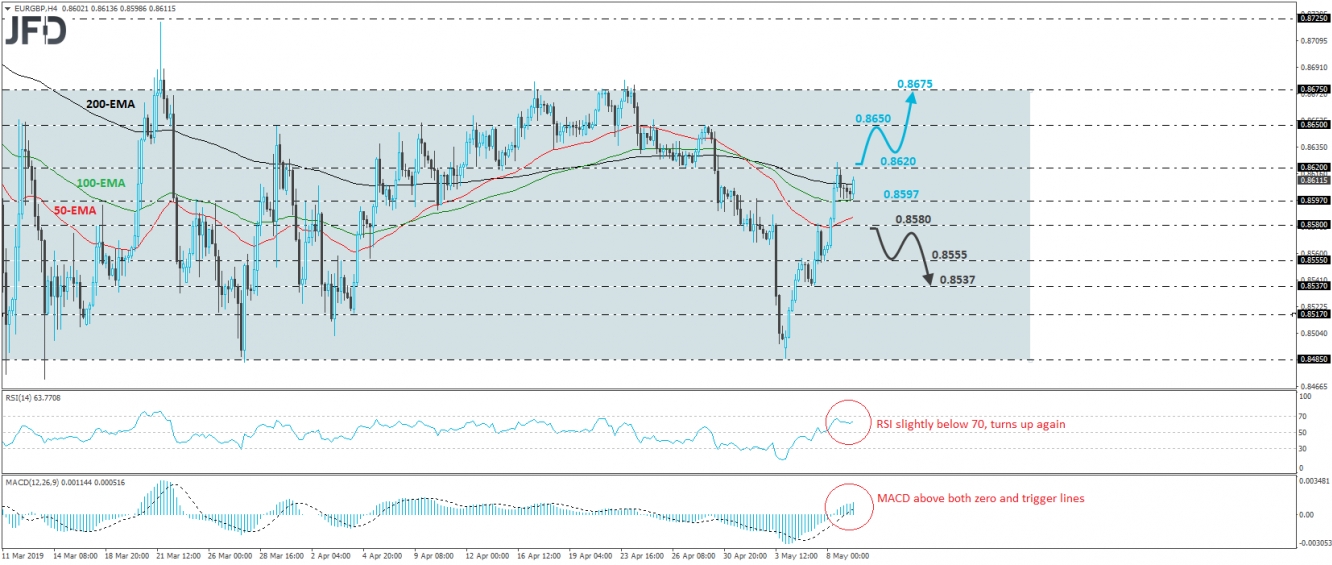

EUR/GBP has been in a rally mode since May 6th, when it hit support near 0.8485, the lower end of the sideways range that’s been containing the price action since February 25th. Yesterday, the rate pulled back after it hit resistance fractionally above the 0.8620 barrier, which acted as a decent support back on April 15th, 26th and 29th, but the setback was stopped at 0.8597 and then, the rate rebounded again. Given that EUR/GBP continues to trade within the aforementioned range, we will consider the medium-term outlook to be flat, but in the short run, we would expect some further recovery.

We believe that the bulls may decide to challenge once again the 0.8620 obstacle, and if they prove strong enough to overcome it, then we could see them driving the battle towards the 0.8650 hurdle, marked by the highs of April 29th and 30th. If they are not willing to liquidate near that resistance, a break higher may allow them to put the upper bound of the range, at around 0.8675, on their radars.

Looking at our short-term oscillators, we see that the RSI hit resistance slightly below 70, moved somewhat lower, but turned up again. The MACD lies above both its zero and trigger lines. Both indicators suggest upside momentum and support the case for this exchange rate to continue trading higher, at least within the aforementioned medium-term range.

In order to start examining whether the bulls have passed the torch to the bears for a while, we would like to see a dip below 0.8580. Something like that may signal that the bulls are not willing to go all the way up to the upper bound of the range and may let the bears to push towards the 0.8555 support. Another break, below 0.8555, could extend the slide towards Tuesday’s low, at 0.8537.