Key Points:

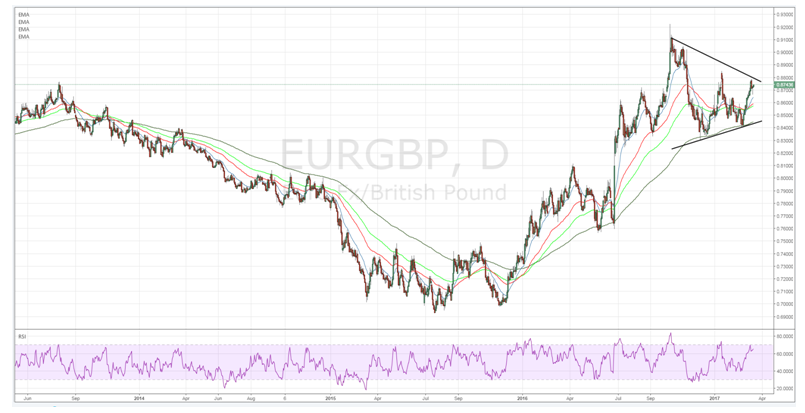

- Price action trading within a descending wedge.

- RSI Oscillator close to overbought levels.

- Watch for a breakdown towards the bottom of the wedge in the coming days.

The last few weeks have been relatively interesting for the EUR/GBP as the pair has continued to remain bullish as the UK seemingly grappled with budget planning issues ahead of the Brexit. However, despite the pair’s relative ascendency price action is now coming close to a key reversal zone that could see the pair trending lower in the coming days.

Taking a look at the charts provides some interesting clues to the EUR/GBP’s direction in the coming days. Presently, price action is caught in a wedge style formation that has seemingly capped its recent movements. However, it’s a descending wedge and the highs are subsequently becoming lower thereby increasing the downside pressure. In addition, the RSI Oscillator has trended higher and is now closing in on oversold territory indicating that a directional change could be coming.

Also, the diverging economic status of the Eurozone and the UK is now becoming clearer as the market digests the pending risks of a Brexit. The latest data seems to imply that the majority of the downside risk over the medium term is actually on the European side and that the UK may actually not experience a recession, despite the recent scare mongering of the anti-Brexit crowd. Subsequently, the pound is likely to see some resurgence, albeit on a fundamental basis, against the euro in the coming months.

Ultimately, the short term is likely to mean a downside move for the pair given the descending wedge and the oversold RSI Oscillator. The most likely scenario would involve price action pulling back from its current level, around the 0.8742 mark, back towards the bottom of the current wedge at 0.8450. However, given the depth of the recent appreciation, a deeper breakdown below the wedge could yield a move back towards the 0.82 handle. Subsequently, there are plenty of benefits to the short positioning for this pair in the near term.