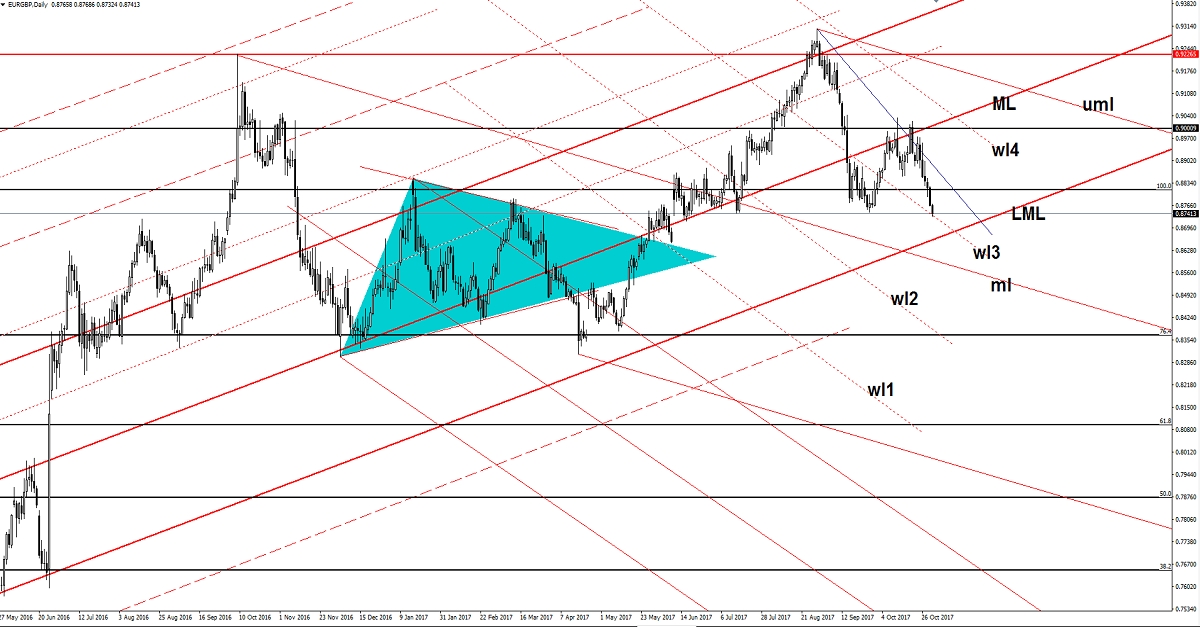

EUR/GBP Trading In The Red

The currency pair plunges and seems unstoppable in the short term. It is trading in the red and resumes its bearish momentum. As i've said in previous reports, it should drop toward fresh new lows after several false breakouts above a major dynamic resistance level. Cable also appreciated versus the yen and greenback and could climb much higher because it has received a helping hand from United Kingdom data. The pair is pressuring a dynamic support right now, but it could ignore it.

The UK's Manufacturing PMI increased from 56.0 to 56.3 points in October, while traders expected a drop of 55.8. The Nationwide HPI surged by 0.2%, matching expectations.

You can see on the daily chart that the rate has failed to stabilize above the median line (ML) of the major ascending pitchfork, signaling exhaustion. Price drops quickly on the short term, ignoring the 100% Fibonacci level. It's pressuring the third warning line (wl3) and could ignore this because it is attracted by the lower median line (LML) of the major red ascending pitchfork.

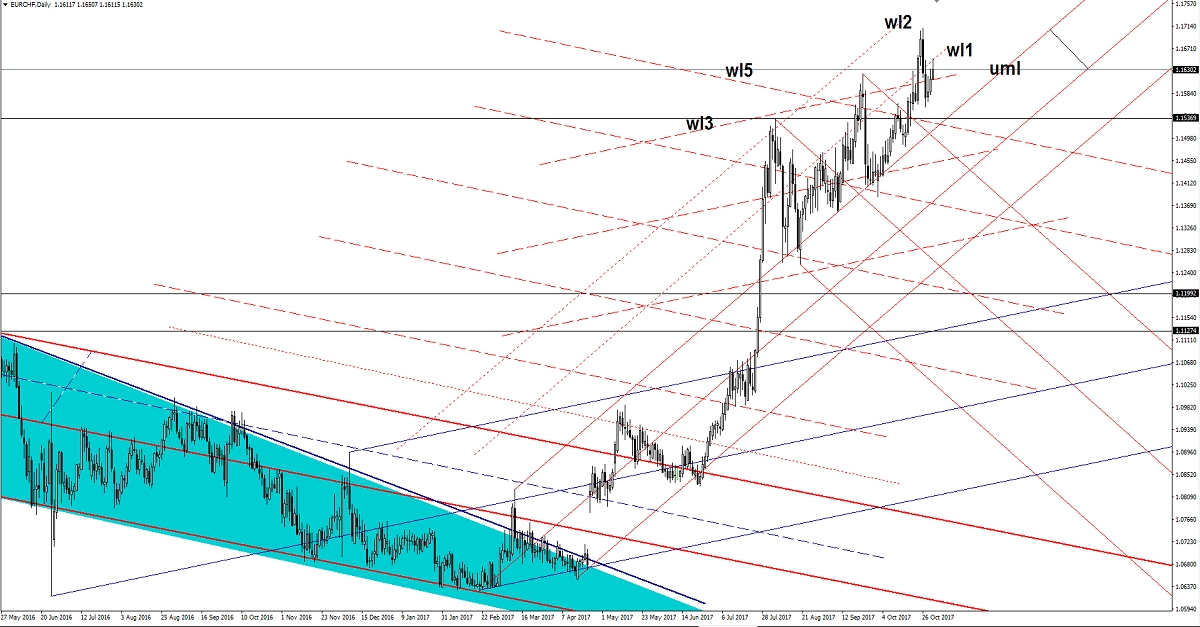

EUR/CHF: Is This A Rising Wedge?

The EUR/CHF increased the last two days, but looks like it has found temporary resistance again. Price touched the first warning line (wl1) of the ascending pitchfork, which has paused the upside movement. Looks like the price is developing a Rising Wedge pattern on the Daily chart, but this is far from being confirmed. Only a valid breakdown below the upper median line (uml) of the ascending pitchfork will confirm a larger drop.

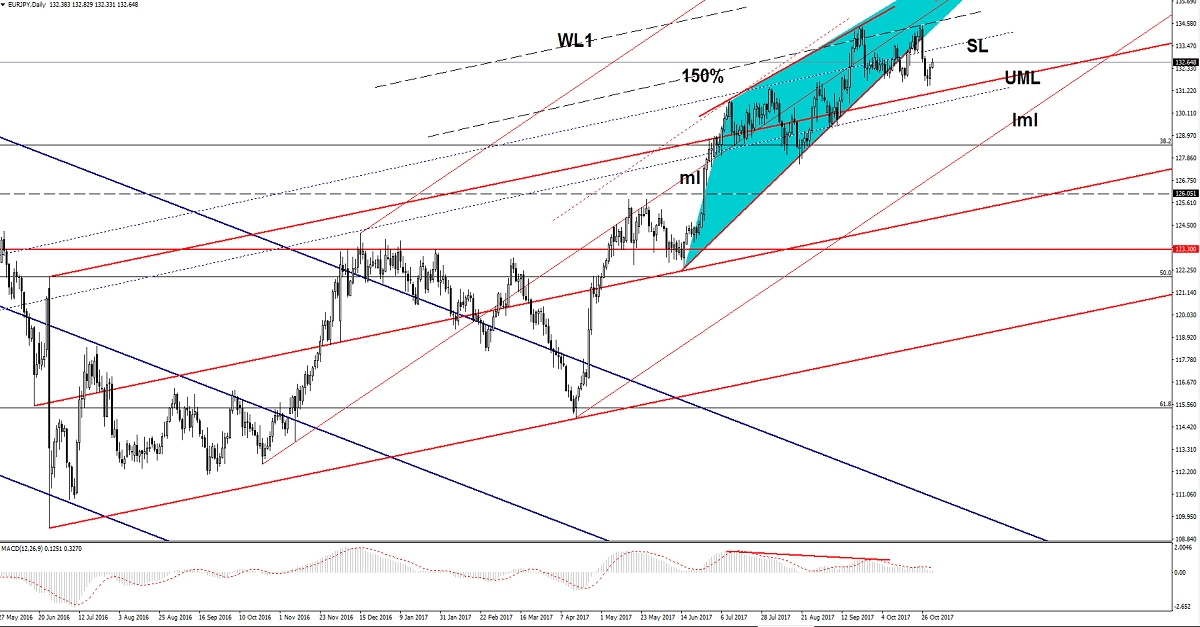

EUR/JPY Downside Paused Again

EUR/JPY increased and resumed yesterday's bullish candle and could move much higher to retest the sliding parallel line (SL) of the major ascending pitchfork. Technically, the rate was expected to drop further following the breakdown from the Rising Wedge pattern. The near-term downside target remains at the upper median line (UML) of the major ascending pitchfork.

By Olimpiu Tuns - Market Analyst