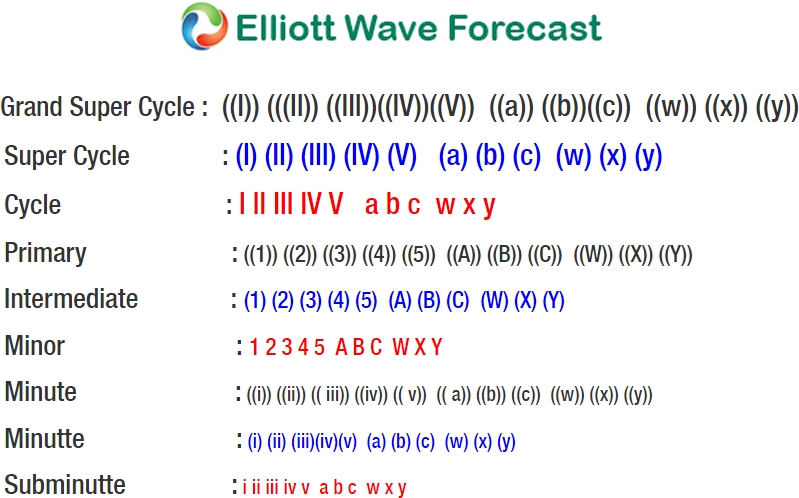

EUR/JPY short-term Elliott wave analysis suggests that the decline to $126.63 on 6/19 low ended intermediate wave (2) pullback. Up from there, intermediate wave (3) remains in progress as Elliott wave impulse. The internals of Minor wave 1 is unfolding as a leading diagonal with sub-division of 5-3-5-3-5. Up from $126.63 low, Minute wave ((i)) ended in 5 waves at $128.84. Minute wave ((ii)) pullback ended in 3 swings as a double three Elliott Wave structure at $127.12 low. Then rally from there ended Minute wave ((iii)) in another 5 waves at $129.5 high. Down from there, the pullback to $128.44 low ended Minute wave ((iv)) pullback as a Running Flat. Above from there, Minute wave ((v)) of 1 remains in progress in another 5 waves structure. The cycle looks mature but pair can extend higher 1 more time before it completes Minor wave 1. Afterwards, the pair is expected to do a pullback in Minor wave 2 in 3, 7 or 11 swings to correct cycle from $126.63 low before further upside towards $132.30-$133.63 area is seen. We don’t like selling the proposed pullback.

EUR/JPY 1 Hour Elliott Wave Chart