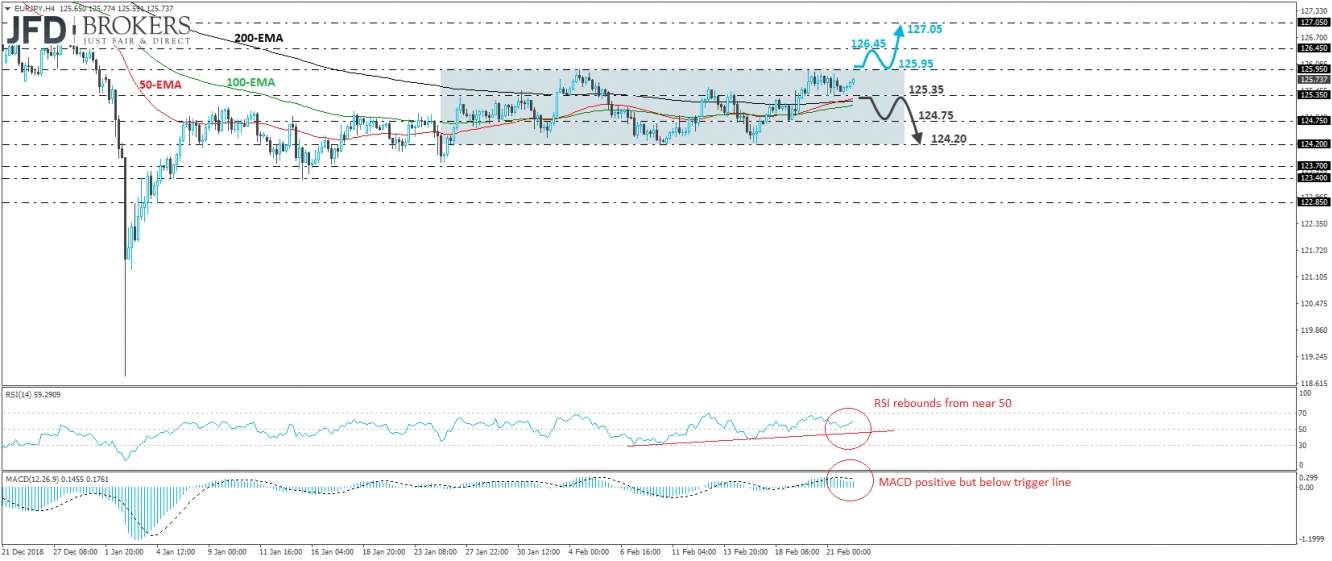

EUR/JPY traded slightly higher today, after it hit support near the 125.35 level yesterday. Overall, the pair has been trading in a sideways manner between 124.20 and 125.95 since January 24th and thus, we will consider the near-term outlook to be neutral for now. We prefer to wait for a decisive break out of the range before we start examining the pair’s forthcoming directional path. That said, bearing in mind that the rate is now approaching the upper bound of the range, we see more chances for an upside exit rather a downside one.

If the bulls are strong enough to push EUR/JPY above 125.95, which is the range’s upper end, then we may see them initially aiming for the 126.45 barrier, marked by the high of December 31st. If that level fails to stop them and breaks, then we may experience extensions towards the highs of December 27th and 28th, near the 127.05 zone.

Turning our gaze at the short-term oscillators, we see that the RSI rebounded from near its 50 line and now points up. The MACD is positive, still below its trigger line, but shows signs that it could start bottoming as well. These indicators suggest that the rate is gathering some upside momentum and add to the chances of an upside exit out of the range.

Now in case the bulls give up and the rate falls below 125.35, this may be a signal that traders want to keep the pair within the range for a while more. Such a dip may result in a slide towards the 124.75 hurdle, marked by the low of February 19th, the break of which may allow a test at the lower boundary of the range, at around 124.20.