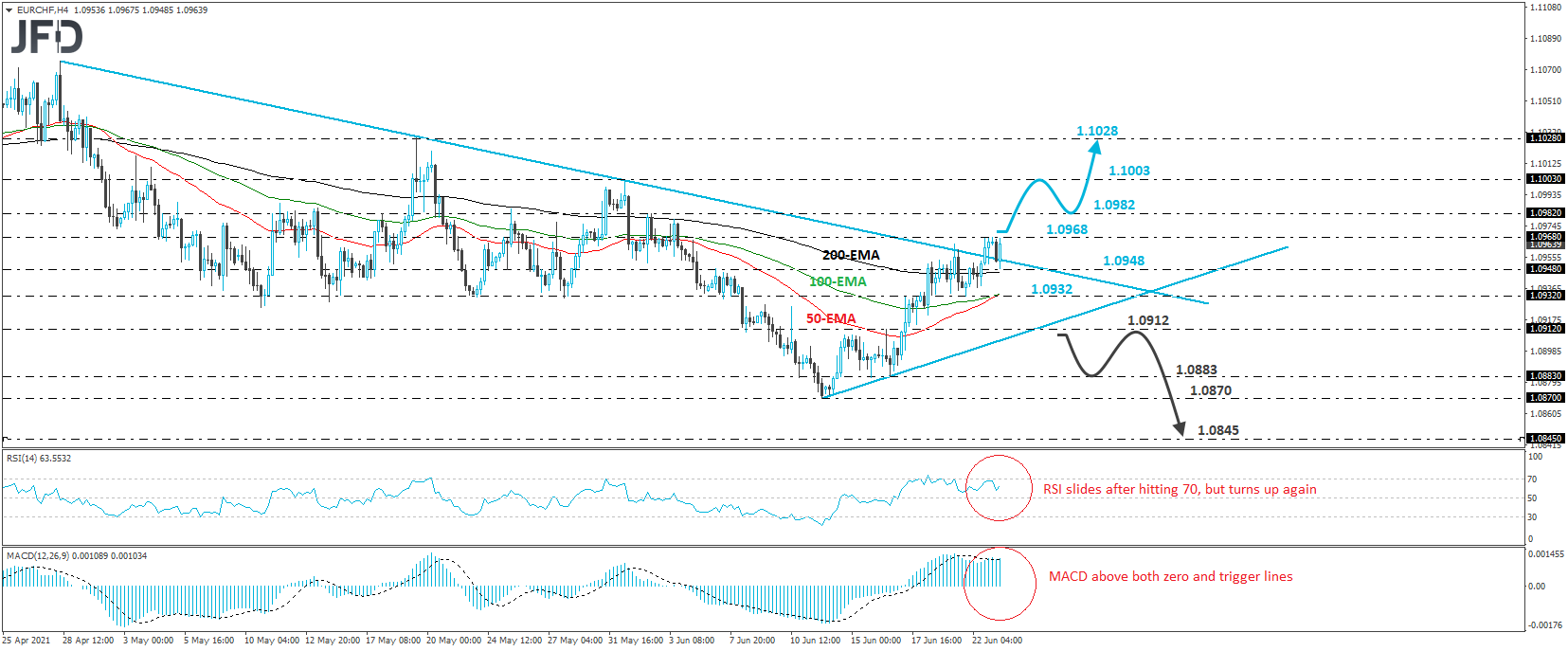

EUR/CHF traded higher yesterday, breaking above the downside resistance line drawn from the high of Apr. 28. Then, the rate hit resistance at 1.0968, and today, it pulled back. That said, the setback was limited near that downside line, from where the bulls took charge again. Given that the rate continues to trade above the prior downside line, we would consider the short-term outlook to be cautiously positive.

That said, in order to get confident over further advances, we would like to see a break above yesterday’s high of 1.0968. This will confirm a forthcoming higher high on the 4-hour chart and may initially target the 1.0982 barrier, which is marked by the high of June 2. If the bulls do not stop there, then we could see advances towards the peak of the day before, at around 1.1003, the break of which could see scope for extensions towards the 1.1028 territory, defined as a resistance by the high of May 19.

Taking a look at our short-term oscillators, we see that the RSI slid after hitting resistance at 70, but today, it turned up again, while the MACD stays above both its zero and trigger lines. These indicators suggest that the rate may start picking upside speed again soon, which supports the notion for further advances.

Now, in order to start examining whether the bears have gained full control, we would like to see a break below 1.0912. This will take the rate below the short-term upside support line drawn from the low of June 11, and may allow declines towards the lows of June 15 and 16, at 1.0883, or the low of June 11, at 1.0870. If neither barrier is able to halt the slide, then, we could see the bears driving the battle towards the 1.0845 zone, defined as a support by the inside swing high of Feb. 8.