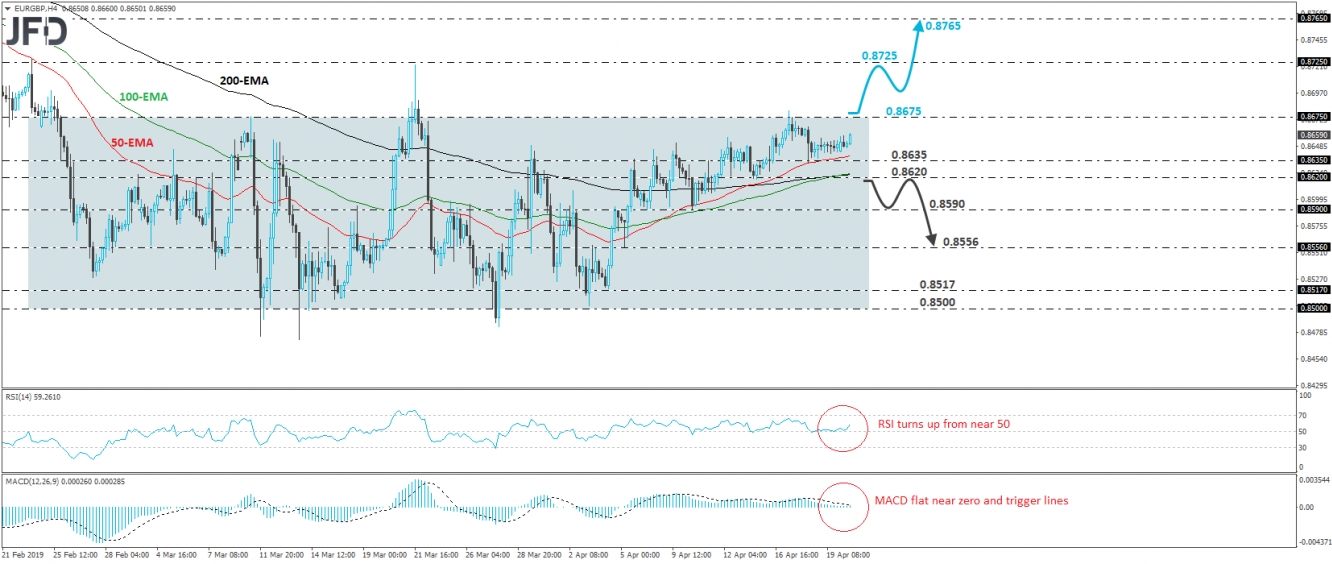

EUR/GBP traded in a consolidative manner on Friday and during the Asian session Monday, staying slightly above the 0.8635 support. That said, some bulls woke up during the European trading and they now seem to be heading towards the 0.8675 hurdle, which has been acting as the upper bound of the sideways range that’s been containing most of the price action since February 25th. Overall, given that EUR/GBP is still within the range, we prefer to maintain our neutral stance, and we would like to wait for a move above 0.8675 before we get confident on more upside extensions.

A clear break above 0.8675 could confirm the upside exit out of the aforementioned range and could initially set the stage towards the 0.8725 area, fractionally below the peak of February 22nd, and near the high of March 21st. That zone was also a decent support between January 30th and February 19th, when it was broken to the downside. Another break, above 0.8725, could carry more bullish implications, perhaps paving the way towards the 0.8765 hurdle, near the highs of February 18th and 19th.

Looking at our short-term momentum studies, we see that the RSI turned up from near its 50 line, but the MACD is still sitting near both its zero and trigger lines, pointing sideways. Although the RSI supports somewhat the notion for further advances, the flat MACD enhances our choice to wait for a move above 0.8675 before we start examining whether the bulls have taken the driver’s seat.

On the downside, a decisive slide below 0.8620 may signal that traders want to keep this exchange rate range-bound for a while more. The bulls could abandon the field, allowing the bears to take the reins and push the rate lower within the broader range. We could see declines towards the 0.8590 area, defined by the lows of April 8th and 10th, the break of which could extend the fall towards the low of April 5th, at around 0.8556.