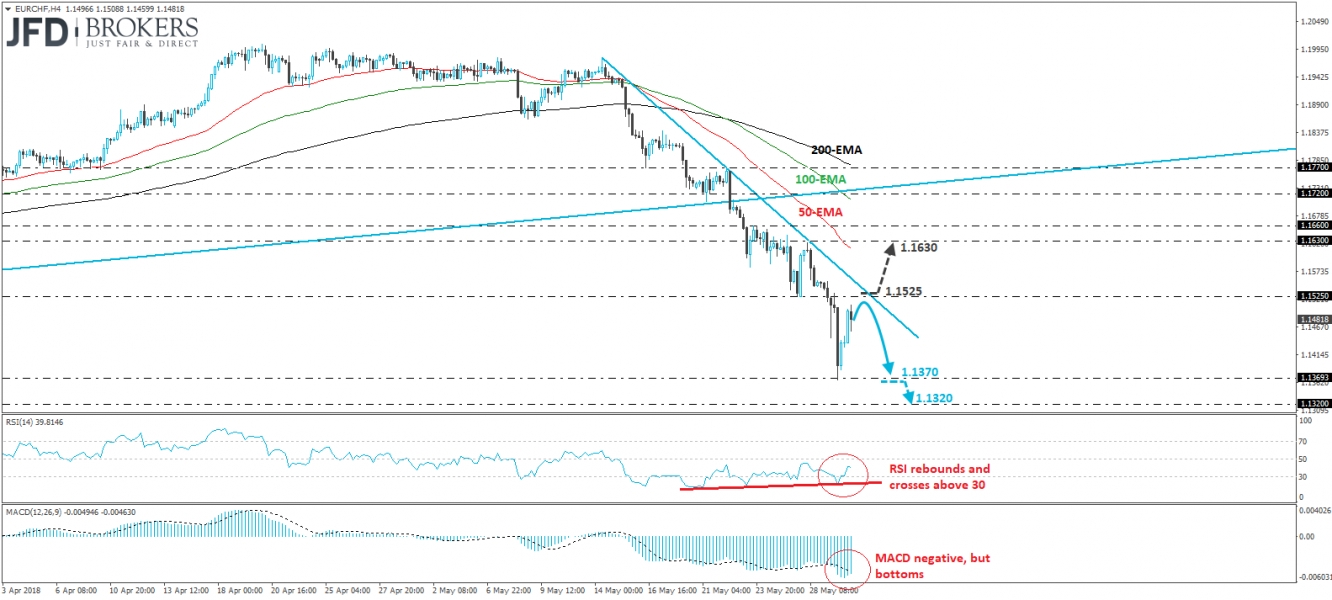

EUR/CHF traded higher after it hit support near 1.1370. However, the price structure remains of lower peaks and lower troughs below the short-term downtrend line taken from the peak of the 14th of May, and also below all three of our moving averages, which point south. In our view, this keeps the short-term picture negative. What’s more, on the 22nd of May, the pair dipped below a long-term uptrend line drawn from the low of the 21st of April 2017, something that supports further the case for the pair to turn down again.

If the bulls are strong enough to take the reins from below the 1.1525 resistance barrier, or the aforementioned downtrend line, then we may see them driving the battle down for another test near the 1.1370 territory. If they manage to overcome that zone, then they could aim for our next support of 1.1320, defined by the low of the 21st of August 2017.

Looking at our short-term oscillators, we see that the RSI rebounded and exited its below-30 zone, while the MACD, although negative, has bottomed and now appears ready to move above its trigger line. These indicators suggest that some more recovery may be in the works before, and if, the bears decide to seize control again.

Nevertheless, as we already noted, as long as such a recovery remains limited below the short-term downtrend line, we would still see a decent likelihood for sellers to jump in again. We would like to see a clear and decisive break above that trend line before we start examining whether the bulls have taken the driver’s seat in the short run. Such a break could pave the way towards our next resistance zone of 1.1630, marked by the high of the 28th of May.