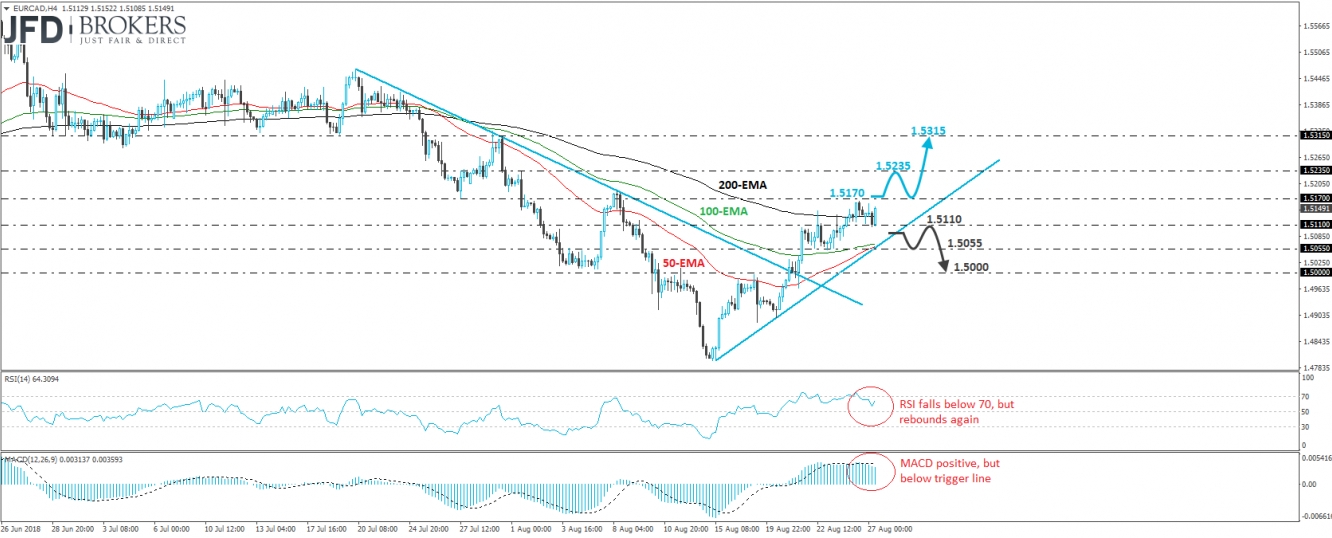

EUR/CAD rebounded during the European morning Monday, after it hit support near the 1.5110 level. The pair continues to trade above the tentative uptrend line drawn from the low of the 15th of August and thus, we would consider the short-term outlook to be positive for now.

If today’s recovery continues and the rate breaks above the 1.5170 barrier, then we would expect such a move to aim for our next resistance hurdle of 1.5235, defined by the peak of the 1st of August. Another break above that zone could set the stage for more bullish extensions, perhaps towards the 1.5315 zone, slightly below the peak of the 31st of July.

Taking a look at our short-term momentum indicators, we see that the RSI has topped and fallen below its 70 line, but it rebounded again today and appears ready to reenter its above-70 zone. The MACD lies within its positive territory, but below its trigger line. The rebound of the RSI supports the case for the pair to continue its upside trajectory, but the fact that the MACD is still below its trigger make us cautious that another setback may occur before the bulls decide to take charge again, perhaps for another test near 1.5110, or the aforementioned trendline.

On the downside, we would like to see a clear break below that trendline before we abandon the bullish case. Such a dip could initially aim for the 1.5055 support, the break of which could open the way for the psychological figure of 1.5000.