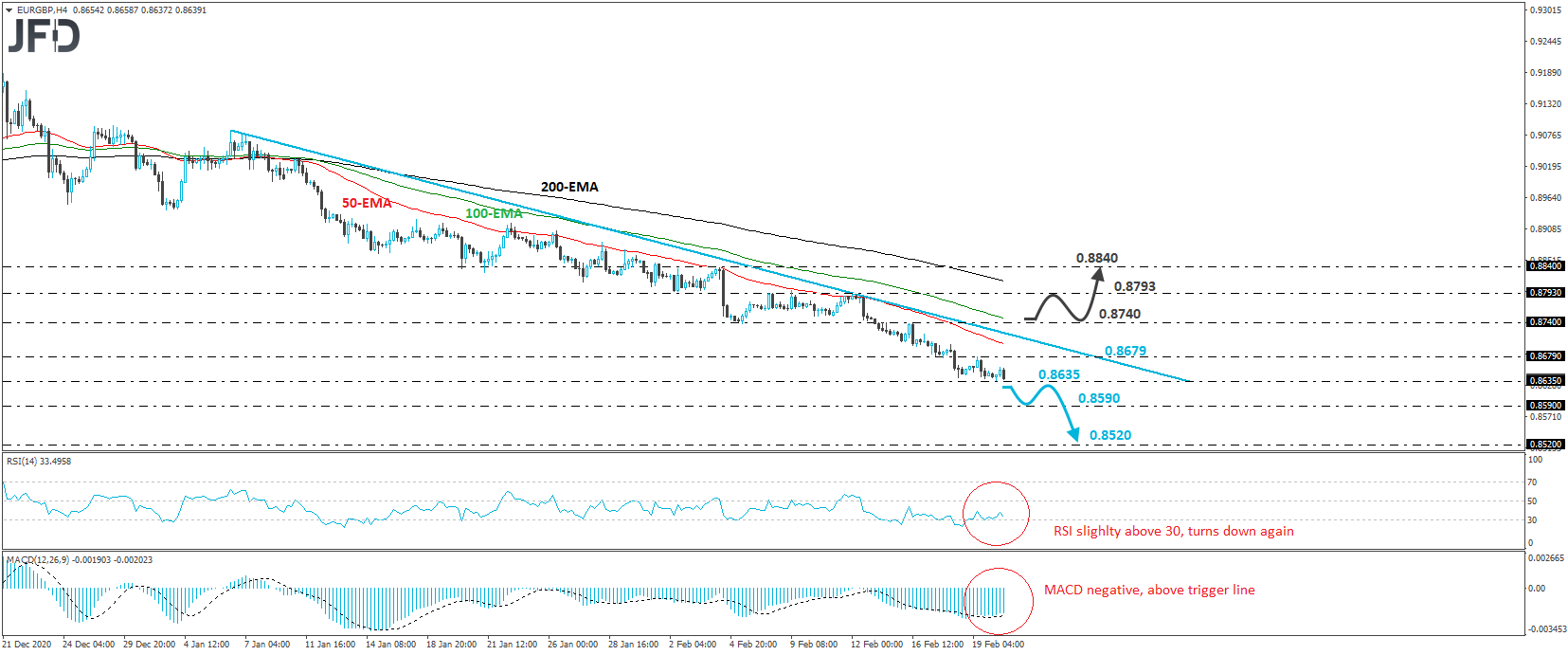

EUR/GBP traded in a consolidative manner on Monday morning, staying fractionally above the 0.8635 level. Overall, the pair is printing lower highs and lower lows below the downside resistance line drawn from the high of Jan. 6, and thus, we would consider the short-term outlook to be negative.

A clear and decisive break below 0.8635 would confirm a forthcoming lower low and may initially pave the way towards the 0.8590 barrier, marked by the low of Mar. 2, 2020. The bears may decide to take a break after hitting that hurdle, thereby allowing the rate to rebound somewhat. That said, as long as it would still be trading below the aforementioned downside line, we would see decent chances for another leg south. A break below 0.8590 could carry larger bearish implications, perhaps setting the stage for the low of Feb. 28, 2020, at 0.8520.

Shifting attention to our short-term oscillators, we see that the RSI lies fractionally above 30 and has just turned down again, while the MACD, although negative, lies above its trigger line. Both indicators detect negative momentum, but the fact that the MACD stays above its trigger line suggests that it would be better to wait for a dip below 0.8635 before getting confident on more declines.

In order to abandon the bearish case and start examining a bullish reversal, we would like to see a rebound back above 0.8740, which is the high of Feb. 16. The rate would already be above the pre-discussed downside line and the bulls may pull the trigger for the peak of Feb. 11, at around 0.8793. Another break, above 0.8793, could extend the advance towards the 0.8840 zone, defined as a resistance by the high of Feb. 4.