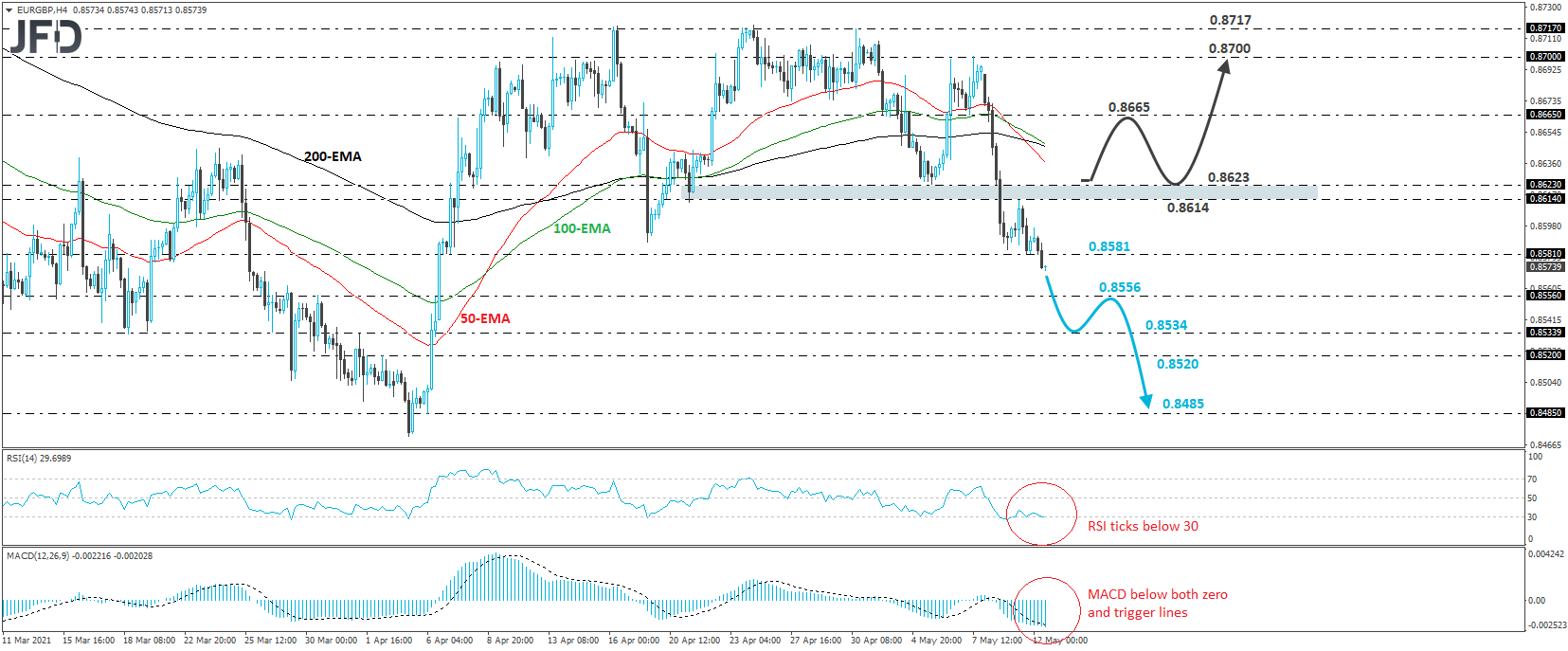

EUR/GBP entered a tumbling mode this week, after hitting resistance at 0.8700 on Friday. On Monday, the rate fell sharply, breaking below the key support (now turned into resistance) zone between 0.8614 and 0.8623, and although it rebounded on Tuesday, the recovery was limited near that zone, from where the bears regained control and pushed the action back down. All that paints a negative technical picture in our view.

Today, the rate fell below yesterday’s low of 0.8581, a move that may have opened the way towards the 0.8556 barrier, marked as a support by the inside swing high of Mar. 30. A break below that support may extend the fall towards the 0.8534 or 0.8520 hurdles, where another dip could see scope for extensions towards the low of Apr. 6, at 0.8485.

Shifting attention to our short-term oscillators, we see that the RSI has just touched its toe below the 30 line, while the MACD remains below both its zero and trigger lines, pointing somewhat lower. Both indicators detect strong downside speed and support the notion for this exchange rate to continue drifting south for a while more.

Now, in order to abandon the bearish case and start examining whether the bulls have woken up, we would like to see a recovery back above the aforementioned key area between 0.8614 and 0.8623. Such a move may allow advances towards the 0.8665 obstacle, marked by the inside swing low of May 7, the break of which could set the stage for the 0.8700 territory, which prevented the rate from moving higher on May 6 and 7.