EUR/GBP tumbled on Monday after BoE Deputy Governor Dave Ramsden said that he and his colleagues are not about to use negative interest rates immediately.

At their latest meeting, BoE policymakers noted that they are exploring how a negative bank rate could be implemented effectively, something that increased speculation over the adoption of sub-zero rates, perhaps as soon as at the upcoming gathering.

With that in mind, Ramsden’s comments may have prompted some GBP-traders to scale back their negative-rate bets, and that’s why the pound rallied.

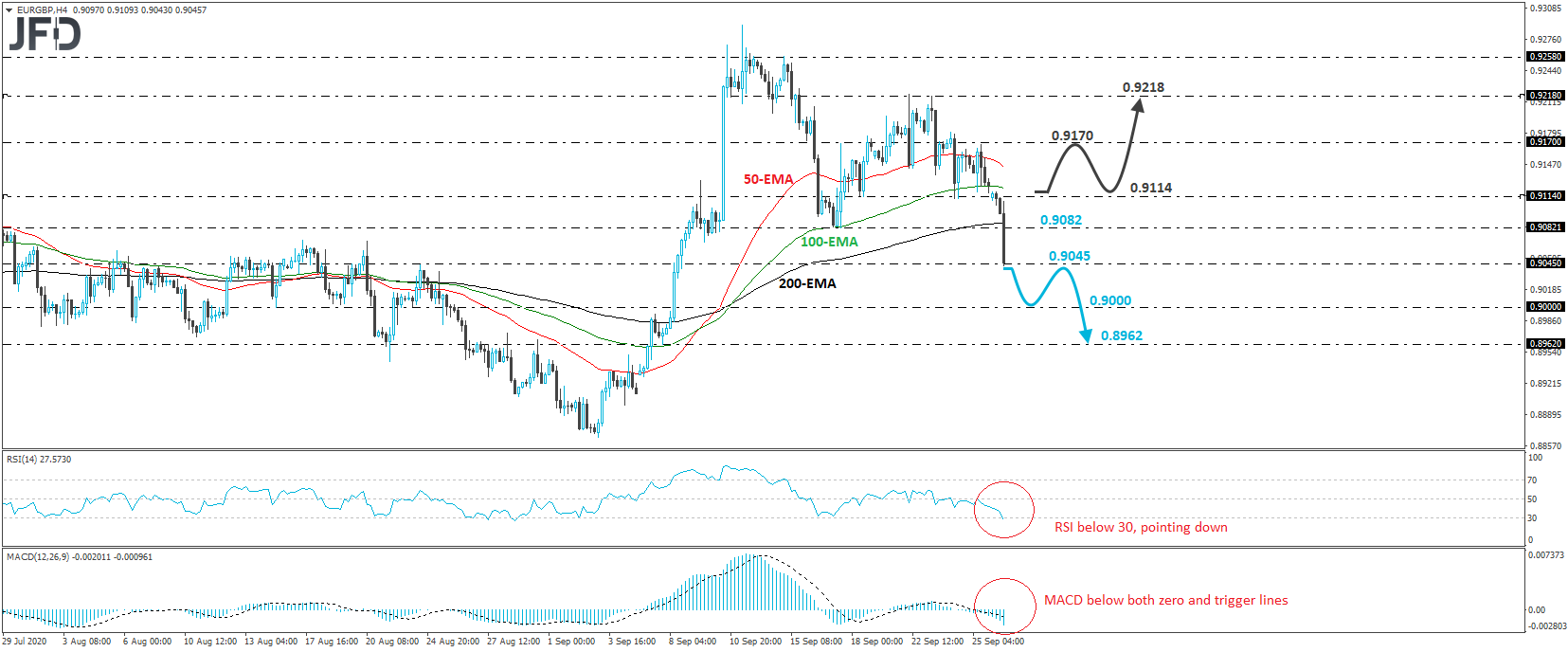

From a technical perspective, the dip took the rate below the 0.9082 barrier, thereby completing a failure swing top pattern on both the 4-hour and daily charts. In our view, this may have turned the short-term outlook of this pair somewhat to the downside, at least for now.

At the time of writing, the rate is testing the 0.9045 zone, marked as a support by the inside swing high of Aug. 24, where a decisive break may set the stage for the psychological zone of 0.9000. If the bears are not willing to stop there either, a break lower could pave the way towards the 0.8962 level, marked by an intraday swing low formed on Sept. 7.

Taking a look at our short-term oscillators, we see that the RSI slid and just touched its toe below its 30 line, while the MACD lies below both its zero and trigger lines, pointing down as well. Both indicators detect strong downside speed, which enhances the case for further declines in the short run.

Now, in order to abandon the bearish case and start examining whether the bulls may have staged a comeback, we would like to see a strong recovery back above 0.9114, a territory which provided strong support on Sept. 18 and 24. Such a move may initially open the path towards the peak of Sept. 25, at around 0.9170, the break of which may extend the advance towards the highs of Sept 22 and 23, near 0.9218.