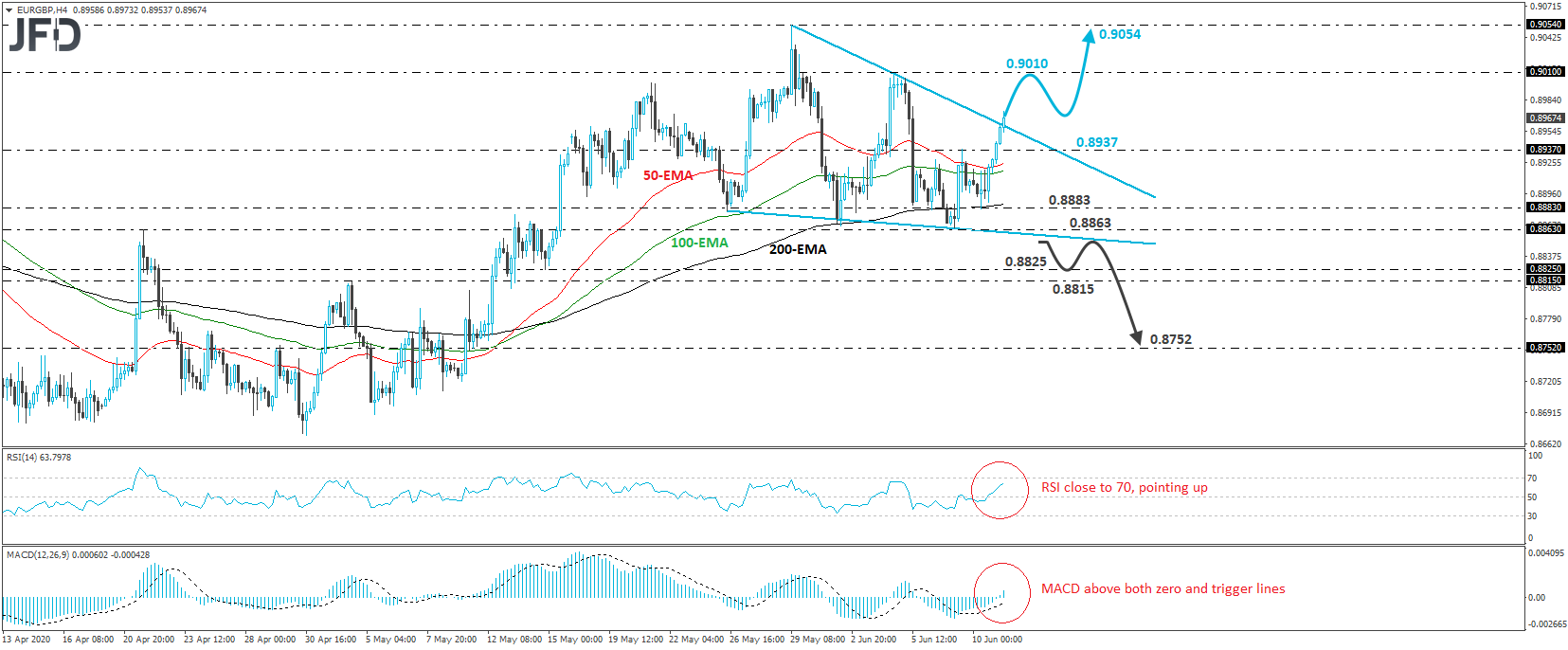

EUR/GBP has been in a rally mode since yesterday, when it hit support at 0.8883. Today, the advance continued, with the rate breaking above the upper side of a falling wedge formation that was containing the price action since May 26th. Having also in mind that the pair is now trading above all three of our moving averages on the 4-hour chart, we would consider the near-term outlook to be somewhat positive.

In our view, the break above the wedge’s upper end may have opened the path towards the peak of June 4th, at around 0.9010. The bulls may decide to take a break after testing that zone, thereby allowing the rate to correct back below 0.9000. That said, as long as the retreat stays limited above the upper side of the formation, we would see decent chances for another leg north and a break above 0.9010. Such a move may set the stage for more upside extensions, perhaps towards the high of May 29th, at 0.9054.

Shifting attention to our short-term oscillators, we see that the RSI is pointing up and looks to be heading towards 70, while the MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect strong upside speed and corroborate our view for some further near-term advances in this exchange rate.

In order to start examining whether the bears have gained full control, we would like to see a strong dip back below 0.8863 and the lower bound of the wedge. Such a move would confirm a forthcoming lower low and may initially pave the way towards the 0.8825 or 0.8815 barriers, marked by the low of May 14th and the inside swing high of May 4th, respectively. If those zones are not able to stop the slide either, its break may carry larger bearish implications, perhaps targeting the 0.8752 area, defined as a support by an intraday swing low formed on May 11th.