- The recent Euro strength in the past week has fizzled out.

- The ongoing trend of the 2-year yield premium shrinkage between the 2-year German Bunds over Japanese Government Bonds reinforced further potential downside in EUR/JPY.

- Watch the 155.45 downside trigger level of the EUR/JPY.

After a multi-month downtrend in the Euro Currency Index from the September 2024 high of 112.14 to the January 2025 low of 101.92, the Euro has started consolidating due to speculative net short positioning. The Euro futures market has seen a significant increase in net short positions of large speculators to -104,399 contracts in the recent two weeks as of 11 February 2025, close to a five-year low.

Hence, any positive related news flow such as last week’s looming peace talks negotiations between Russia and Ukraine brokered by US President Trump can trigger a rally in the EUR/USD and the Euro Currency Index via the partial closure of such significant leveraged net short positions in the Euro futures market.

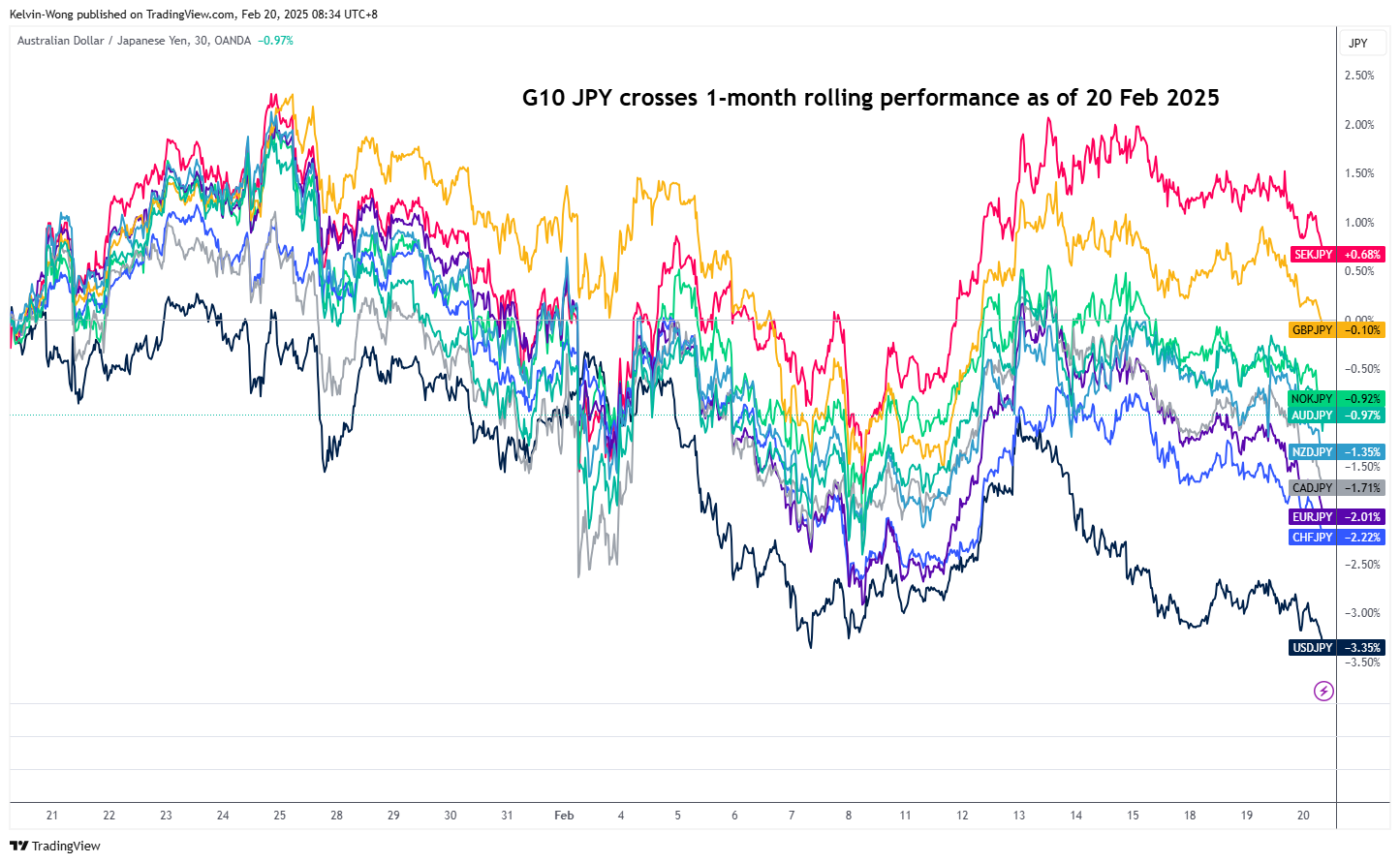

JPY Has Strengthened Across the Board in the Past Month

Fig 1: 1-month rolling performance of the JPY against major currencies as of 20 Feb 2025 (Source: TradingView, click to enlarge chart)

On the other hand, the Japanese yen has strengthened since mid-January 2025 after several prominent Bank of Japan (BoJ) officials, including Governor Ueda, talked up the yen which increases the odds of further interest rate hikes in 2025 with the possibility of two more hikes of 25 basis points each to raise the key policy short-term interest rate to 1% coupled with an improvement in wage growth and stable inflationary trend in Japan.

Therefore, an emerging medium-term Japanese yen strength trend has started to flash across the board in the currency market, one of the major yen cross pairs is the EUR/JPY.

Based on the one-month rolling performance, the EUR/JPY is the third worst performer (Japanese yen strength against Euro) among the major JPY crosses that shed -2% at this time of the writing (see Fig 1).

EUR/JPY Is Tracing Out a Major Bearish Reversal Formation

Fig 2: EUR/JPY medium-term & major trend phases as of 20 Feb 2025 (Source: TradingView)

Two significant technical analysis elements have emerged on the EUR/JPY. Firstly, it has broken below the former long-term secular ascending channel support from March 2022 low on 1 August 2024. Secondly, the price actions configuration of the swing highs of 16 November 2023, 11 July 2024, and 31 October 2024 has formed an impending major bearish reversal “Head & Shoulders” formation.

These observations suggest that the EUR/JPY is likely on the brink of a major trend change from bullish to bearish that may transform into a multi-month bearish trend phase.

In addition, the ongoing 2-year sovereign bond yield premium shrinkage between the German Bund and the Japanese Government Bond (JGB) also supports further potential weakness in EUR/JPY as Eurozone fixed income instruments are getting less attractive relatively versus Japanese fixed income.

Watch the 155.45 potential downside trigger level on the EUR/JPY (the neckline support of the major “Head & Shoulders” bearish reversal formation). A break with a daily close below it may open up scope to kickstart a major multi-month downtrend phase that may expose the next medium-term supports of 151.00 and 145.60 in the first step (see Fig 2).

On the other hand, clearance above the 163.80 key medium-term pivotal resistance invalidates the bearish scenario to see the next medium-term resistances coming in at 166.80 and 171.60.