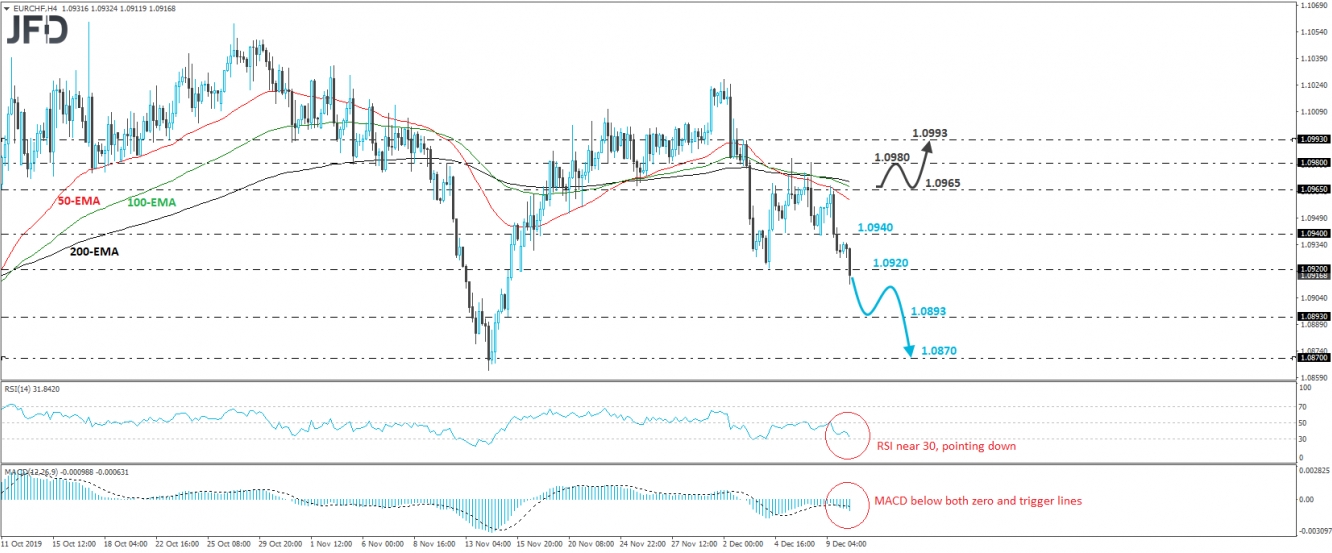

EUR/CHF has been in a sliding mode since yesterday, when the rate hit resistance near the 1.0965 barrier. The rate fell below the 1.0940 zone, which is near the low of December 6th, while today it dipped slightly below the low of December 4th, at around 1.0920. The latest move may have been a signal for a forthcoming lower low and thus, we will hold a somewhat bearish stance for now.

If the bears are strong enough to keep the pair below 1.0920, we may then experience declines towards the 1.0893 hurdle, defined as a support by the low of November 15th. If that zone is not able to halt the tumble either, then the slide may be extended towards the 1.0870 zone, marked by the low of October 8th, and slightly above the low of November 14th.

Taking a look at our short-term oscillators, we see that the RSI lies below 50, near 30, and points down. The MACD lies below both its zero and trigger lines. Both indicators detect negative speed and support the case for some more declines in this exchange rate.

On the upside, we would like to see a clear break above 1.0965 before we start examining whether the bears have abandoned the field for a while. Such a move could initially target the 1.0980 zone, the break of which may extend the recovery towards the peak of December 3rd, at around 1.0993.