Key Points:

- Price action breaches bottom of channel.

- RSI Oscillator trending sharply lower.

- EUR/GBP breakdown in the coming days likely.

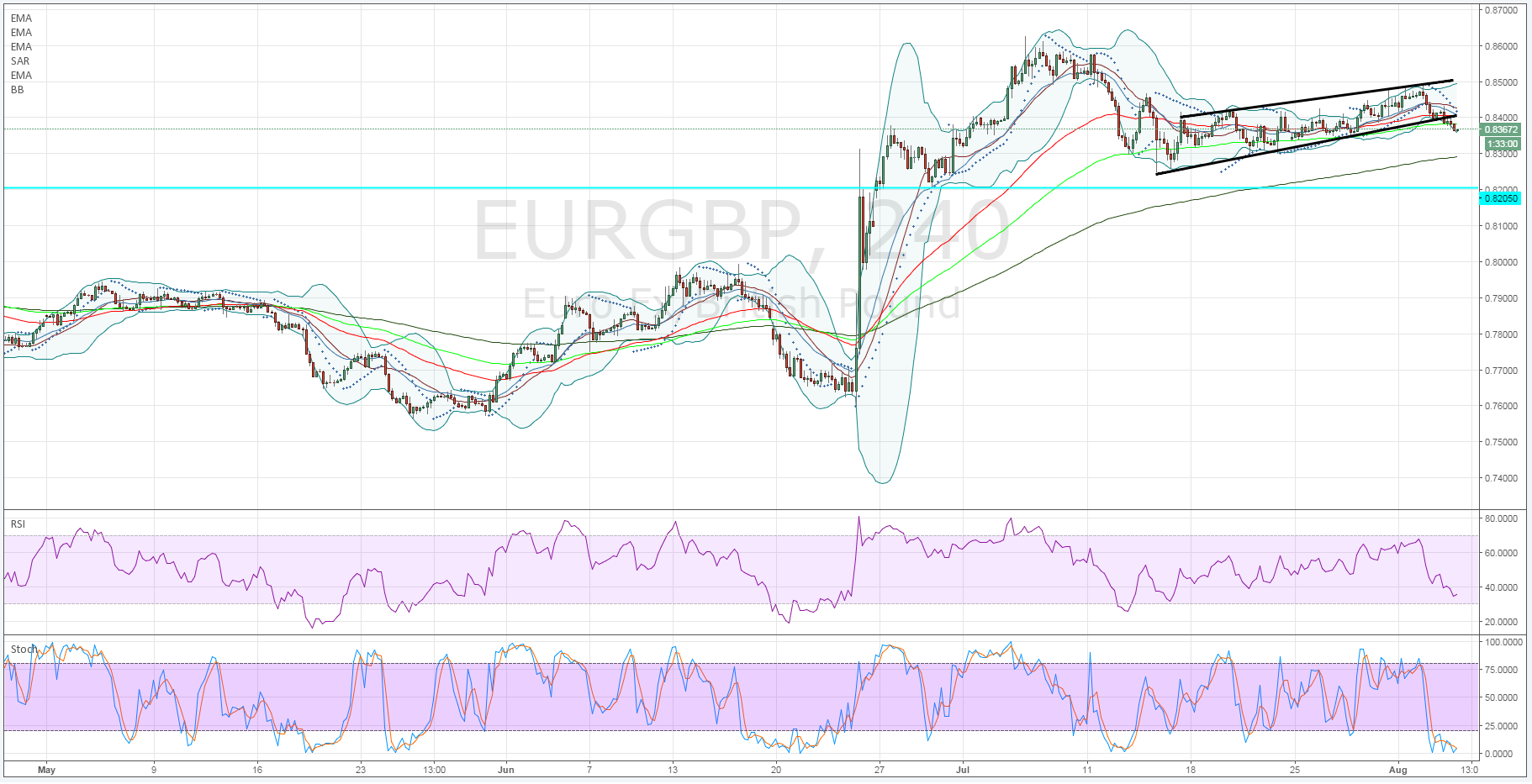

The Euro-Pound has largely been in a sideways consolidation phase over the past few weeks as price action has meandered within a relatively tight channel. However, price action has been trending lower over the past few days and finally broke through the bottom of the channel during yesterday’s session. Subsequently, the downside is now beckoning for the pair and we could be seeing the initial stages of a break down.

Taking a technical perspective, there is clear case for a short term breakdown given the breach of the channel constraint over the last 24 hours. In addition, the daily chart shows a symmetrical triangle formation that also predisposes the currency pair to a near term sharp move. However, the RSI Oscillator on the 4-hour timeframe is close to oversold which could mean that the pair requires a period of moderation outside of the channel before commencing an orderly retreat. Regardless, given the recent importance of the short term channel, the breach lower should not be underestimated.

However, there is also a fundamental risk event looming on the horizon with the Bank of England set to meet to determine their monetary policy. Given some of the shocks that the UK economy has experienced of late, it is no surprise that most analysts see a 25bps cut to the Official Bank Rate occurring. That would bring UK interest rates relatively close to the zero lower bound but is also probably required to offset a general slowdown in both output and confidence following the Brexit.

Normally, such a decisive cut to the bank rate would cause a sharp depreciation to the Pound but a 25bps is largely expected so the volatility around any such move might not provide too much in the way of a fall in sentiment for the Pound. Subsequently, a 25bps might not restrict the EUR/GBP’s downside all that much on a short term basis.

Ultimately, the next 24 hours are likely to be a critical period for the EUR/GBP given that the pair is currently at a crossroad and awaiting a strong trend. However, the technical indicators largely predispose the pair to the downside given the recent fall out of the channel. Subsequently, in the absence of a strong fundamental surprise from the BoE a short push is the likely play over the next few days.