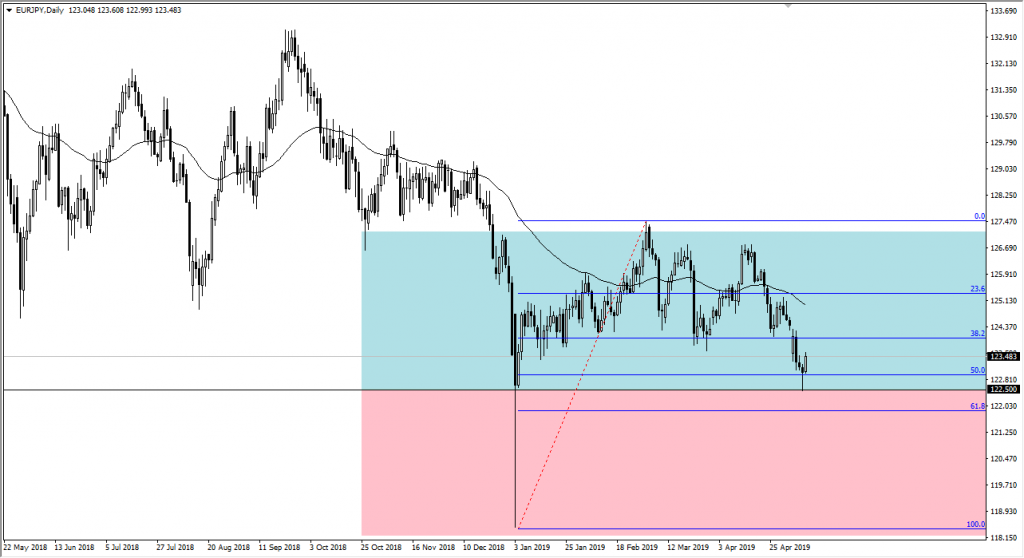

The euro has shown signs of strength finally, after initially dipping rather significantly against the Japanese yen. As you can see from this chart, I have two levels drawn out by putting a pink box and an aqua box. The pink box represents the “sell zone”, just as the aqua box is the “buy zone.”

I am trying to simplify my analysis for my readers by drawing out the charts as such. I will start to produce these types of charts on the blog, giving you an idea as to how I am looking at the market. With the last couple of days, the Euro has shown signs of resiliency, and as a result, I started looking around at the various currency pairs. What I find compelling about this is that there are a few different technical factors lining up at the same time.

While the moving averages aren’t particularly compelling for the buying side, the reality is that we have seen support hold and the vital 50% Fibonacci retracement level, as well as the ¥122.50 level which has been important previously. The hammer that formed on Thursday, of course, doesn’t hurt the situation either, and the Friday candlestick closing towards the top of the range shows that there is the strength to be found.

Looking at the chart, there is a gap from the beginning of the week, meaning that we could go to the ¥124.50 level without much difficulty. If we break above there, then it’s very likely that we go to the other side of the aqua box. However, if we were to break down below the hammer and enter the pink zone, then I believe that the market will continue to drift quite significantly to the downside, perhaps even as low as 118.50 again.

Keep in mind that this pair does tend to be very sensitive to risk appetite, and you should always keep in mind that the EUR/USD pair will have its influence as well. After all, we need to see euro strength against the benchmark to help this pair. Of other concern will be the USD/JPY pair, because it will give us an idea as to how the Japanese yen is doing. If it starts to lose strength against the US dollar, then that should help here as well. All things being equal, it does look like the market is trying to turn around and go to the upside.