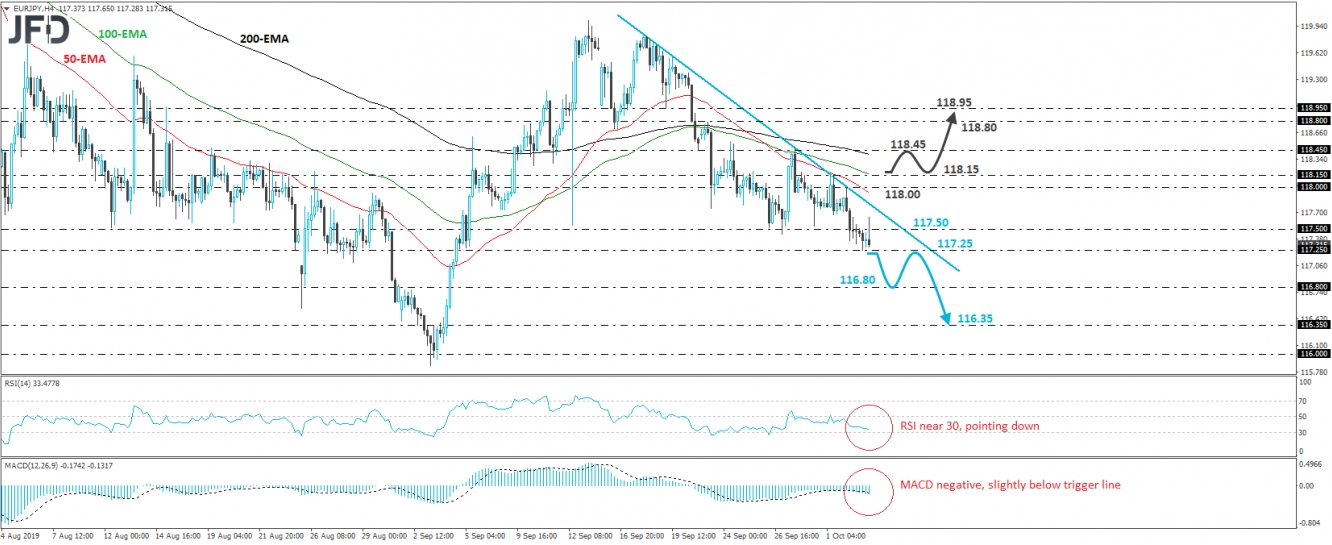

EUR/JPY traded lower yesterday after it hit the downside resistance line drawn from the high of September 18th. The slide also brought the rate below the 117.50 zone, thereby confirming a forthcoming lower low, which combined with the fact that EUR/JPY remains below the aforementioned line, as well as below all three of our moving averages, paints a negative short-term picture.

The pair is now flirting with yesterday’s low of 117.25, where a break may encourage the bears to pull the trigger for declines towards the 116.80 zone, near the inside swing high of September 2nd. Another dip, below 116.80, could extend the slide towards the 116.35 hurdle, marked by an intraday swing high formed on September 4th.

Looking at our short-term oscillators, we see that the RSI is drifting south and looks to be heading towards 30, while the MACD, already negative, lies slightly below its trigger line. Both indicators detect downside speed and corroborate our view that EUR/JPY may be poised for some further near-term declines.

On the upside, we would like to see a strong move above 118.15 before we start examining the case of a short-term bullish reversal. Such a move could initially aim for the 118.45 area, which is near the high of September 27th and is also marked by the inside swing low of September 20th. If the bulls are not willing to abandon the action near that area, its break may allow them to target the peak of September 23rd, at around 118.80, or the 118.95 territory, defined by the inside swing low of September 19th.