For EUR/GBP traders, there’s been good news and bad news over the last couple of months: The good news is that they’ve had plenty of time to watch the World Cup…and the bad news is that neither bulls nor bears are making any money in the pair!

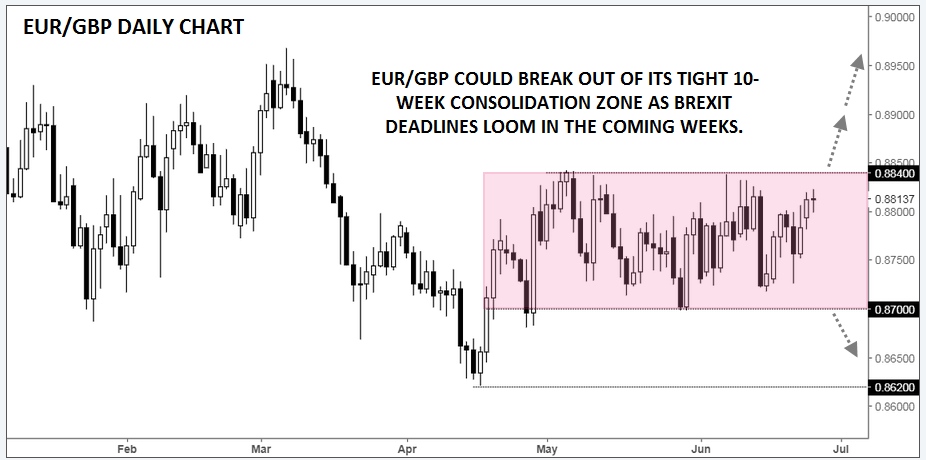

The historically quiet “English Channel” cross has gone deathly silent over the last 10 weeks. Since mid-April, EUR/GBP has been contained to just a 140-pip range with rates chopping around between support at 0.8700 and resistance up at 0.8840.

Fundamentally speaking, traders are weighing both the geopolitical and monetary policy risks to each currency and finding them perfectly balanced…for now:

Monetary policy favors the GBP…

From a monetary policy perspective, the Bank of England is potentially looking to raise interest rates as soon as August, while the European Central Bank has already suggested that it won’t be touching interest rates until a year from now at the earliest.

In addition, the BOE has already stopped purchasing assets (quantitative easing) and has a plan to start selling off those accumulated reserves when interest rates hit 1.5%. By contrast, the ECB just announced that it will cease its QE program in Q4 of this year, with no explicit plan to start drawing down its balance sheet. Clearly, the BOE is further along the path toward monetary policy normalization than the ECB.

…Whereas geopolitical risks support the EUR

The situation is reversed when it comes to geopolitical risk. While the UK’s looming “Brexit” from the European Union will impact both regions’ economies, the impact on the UK will be far more acute. The UK is set to officially leave the European Union on March 29, 2019, but there are plenty of decisions to be made in the next couple of weeks that will have a dramatic impact on sterling and the UK economy more broadly:

June 28/29 – EU Summit

The European Union had hoped to resolve the sticky issue of the Irish border by this week’s meeting, but little progress has been made. Watch for headlines around this issue, which if unresolved, could increase the risk of a no-deal, “hard” Brexit.

Early July – UK Cabinet Meeting

PM Theresa May’s government will try to produce a united “white paper” on its vision of the post-Brexit UK-EU economic relationship. Previous attempts have failed, so expectations for next week’s meeting are relatively low.

Mid-July – Customs Union Vote

The long-delayed trade and customs bills that could call for the UK to stay in the EU customs union is set for debate a few weeks from now. The outcome of this debate should provide insight into the likelihood of a hard Brexit, as well as how the future trade arrangements between the two regions may evolve.

Of course, there will plenty more Brexit checkpoints and deadlines over the next nine months, but the concentration of high-impact events in the coming weeks may well lead to a breakout in EUR/GBP.

If the next couple of weeks suggest that the hard Brexit scenario is growing more likely, the pair could see a bullish breakout above 0.8840 resistance, opening the door for a continuation up toward 0.8900 or even the nine-month highs near 0.9000 next. Conversely, progress in the negotiations would increase the likelihood of an amicable split, potentially causing EUR/GBP to break support at 0.8700 and target the 13-month low at 0.8620.

One way or another, volatility in EUR/GBP is set to heat up along with the weather over the next couple of weeks!