As we noted on twitter earlier Thursday, the British pound is once again the strongest major currency on the day, but more to the point, it’s also making a run at the Canadian dollar for the strongest major currency on the year.

While it’s true that traders generally fear uncertainty (and with the looming specter of Brexit and now an election in less than two weeks’ time, there is no major currency that’s experienced more uncertainty this year than the pound), it’s also true that ambiguity creates opportunity for traders. As the perceived probability of no-deal “hard” Brexit has faded, the pound has come storming back against its rivals, hitting a 7-month high against the greenback and a 2.5-year high against the euro.

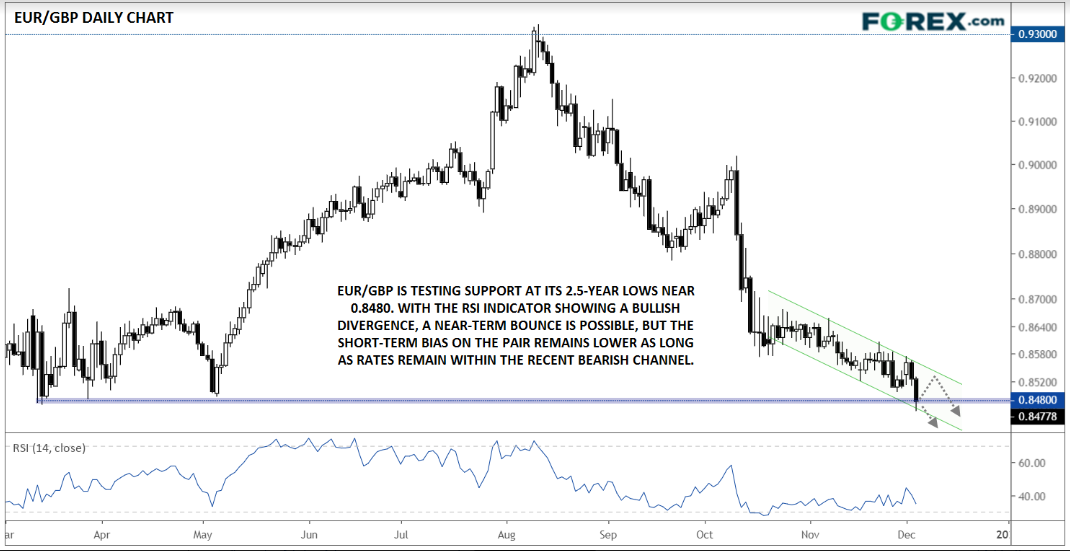

Keying in on EUR/GBP, the pair briefly peeked below 0.8480 to its lowest level since May 2017 Thursday morning. From a technical perspective, rates remain in a clear downtrend off their August highs, with the unit down an astounding 800 pips over that period:

Source: TradingView, FOREX.com

As the chart above shows, EUR/GBP is testing strong previous support just below 0.8500, and with the RSI indicator in a persistent state of bullish divergence, there’s a case for a small recovery in the latter half of this week.

Taking a step back, the longer-term bias clearly remains to the downside; accordingly, readers may want to consider short opportunities on bounces toward the top of the recent bearish channel near 0.8530 or on a confirmed close below 0.8480 support, especially if opinion polls continue to show the Conservatives with a comfortable majority. Below that key area, there’s little in the way of relevant support until the May 2017 lows just under 0.8400 and the April 2017 trough around 0.8300 after that. Only a break above the weekly high at 0.8570 would shift the near-term bias back in favor of the bulls.