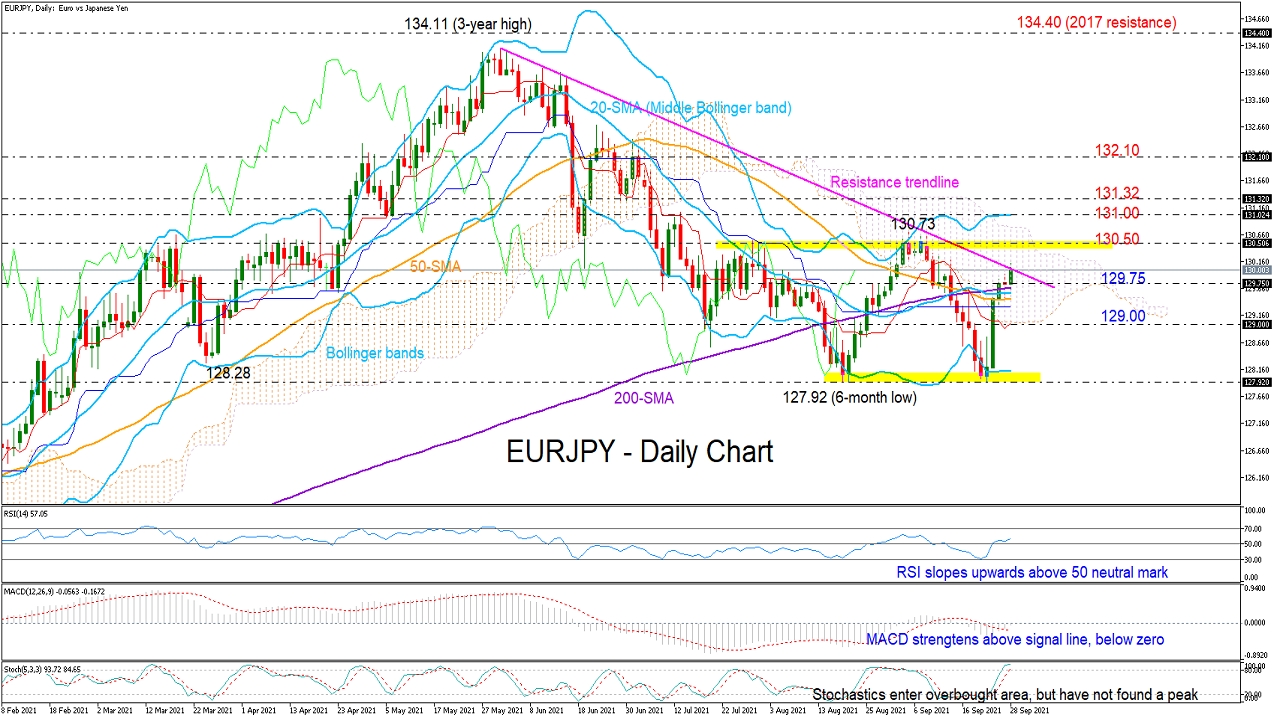

EURJPY resumed its positive momentum on Tuesday after a neutral start to the week with scope to test the descending trendline drawn from June’s 3 ½-year high and the 130.00 mark, which proved hard to claim yesterday.

A sustainable move above the trendline would signal further continuation of last week’s rebound, which took place exactly where the summer sell-off paused in August, creating a sort of double bottom pattern around 127.92. Hence, if traders monitor this bullish structure, they will probably wait for confirmation to come above the 130.50 neckline in order to boost buying orders towards the 131.00 -131.32 restrictive region. Beyond that, the next stop could be around the 132.00 psychological level.

Technically, the short-term risk is tilted to the upside, backing the above scenario. The price has jumped into the bullish upper Bollinger band area, the RSI is rising with a steep positive slope above its 50 neutral mark, and the MACD, although in the negative region, is strengthening above its red signal line.

Nevertheless, if bullish forces prove unsuccessful in breaching the trendline, with the price pulling below the nearby support of 129.75, the 129.00 mark could be the last opportunity for a rebound before all eyes turn to the 127.92 bottom.

In brief, EURJPY seems to be at a make-or-break point. A clear step above 130.00 could produce additional upside corrections, though only a fresh higher high above 130.50 would add credibility to the latest rebound. Otherwise, a new bearish wave could start below 129.75.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/JPY Fights For A Bullish Trendline Breakout

ByXM Group

AuthorTrading Point

Published 09/28/2021, 05:16 AM

Updated 05/01/2024, 03:15 AM

EUR/JPY Fights For A Bullish Trendline Breakout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.