Most traders will have stayed away from Swiss Franc pairs ever since the SNB blindsided the market back in January. But a consolidation pattern is a technical setup that may interest some as the bulls look to take hold of the market.

The EUR/CHF has been searching for equilibrium ever since the Swiss National Bank removed the price floor that held the Swiss Franc against the Euro at no less than 1.20. This was a complete shock to the market and no doubt plenty of people got their fingers burnt and have stayed clear of the pair.

The fundamentals have seen the Euro strengthen slightly against the Swiss Franc as the temporary resolution to the situation in Greece decreases the demand for the safety of the Franc. The economic news has begun to show signs of life in the EU with the German IFO Business Climate ticking higher this week and the ZEW Economic sentiment reports all lifting last week.

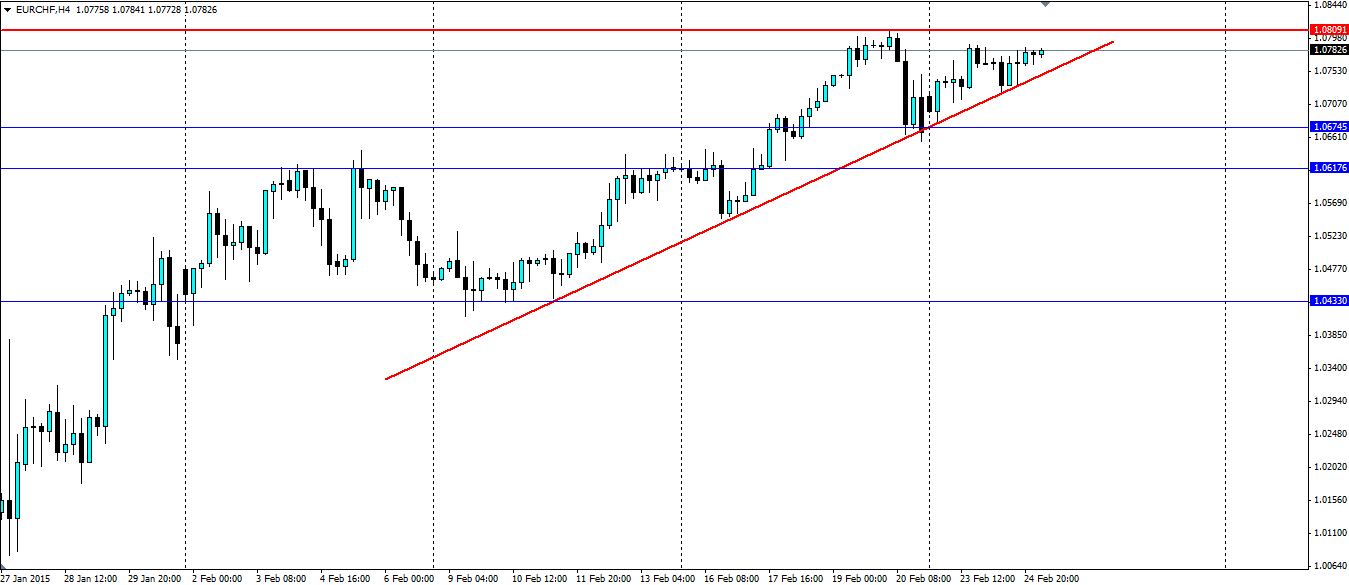

The technical setup shows a struggle between the bulls pushing the market higher and the bears standing their ground to form a bullish triangle. An upside breakout would be the key outcome and one the bulls will be looking for here. Certainly anyone looking to trade this pair will be watching to see how this shape forms and a bullish breakout will be as good an entry signal as any.

Watch for the resistance at 1.0809 to breakdown before jumping in. After that it will be difficult to gauge where the next lines of resistance lie as this pair hasn’t traded around this level in quite some time. Looking back to 2011, the psychological level at 1.1000 was a support/resistance level the price was interested in. This will be a good level to target for a breakout.If we see a downside breakout, look for support to be found at 1.0674, 1.0617 and 1.0433.