Investing.com’s stocks of the week

- EUR/GBP charts new 2 ½-year low after UK retail sales beat estimates

- Short-term bias is skewed to the downside, but price near familiar support line

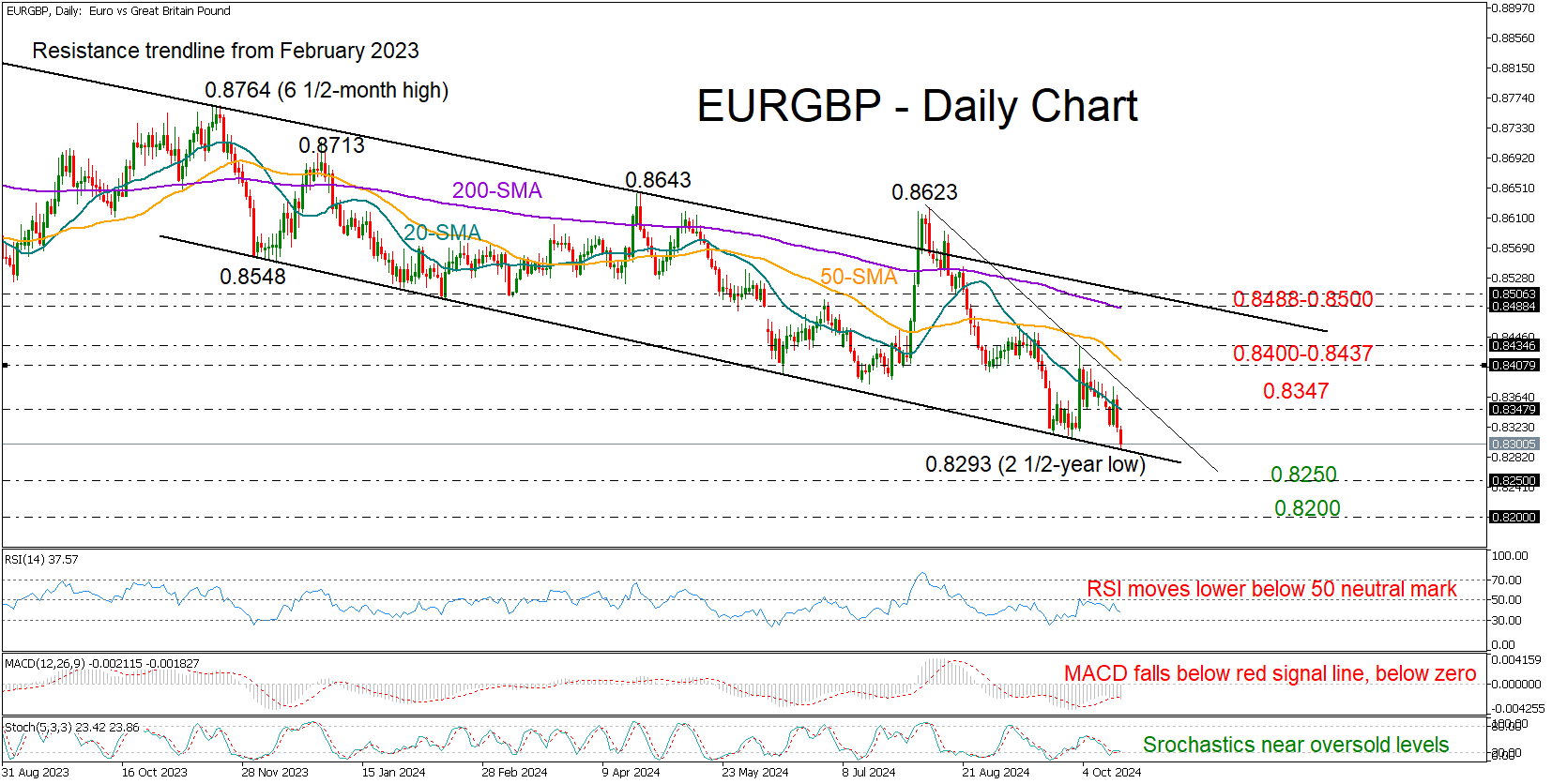

EUR/GBP plunged to a new 2½-year low of 0.8293, weighed by upbeat UK retail sales at 4.0% y/y and a dovish ECB policy stance, which raised concerns about the eurozone's growth.

The outlook appears grim: the RSI is declining in bearish territory, and the MACD has crossed below its signal line. However, the stochastic oscillator hints at a potential rebound from oversold levels as the price tests a critical support line established in December 2023.

If selling pressure persists below 0.8300, the pair could halt within the 0.8200-0.8250 range, a pivotal area from which the uptrend to 0.9249 began in 2022. A breach here could push the price towards 2016 levels and particularly to 0.8150.

Conversely, if buyers step in, immediate resistance could come from the 20-day simple moving average (EMA) at 0.8347. A step beyond 0.8400 could retest October's high of 0.8433 and then the 200-day SMA at 0.8488 and the falling resistance line from February 2023 at 0.8500.

In summary, EUR/GBP's downward trajectory continues, with limited signs of a bullish reversal on the horizon.