Key Points:

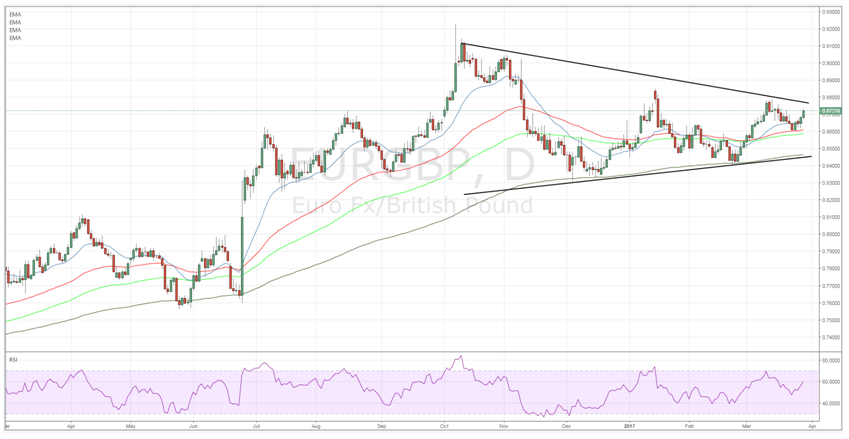

- Price action trading within a constricting wedge.

- RSI oscillator trending higher.

- EUR/GBP likely to retrace to top of current range.

The euro-pound pair has been trapped by a tightening wedge over the past few weeks as it has largely traded between 0.8395 and 0.8800. However, the past few days has seen the pair steadily breaking above the current cloud formation which suggests that we are about to see a breakout in the coming days.

A cursory review of the technical indicators also seems to support the view that there is likely to be a bullish move coming in the short term. In particular, the stochastic oscillator (daily time frame) has recently returned to trending higher, after a consolidative pullback, and still remains within neutral territory which means that there is plenty of room to move on the upside. In addition, price action has now moved above the 20, 60, and 100 day EMA’s as price has converged towards the top of the wedge pattern. Subsequently, there is plenty of scope for a retracement given the building pressure within the various indicators, as well as from the increasing wedge.

From a fundamental perspective, there are also some key economic events which are coming in the remainder of the week with the UK finally about to trigger the Article 50 provisions. This is likely to bring about a change to the pair’s equilibrium price following a bout of sharp volatility.

Regardless, the current constricting wedge pattern, and requisite price level, is unlikely to hold given the current economic uncertainty around the Brexit. However, it’s not all bad news for the pound given that some economic analysts are now predicting that an exit from the Eurozone is likely to bring about some gains for the UK economy as EU regulation falls away.

Ultimately, given the technical and fundamental indicators, with a particular focus of the risk of a Brexit, the euro is probable to rally against the pound within the current range structure. However, before considering any long entry, look for a strong bullish candle to pierce some key support at the top of the wedge around the 0.8785 mark. In addition, consider your euro exposure on Friday (09:00 GMT) given that the EU Flash CPI Estimate figures are due out. Given the focus on interest rates lately, this is likely to be a key fundamental driver of the near term trend.