Key Points:

- Ascending channel remains intact.

- Reversal could already have begun.

- Currently in oversold territory.

The EURGBP is setting up for what could be a fairly strong reversal in the coming session by virtue of the robust channel that has confined it over the last number of weeks. Furthermore, both the stochastics and EMA activity are in agreement and this should help the pair to climb as we move forward.

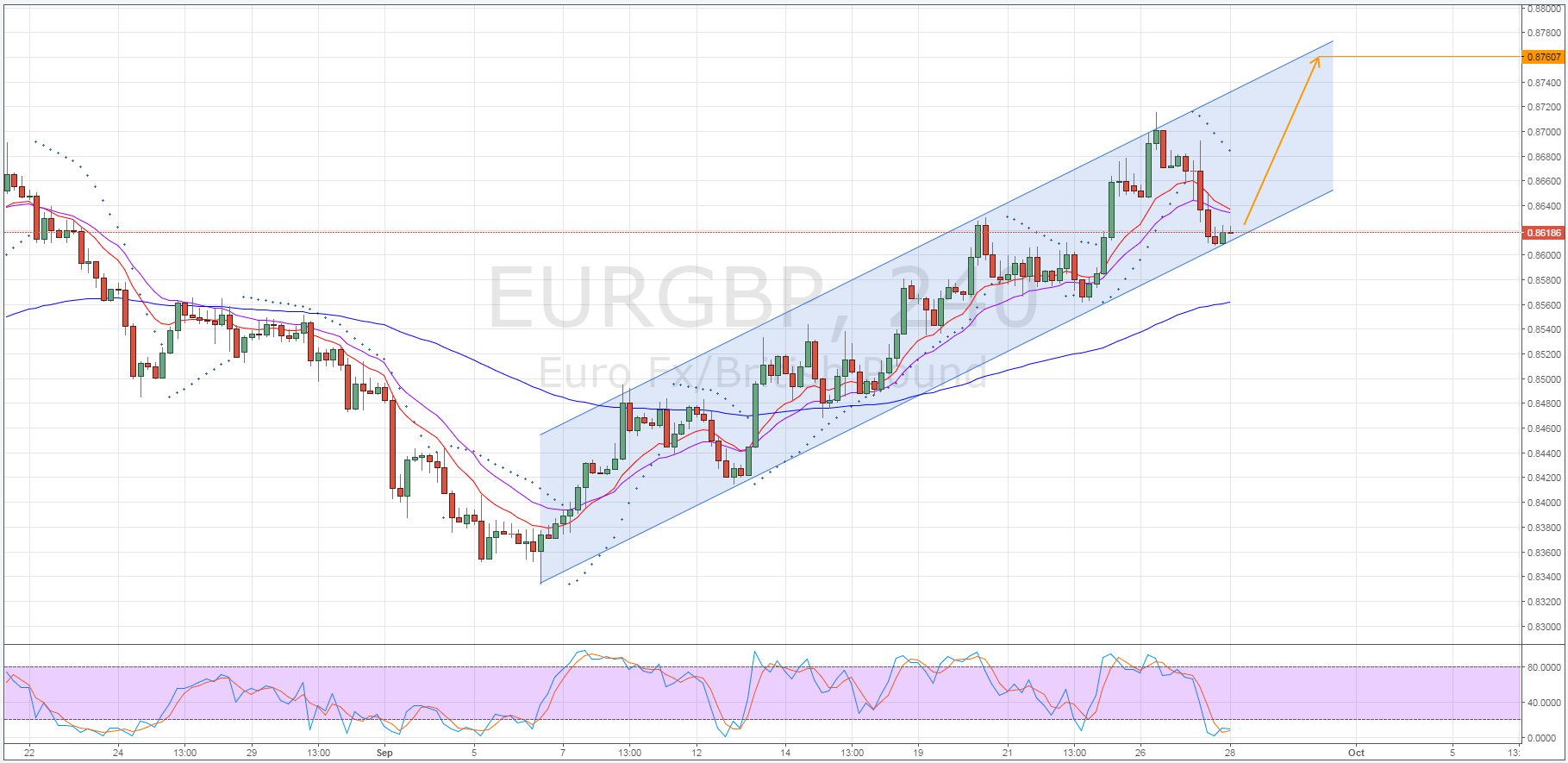

As shown below, the EURGBP has been following a fairly robust ascending channel higher over the past few weeks. Consequently, a continuation of the recent trend is expected to occur as we move on, even given the pair’s poor performance last week. In fact, it appears as though the EURGBP has already begun to make its reversal which could mean a surge in sentiment is imminent in the second half of the week.

The reasons why this reversal is expected are twofold. Firstly, recent bearishness has now pushed the H4 Stochastic oscillator firmly into oversold territory. As a result, selling pressure has been evaporating in the early stages of this week and this trend should continue moving forward.

Secondly, even with the recent dip, both the H4 and Daily EMA’s remain bullish. Consequently, we should now see the bulls begin to get back on board and wrest control back from the bears.

However, as is patently obvious above, the Parabolic SAR reading on the H4 chart is currently hinting that the recent downtrend may yet have some momentum left. Fortunately for the bulls out there, this bias is not reflected in the daily readings which retain their rather strong bullish signal and this should help to see the upside constraint of the channel challenged once again.

As for just how large of a rally we can expect, we could see the pair travel as high as the 0.8760 mark but the 0.8721 level could also prove to be a strong zone of resistance. Specifically, the 0.8721 mark coincides with the peak representing last month’s high. As a result of this, fundamentals will likely be pivotal in seeing this pair breakthrough this zone of resistance so keep an eye out for any pertinent releases as the EURGBP reaches the 0.8721 price.

Ultimately, this pair has been blazing a path higher for some time now and the continued anti-GBP sentiment resulting from the ongoing Brexit risk has been doing its part to fuel the ascent. Consequently, the technical bias for the EURGBP should remain bullish in not only the near-term but also in the medium to long term.

However, this being said, keep an eye out for any major shifts in sentiment which could be seen as a result of scheduled remarks by ECB president Mario Draghi as his statements will be widely scrutinised.