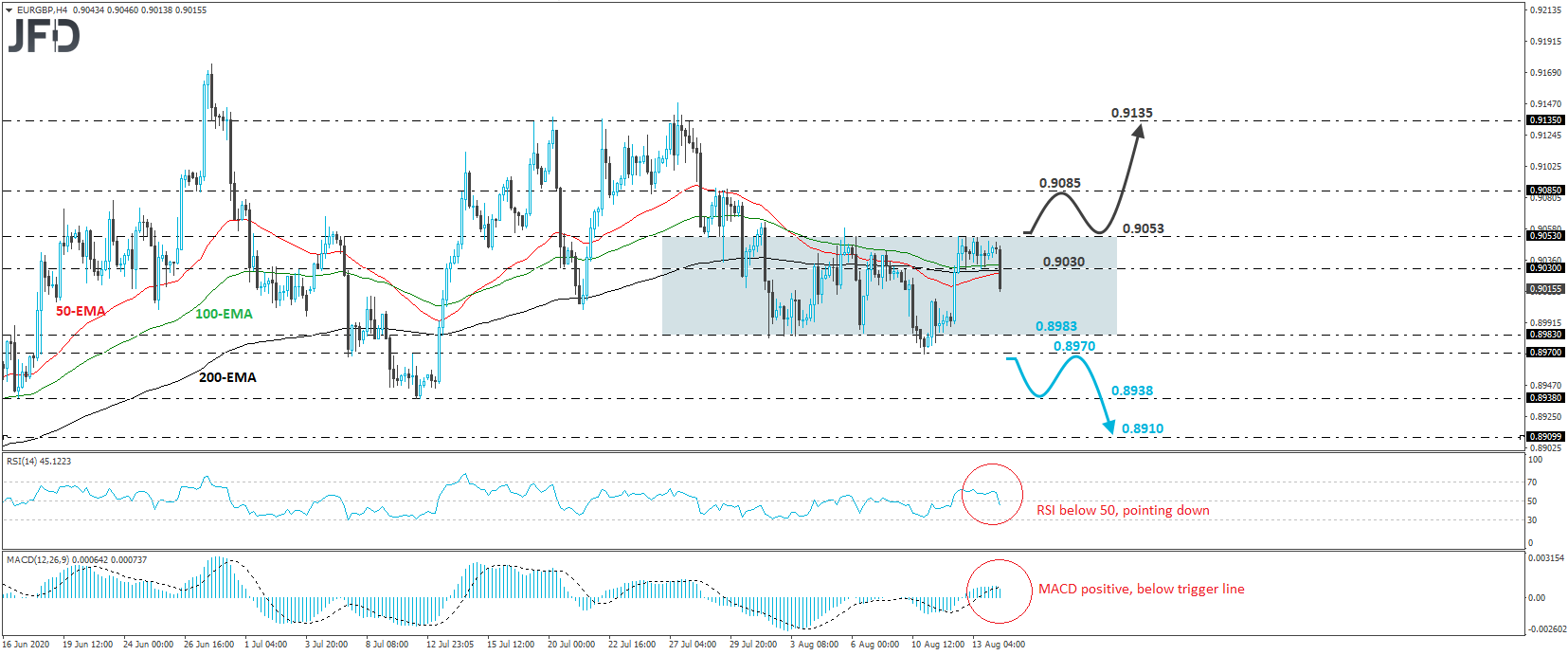

EUR/GBP traded lower on Friday, after it hit resistance near 0.9053 on Wednesday and Thursday. The slide brought the rate below yesterday’s low of 0.9030, but the price action still remains within a sideways range between the 0.9053 barrier and the 0.8983 level. Thus, with that in mind, we prefer to remain sidelined for now, despite today’s decline.

In order to start examining whether the outlook has turned negative, we prefer to see a dip below the lower end of the range, at 0.8983, or even better below Tuesday’s low of 0.8970. Such a move would confirm a forthcoming lower low and may initially see scope for declines towards the low of July 10th, at 0.8938. If that level is not able to stop the slide either, then we may see extensions towards the 0.8910 area, marked as a support by the low of June 16th.

Shifting attention to our short-term oscillators, we see that the RSI just dipped below 50 and continues to point down, while the MACD, although positive, has fallen below its trigger line, pointing down as well. Both indicators support the notion for further declines in this exchange rate, but as we already noted, we prefer to wait for a dip below 0.8970 before we get more confident on that front.

On the upside, the move that could invite more bulls to the action may be a break above the upper end of the pre-mentioned range, at 0.9053. This may open the path towards the 0.9085 territory, near the high of July 29, a break of which may extend the advance towards the high of the day before, at around 0.9135.