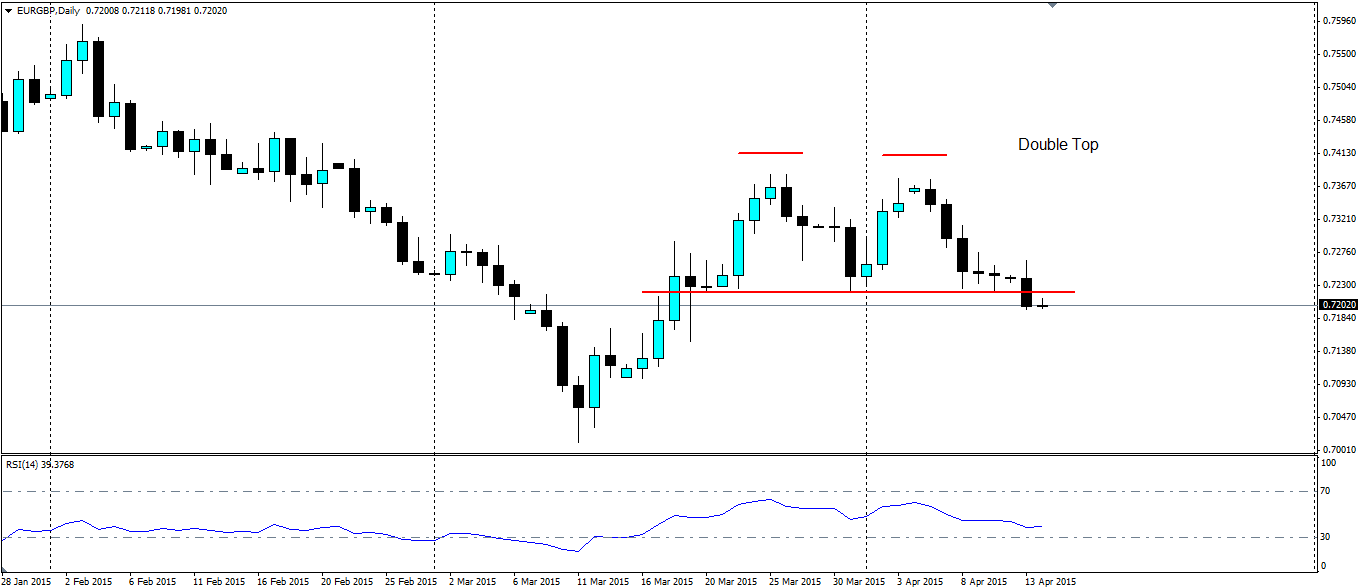

The EUR/GBP pair has seen a pullback counter to the trend recently. This has run out of steam with a double top forming in recent days that signals a continuation of the bearish trend. If it plays out it will likely test the support at the recent seven year low.

The bears are beginning to return to the market after a short term bullish run in the EUR/GBP that lasted almost two weeks and netted over 360 pips. There are fundamental reasons for the pull back; interest rate expectations. The market is concerned we will not see any interest rate increases from the Bank of England until early next year. The US Federal reserve on the other hand could raise rates as early as June, hence the pound weakness.

We have seen all of the cards the ECB is willing to play at this stage so all of the downside in the Euro has been priced in, which is why this cross lifted off the seven year low. It could also be that traders were inevitably going to exit short positions in the EUR/GBP cross after pushing out to a seven year low.

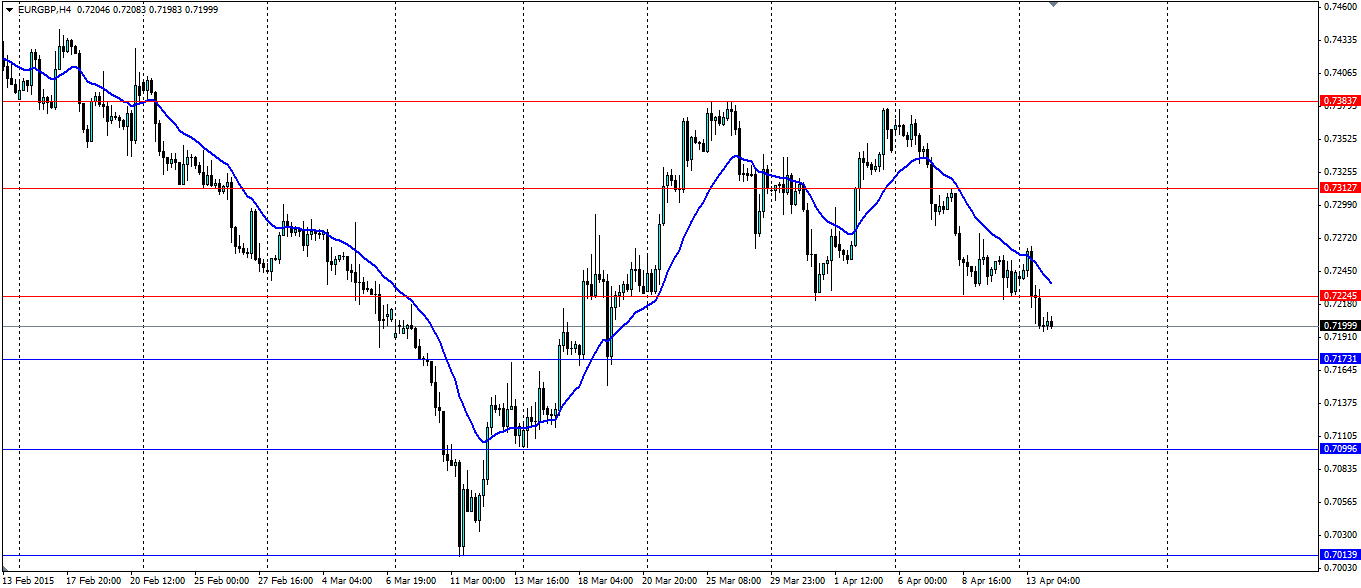

The bullish run found support that was tested twice and held both times. This is the formation of the double top with a clear neck line at 0.7224 that has recently failed as support. This failed support is as clear a signal as the market will give that a down trend is likely to begin, if technicals play out perfectly.

Watch for UK inflation figures due out shortly as they could throw a spanner in the works. The Bank of England bases interest rate decisions off the inflation rate, so a worsening rate will signal to the market that rate rises will be a long time off. UK Unemployment is due at the end of the week. Tomorrow will see the ECB meet to set interest rates (unlikely to change). We will, however, get an insight into how they view the economy at present, so watch for increased volatility.

This structure could see a run down to the support at the seven year low at 0.7013 if technicals are allowed to play out. Price will look for support along the way at 0.7173 and 0.7099, so watch for these levels as potential targets. Resistance will be found at the neck line at 0.7224, if that fails further resistance will be found at 0.7312 and the top of the structure at 0.7383.

The Euro-Pound pair has formed a double top that could signal a reversal down towards the recent seven year low. Watch for volatility from UK inflation figures and the ECB meeting.