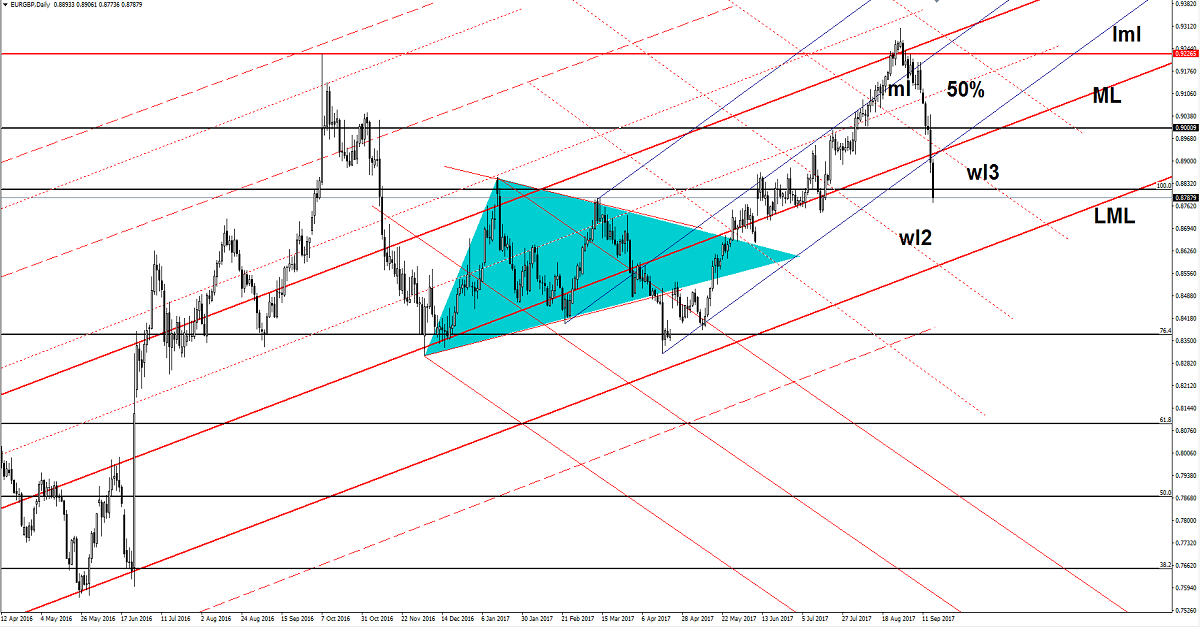

EUR/GBP Seems Unstoppable

Price edges lower on the short term and managed to hit fresh new lows. Is trading in the red and seems unstoppable because has ignored some important support levels. EUR/GBP extended the sell-off as the Cable is strongly bullish on the short term.

Technically, it could drop much deeper in the upcoming days as the rate is located much below the 0.8900 psychological level. However, we may have a minor rebound because it could come back to retest the broken support levels (support turned into resistance) before will resume the downside movement.

The Euro dropped aggressively as the Euro-zone Trade Balance decreased from 21.7B to 18.6B in July, has come much below the 20.1B estimate. On the other hand, the CB Leading Index decreased by 0.1%, much versus the 0.2% estimate.

You can see that the rate has confirmed the breakdown below the median line (ML) of the major ascending pitchfork and below the lower median line (lml) of the minor ascending pitchfork. Has also dropped below the 100% Fibonacci level, signaling that the bears are in full control. Technically is expected to be attracted by the lower median line (LML) of the major ascending pitchfork, where he may find support again.

However, it could come back to retest the broken warning line (wl3) before will drop much deeper. Remains to see what will happen because it seems too heavy to be stopped.

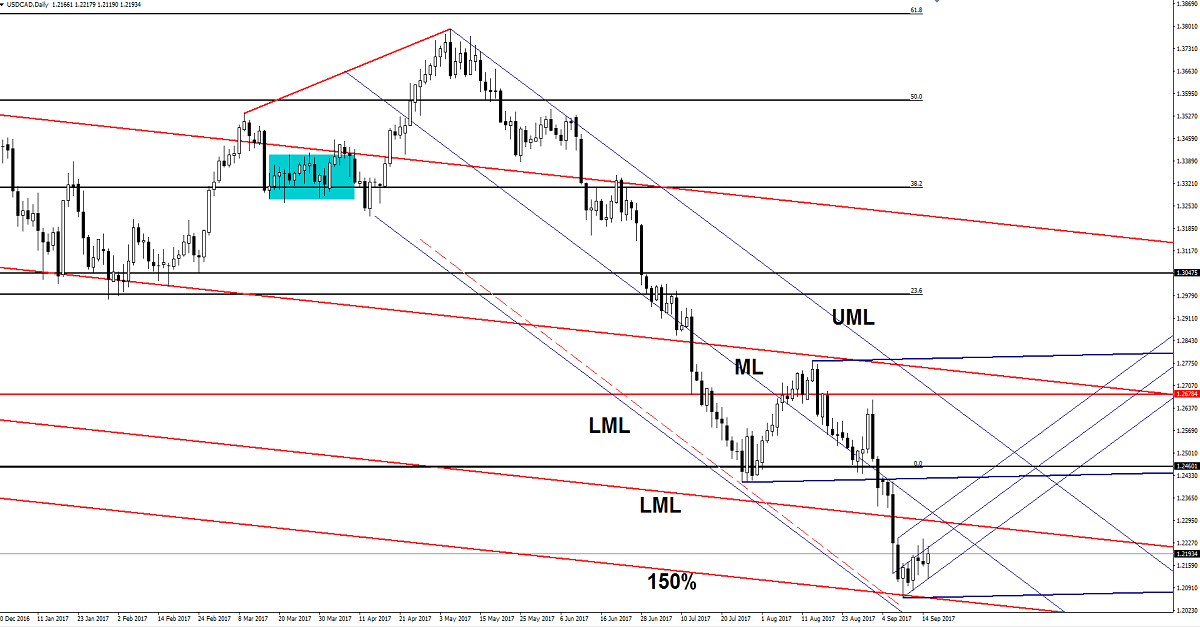

USD/CAD Is Trading In The Green

We have a rebound in play, which could approach and reach the confluence area formed at the intersection between the lower median line (LML) of the major red descending pitchfork with the median line (ML) of the blue descending pitchfork.

I’ve added a minor ascending pitchfork to catch a potential upside movement. Technically, it could climb much higher after the failure to test and retest the lower median line (LML) of the dark blue descending pitchfork.

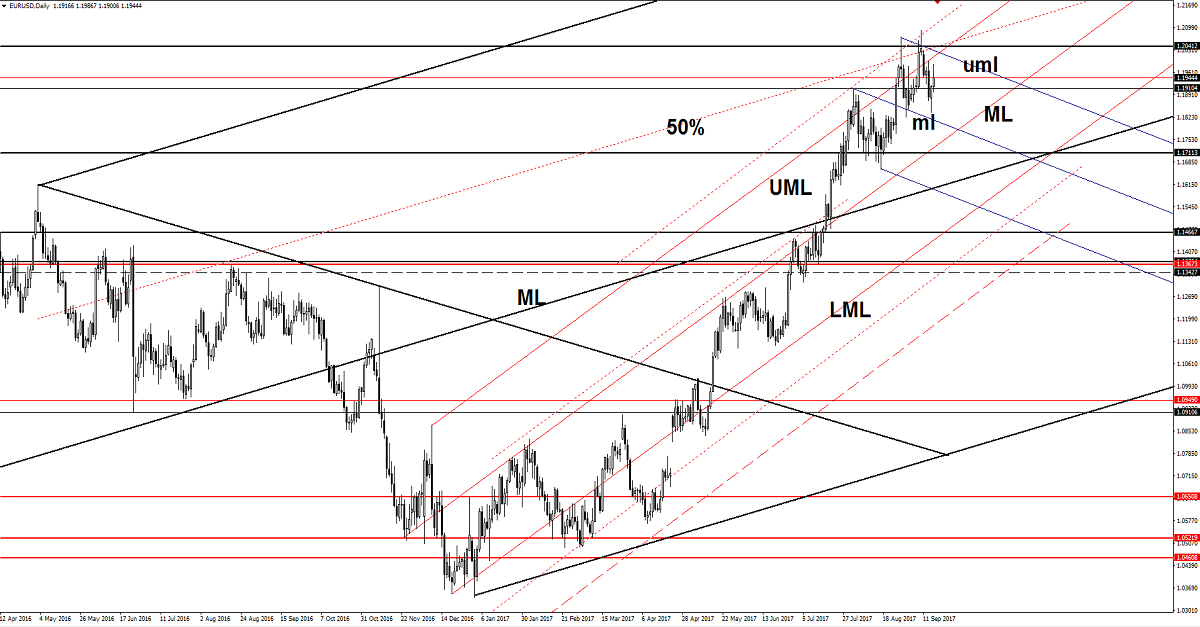

EUR/USD Narrowing

EUR/USD is trading in the green and resumes the yesterday’s bullish candle. It should reach and retest the upper median line (uml) of the minor descending pitchfork before will drop much deeper. Is moving in range on the short term, but is still expected to drop to reach the median line (ML) of the minor ascending pitchfork.

Risk Disclaimer: Trading, in general, is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.