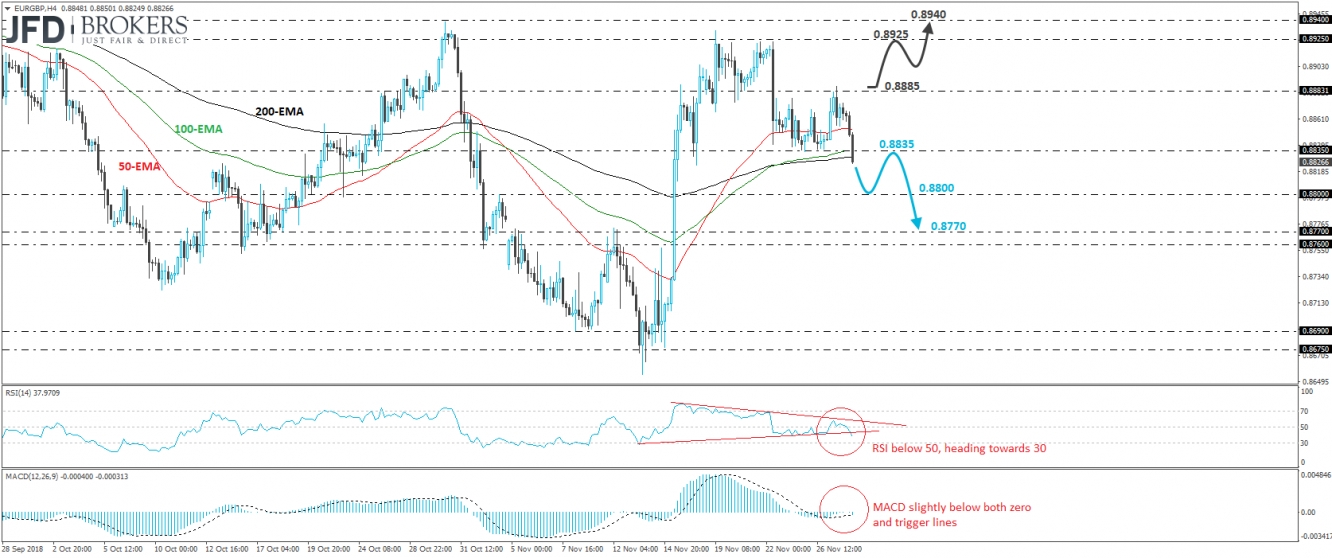

EUR/GBP traded lower on Wednesday, breaking below key support zone of 0.8835, defined by the lows of the 23rd and 26th of November. On Tuesday, the pair formed a lower high near the 0.8885 zone, while the dip below 0.8835 today confirms a forthcoming lower low. In our view, this has turned the short-term picture to the downside and thus, we would expect the bears to stay in the driver’s seat for a while more.

We believe that the dip below 0.8835 may have opened the way for the 0.8800 mark, defined by the inside swing peak of the 2nd of November. If sellers prove strong enough and manage to overcome that support as well, then we may experience extensions towards the 0.8770 zone, which is near the inside swing peak of the 12th of the month.

Shifting attention to our short-term momentum indicators, we see that the RSI turned down after it topped slightly below its respective downside resistance line, fell below 50, and also dipped below the upside support line drawn from its low formed on the 13th of November. It now looks to be heading towards its 30 line. The MACD, already slightly below zero, has just touched its toe below its trigger line. These technical studies detect negative momentum and corroborate our view for some further declines.

On the upside, we would like to see a decisive recovery back above 0.8885 before we start examining whether the bears have abandoned the battlefield. Such a move could lead the rate towards last week’s highs, at around 0.8925, where a break could aim for the peak of the 30th of October, near 0.8940. Having said all that though, we would like to see a clear close above 0.8940 before we confidently assume that the near-term outlook has switched to positive.