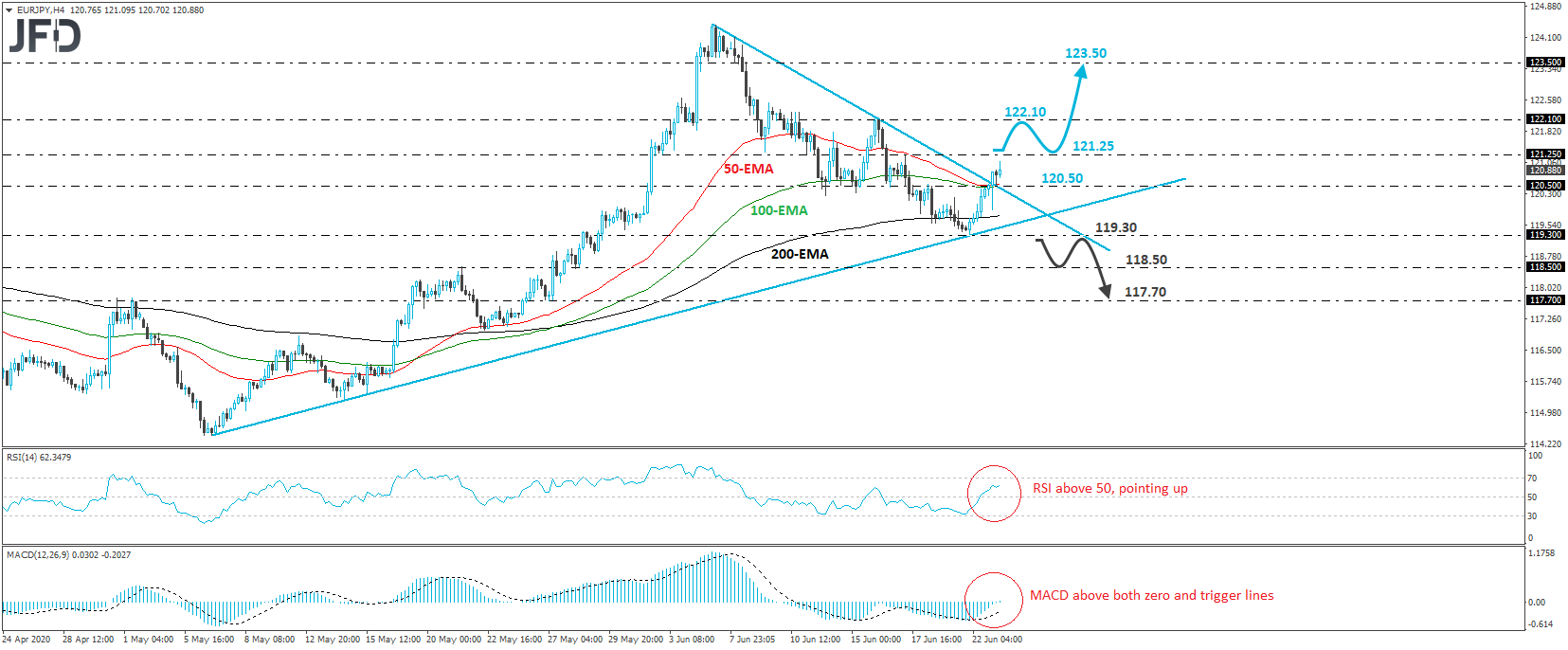

EUR/JPY traded higher on Tuesday, breaking above the downside resistance line drawn from the high of June 5th. The recent recovery started yesterday, when the rate hit support at the crossroads of the 119.30 level and the upside support line drawn from the low of May 6th. Thus, bearing in mind that it continues to trade above that line, and also that it broke the short-term downside one, we would consider the near-term picture to be positive.

If the bulls are willing to stay behind the steering wheel, we may see them soon emerging above the high of June 17th, at 121.25, a move that could pave the way towards the high of the day before, at around 122.10. Another break, above 122.10, may carry larger bullish implications, perhaps setting the stage for extensions towards the 123.50 zone, near the inside swing low of June 5th.

Looking at our short-term oscillators, we see that the RSI stands above 50 and points up, while the MACD, already above its trigger line, has just poked its nose above zero. Both indicators detect positive momentum and corroborate our view for some further advances in the near term.

In order to start examining whether the bears have stolen the bulls’ swords, we would like to see a dip below 119.30. Such a move would not only confirm a forthcoming lower low, but would also take the rate below both the aforementioned diagonal lines. The bears may then get encouraged to shoot for the low of May 28th, at 118.50, the break of which may extend the decline towards the low of the day before, at 117.70.