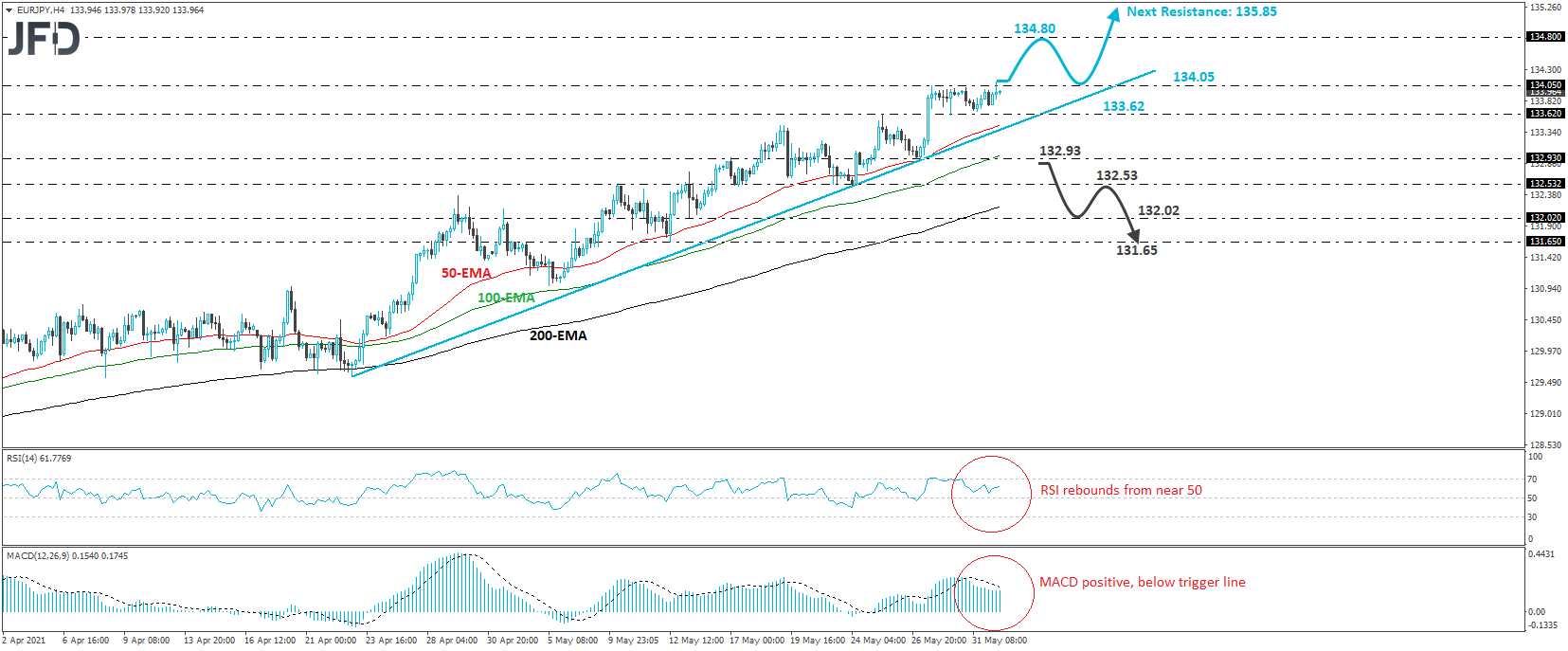

EUR/JPY has been trading in a consolidative manner since Thursday, between the 133.62 support and the resistance of 134.05. Overall though, the pair continues to trade above the upside support line drawn from the low of Apr. 22, which keeps the near-term outlook positive.

Today, the bulls made an attempt to move above 134.05, but their success was very brief. If they insist and eventually clear that hurdle, their action would confirm a forthcoming higher high and perhaps allow them to travel towards the 134.80 zone, which is defined as a resistance by the high of Feb. 8, 2018. If they are not willing to stop there, then we may see the trend extending towards the 135.85 area, marked by the peak of Feb. 6, that year.

Turning our gaze to the short-term oscillators, we see that the RSI rebounded after hitting support slightly above 50, while the MACD is positive, and although it continues to run below its trigger line, it shows signs that it could turn up again soon. Both indicators suggest that EUR/JPY could start gaining upside speed again, which increases the chances for a break above 134.05.

On the downside, we would like to see a break below 132.93 before we start examining whether the bears have stolen the bulls’ swords. The rate would already be below the aforementioned upside line, while the dip would confirm a forthcoming lower low. The next support may be the 132.53 level, marked by the lows of May 21 and 24, which if also broken, could see scope for declines towards the low of May 13, at 132.02. Another break, below 132.02, could extend the slide towards the low of the day before, at 131.65.