Scandinavian Capital Markets

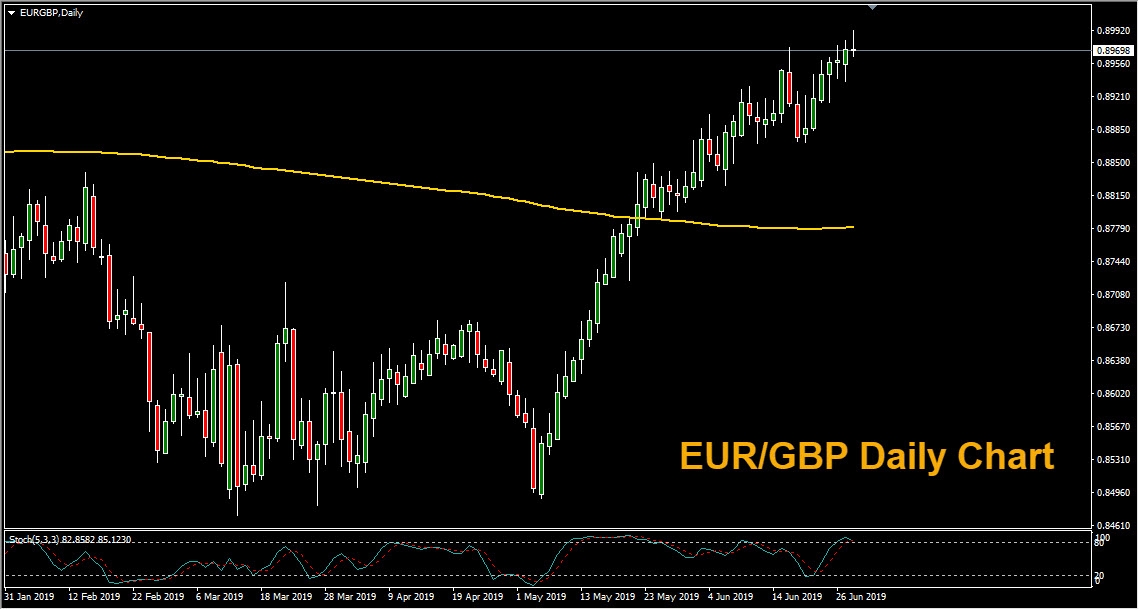

In early Friday trading EUR/GBP inched upwards, reaching its highest levels since January 11th. The month of June and second quarter of 2019 end with a busy economic calendar and the all important G20 Summit in Japan.

GDP data released on Friday showed that the UK economy grew 0.5% in the first quarter, as expected. The news had little impact on Sterling and investors remained focused on the danger of a no-deal Brexit posed by Conservative party fron-trunner Boris Johnson. The winner of the Conservative party leadership race will be announced on July 22nd, with a new Prime Minister set to move in to Downing Street shortly thereafter.

Johnson has said Britain will leave the European Union on October 31st deal or no-deal. Meanwhile, the EU has repeatedly stated that it will not revisit Theresa May’s withdrawal deal. The possibility of EUR/GBP rising to parity for the first time will increase if Boris Johnson maintains his rigid stance on Brexit.

After making his “do or die” pledge to leave the EU by the official October 31 deadline, Johnson has also stated that the odds of a no-deal Brexit are only a one in a million.

According to Bank of England projections, a no-deal Brexit could send the UK economy into a deeper recession than 2008. The central bank warned that if the UK leaves the EU without a negotiated deal the nation’s GDP could fall by 8% and unemployment could rise to 7.5%. Analysts widely expect Sterling to remain on the back foot until Brexit uncertainties and the threat of a disorderly withdrawal from the EU have been resolved.