, near the low of the same day.