There was a central bank meeting on Wednesday, but you’d be excused for not noticing.

Overnight, the Bank of Japan made no changes to monetary policy and reiterated its vow to keep interest rates extremely low “for an extended period,” as widely expected. Recall that the BoJ made a number of tweaks to monetary policy in its July meeting, essentially preparing the central bank for an extended fight to raise inflation.

Last week, Japanese PM Shinzo Abe stated that the BoJ’s large-scale easing couldn’t continue indefinitely and that he wanted to see a concrete plan for normalizing monetary policy over the next three years (assuming he wins re-election). When he was asked about Abe’s comments, BoJ Governor Kuroda gave the political answer: “Any central bank would want to achieve its goal as soon as possible and enter the process of normalization.” In other words, it’s steady as she goes at the BoJ.

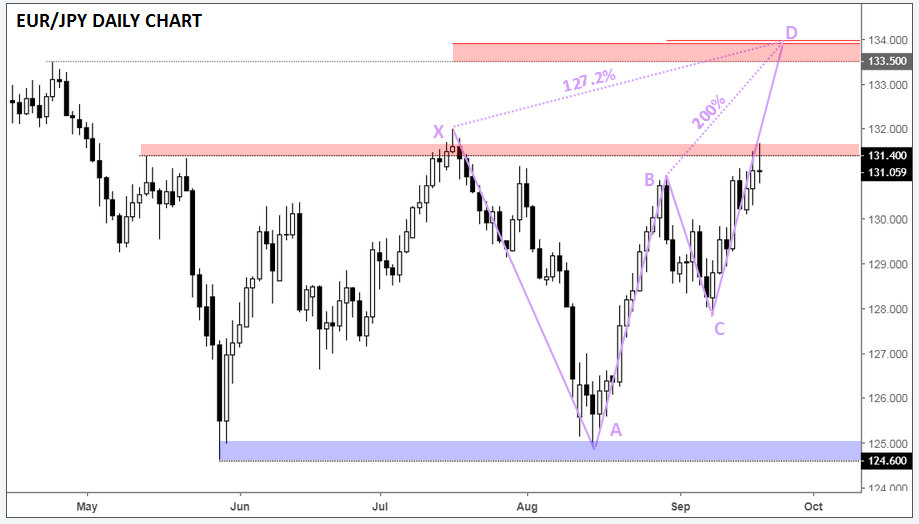

From a technical perspective, EUR/JPY has rallied into an interesting crossroads. As the chart below shows, the pair is testing its highest level since early May in the mid-131.00s. A confirmed breakout of that level would leave little in the way of significant resistance until the upper-1.3300s, which marks both a previous resistance level and the completion of a Bearish Butterfly pattern.

For the uninitiated, a Bearish Butterfly pattern marks the confluence of three major resistance levels (the 127.2% Fibonacci extension of XA, the 200% extension of BC, and ABCD pattern completion). The tight convergence of three separate resistance levels suggests that rates are more likely to form a near-term top if they reach that level, so it will be a critical area to watch if EUR/JPY rallies further, perhaps on Friday’s flash PMI readings from the Eurozone.

Source: TradingView, FOREX.com

Cheers