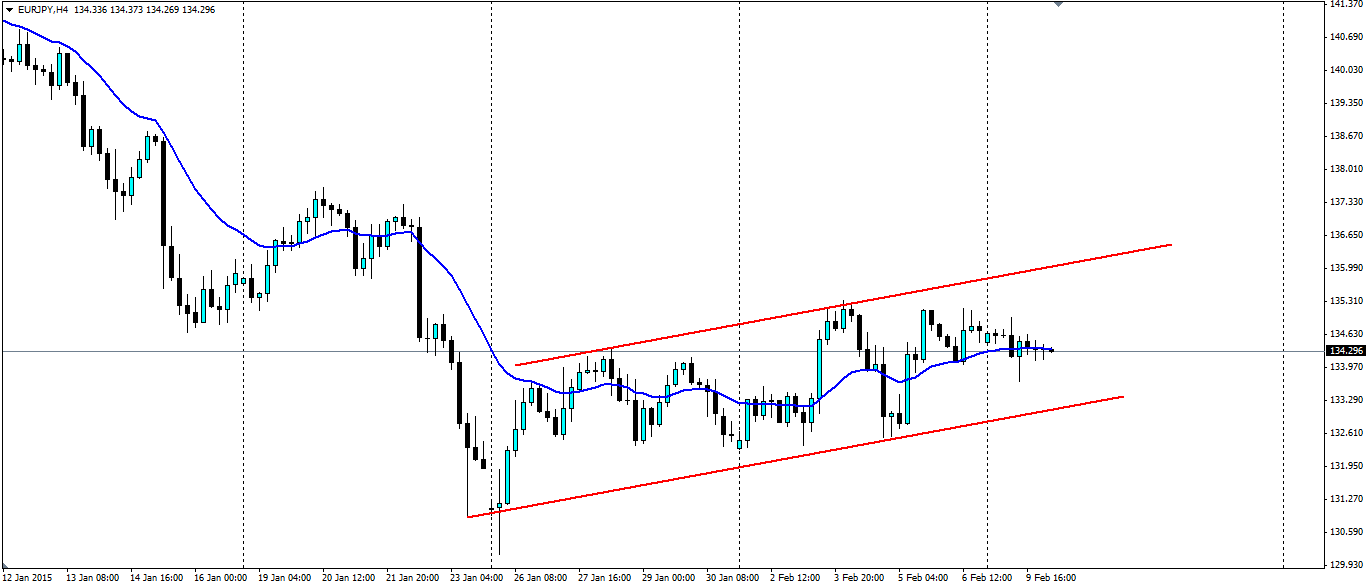

The euro-yen pair has been following a nice channel for the last few weeks and a consolidation within the channel could lead to a wider breakout.

Source: Blackwell Trader

The EUR/JPY pair has formed a ranging pattern within a channel with a slight bullish bias. This is largely because of the strong bearish run the pair went on at the end of last year and the beginning of this year. Such a large movement is inevitably going to lead to a pullback and some consolidation.

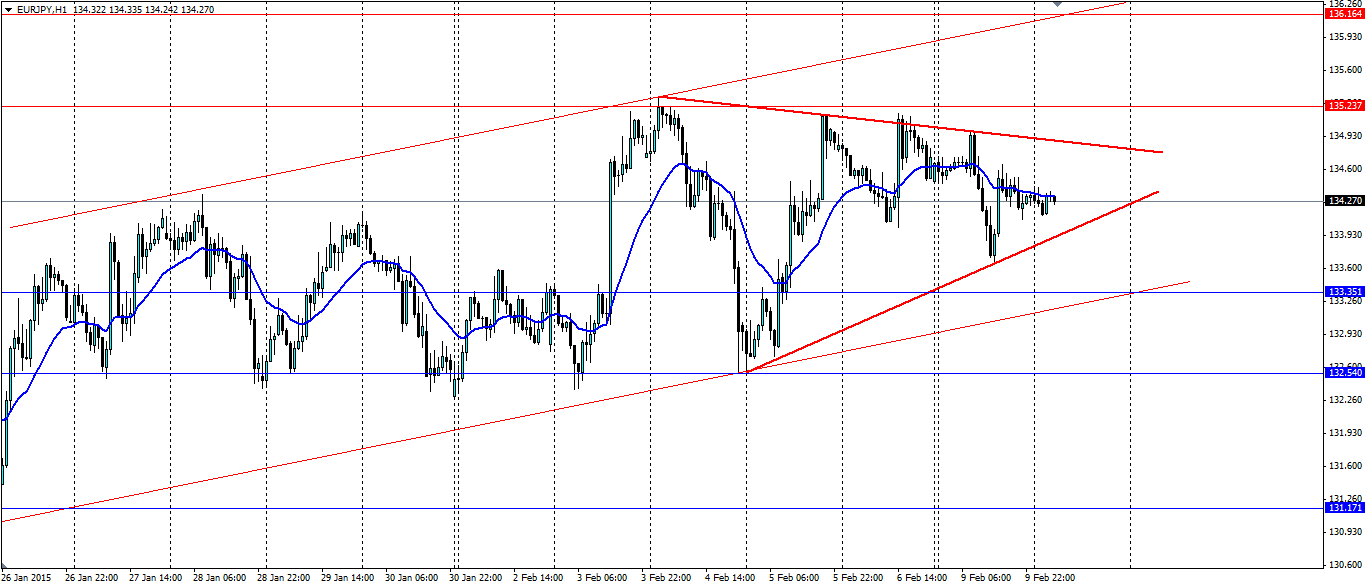

The channel has been tested several times on both the upper and lower levels, each time holding firm with just the one false breakout at the beginning. In the last week the price has had plenty of trouble breaching the resistance at 135.237 and a consolidating pattern has formed underneath this level.

We are likely to see a breakout of this pennant pattern and if it is upwards, the bears will be waiting for a test of the upper level of the channel before coming back in to push it lower. If we see a bearish breakout of the pennant, we could see a larger push leading to a breakout of the channel.

Source: Blackwell Trader

A bullish breakout will look for resistance at 135.237, 136.164 and 137.288, of course with the channel acting as dynamic resistance somewhere around the 136.40 mark. A bearish breakout will look for support at 133.351, 132.540 and 131.171 with the lower level of the channel likely to act as dynamic support close to the 133.351 level.