Risk appetite has certainly deteriorated over the past week as Turkey clashes with President Trump and battles with the financial markets. It seems we are all emerging markets traders now as CNY and ZAR also get hit and trade near significant resistance levels, where the issues potentially become a wider test of global risk sentiment.

Of course EUR/USD among the majors has been a big catalyst for the moves in currencies recently with new multi-month lows on concerns over Eurozone bank exposures. One similar pair also worth keeping an eye on is EUR/CHF, which is currently a pure risk proxy for the wider market. Rising spreads in the Eurozone periphery have driven this pair lower, while the volatility in TRY has also helped the safe-haven swissie due to the bank issue.

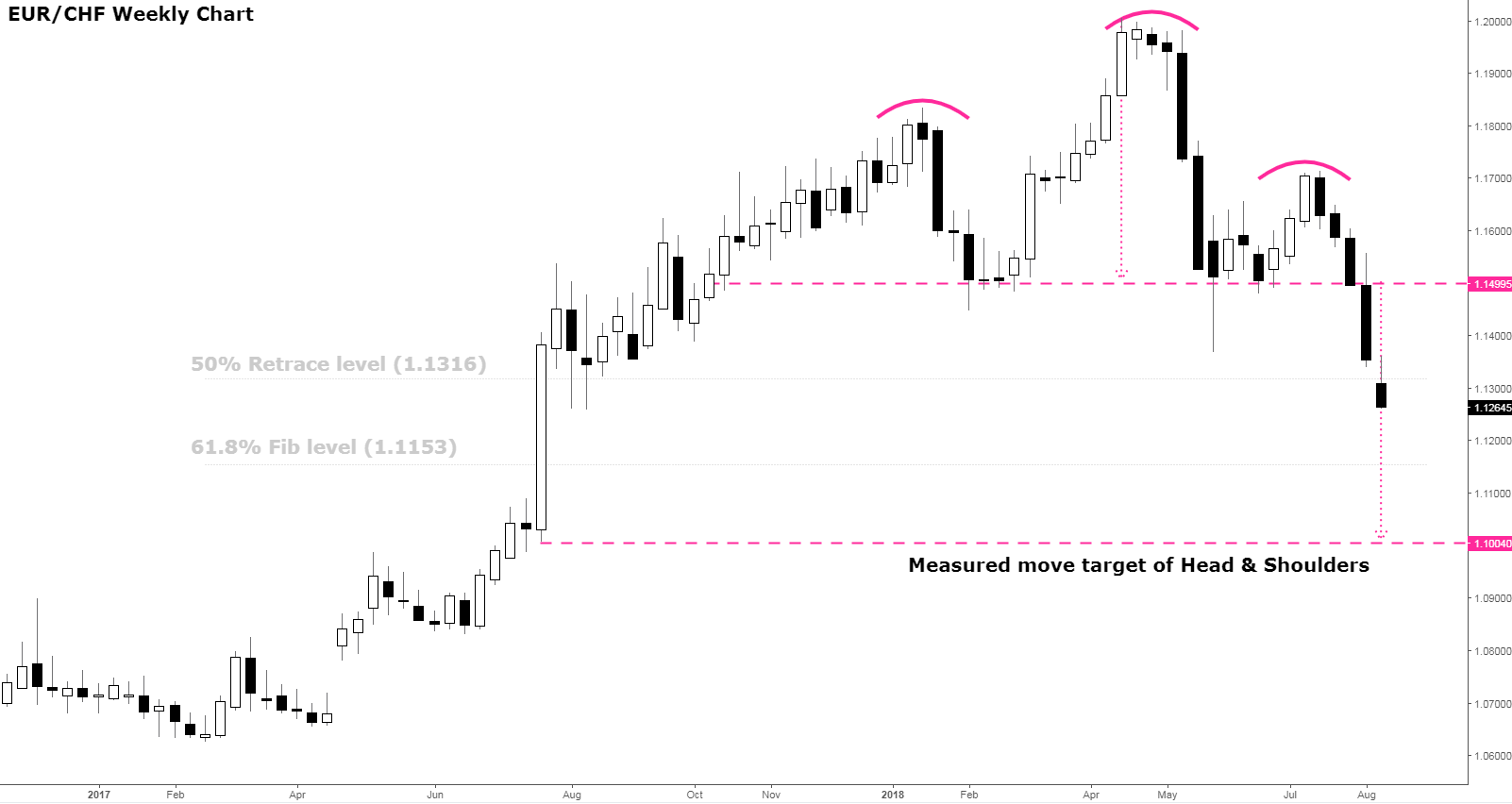

Having hit multi-year highs above the mythical 1.20 level, prices in EUR/CHF have fallen quite sharply. The weekly chart shows us a potential head and shoulders reversal pattern with a measured move of roughly 500 points from the neckline, targeting 1.10. Interestingly, we are also just trading below the 50% retrace level (1.1316) from the 2017 lows to those long-forgotten April highs this year. The next significant Fib level below here would be around 1.1153.

However, the strength of the sell-off most recently does caution against the pace of this move continuing as prices are looking overstretched on a number of short-term indicators. Of course, in these volatile times, much depends on the fragile risk appetite and whether we see some easing of the current environment. Keeping your eyes on some of the currencies outside of the G10 space may help decide if we can get closer to that measured move target in EUR/CHF over the medium-term…