Key Points:

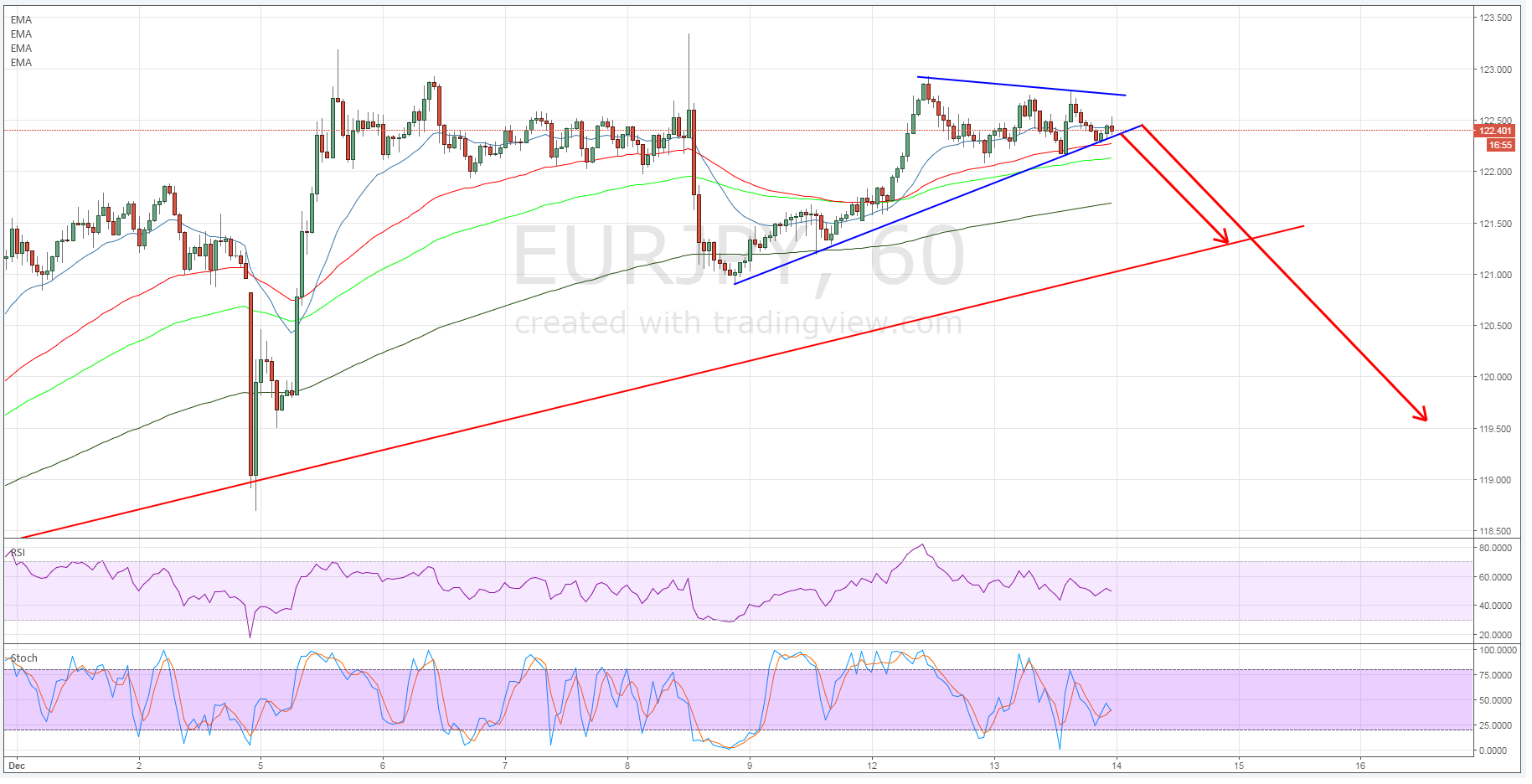

- RSI divergence evident on hourly timeframe.

- Price action challenging lower supporting constraint.

- Expect a breakdown in the coming days.

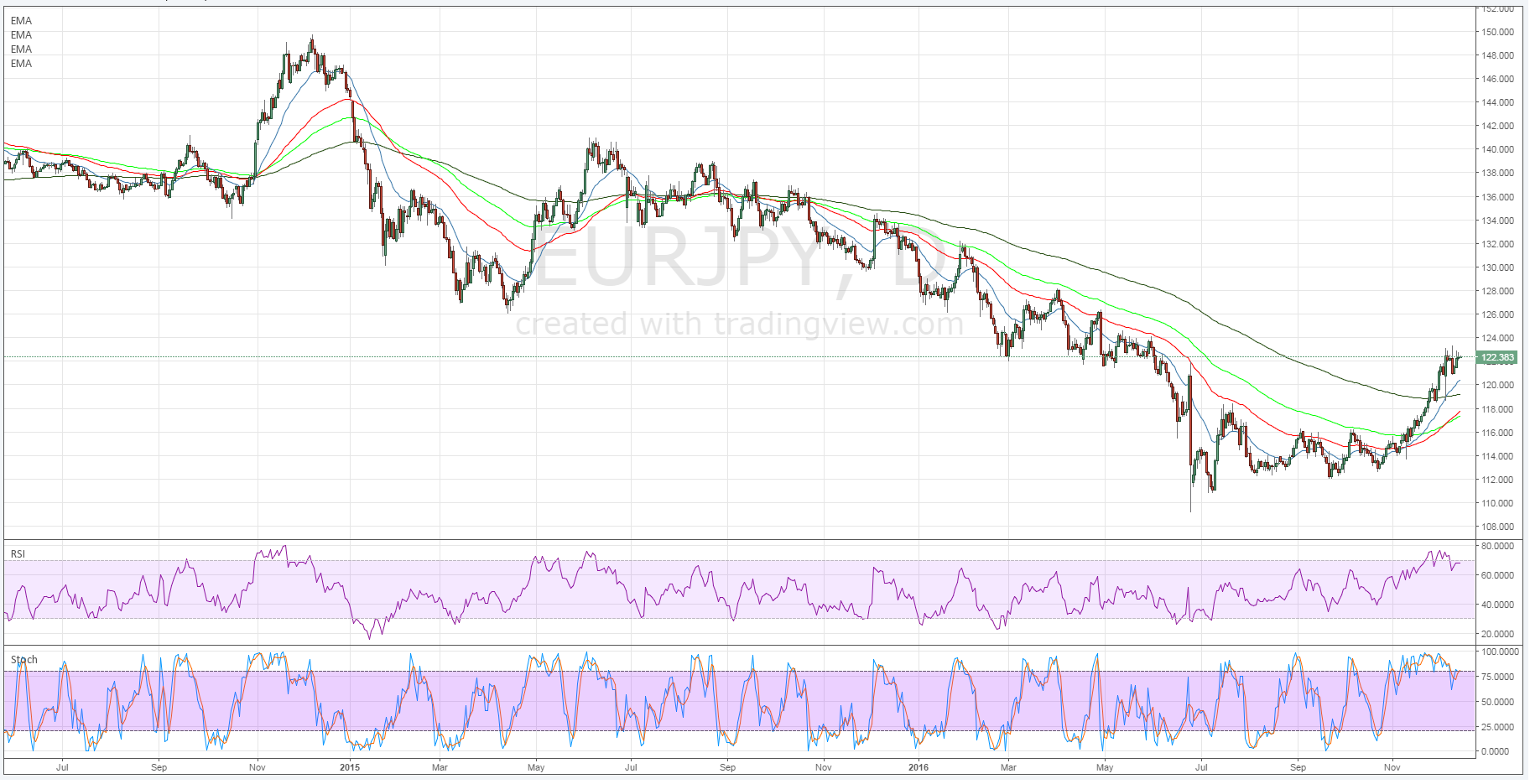

The euro-yen has been one of the recent net beneficiaries of the slew of relatively weak Japanese economic data as the pair has seemingly continued to rise throughout most of November and December. However, the last few days have seen price action reach a critical zenith that could be signalling a short squeeze in play over the coming days.

In particular, a cursory review of the pair’s hourly chart demonstrates the cross that the EURJPY currently faces. The ongoing rally has taken the pair into a key zone of resistance which is going to be relatively difficult for the pair to breach. A wedge pattern has also appeared in the past week which is constraining price action’s movements and likely to bring about a breakout in the coming days.

Also, lending some further credence to a breakdown is the divergence that is currently evident on the 4-hour and daily RSI Oscillator readings. Despite price action remaining relatively buoyant the RSI indicator has continued to decline signalling that there may be some sharp falls to come.This divergence has also been mirrored by the Stochastic Oscillator which has also been trending lower, within neutral territory, over the past few days.

Subsequently, there are some relatively sharp signals pointing to a potential short squeeze in play. The most likely scenario over the next few days is one where price action challenges the short term bullish trend line and collapses towards the 121.50 level. However, the pair will need to surmount the 100 and 200-hr moving averages if it has any chance of gaining some downside momentum.

Ultimately, a breakdown is the most likely scenario moving forward given the current level of divergence amongst the oscillators. Therefore, the short term supporting trend line is likely to be the key battleground in the days ahead if a sharp depreciation is set to comment. However, keep a close watch on the coming US FOMC announcement as it could stoke volatility throughout much of the market.