EUR/CAD: Loonie strengthened by rising inflation in Canada

Macroeconomic overview: Canada's annual inflation rate ticked higher in July as gas prices climbed, suggesting price pressures are picking up after June's subdued reading and clearing the way for the Bank of Canada to raise interest rates again in the fall.

The inflation rate rose to 1.2% from June's 20-month low of 1.0%, matching expectations, and two of the three measures of core inflation that the Bank of Canada introduced last year saw gains, Statistics Canada said.

CPI common, which the central bank says is the best gauge of the economy's underperformance, was unchanged at 1.4%, while CPI median, which shows the median inflation rate across CPI components, rose to 1.7% from 1.6%. CPI trim, which excludes upside and downside outliers, rose to 1.3% from 1.2% in June.

We think the data gives the central bank room to raise interest rates in September or October. There is a two-in-three chance of an interest rate hike by the Bank of Canada in October, data from the overnight index swaps market shows, little changed from before the inflation report.

The rate hike in July, the first in nearly seven years, was seen as a step towards returning borrowing costs to more normal levels after rate cuts following the global financial crisis took them to near-historic lows.

The CAD rose to a two-week high against the USD and the EUR on Friday. Investors are not sure whether the Fed is going to raise rates but are more inclined to believe that the Bank of Canada is going to raise rates. Adding to support for the loonie, prices of oil, one of Canada's major exports, rose 3% as U.S. drillers cut rigs and the greenback fell.

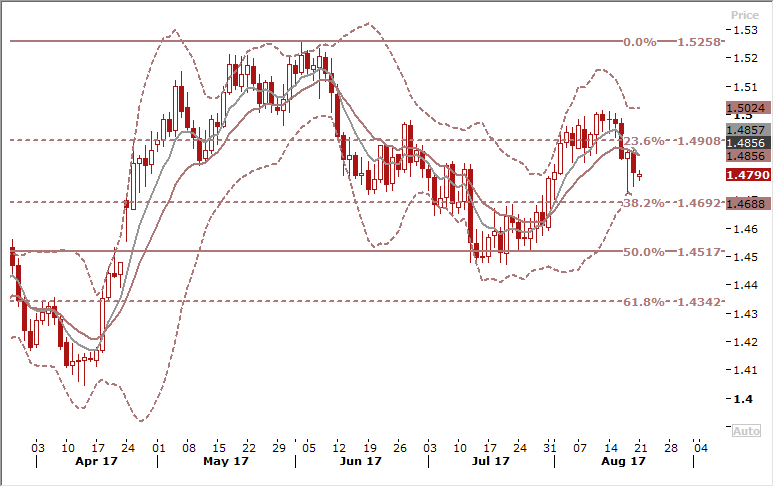

Technical analysis: The EUR/CAD remains below short-term moving averages that are negatively aligned. This supports our bearish view on this pair. The nearest support levels are: 1.4732 low on August 17 and 1.4692 (38.2% fibo of February-May rise).

Short-term signal: We stay short for at least 1.4650.

Long-term outlook: We stay flat in the long term.

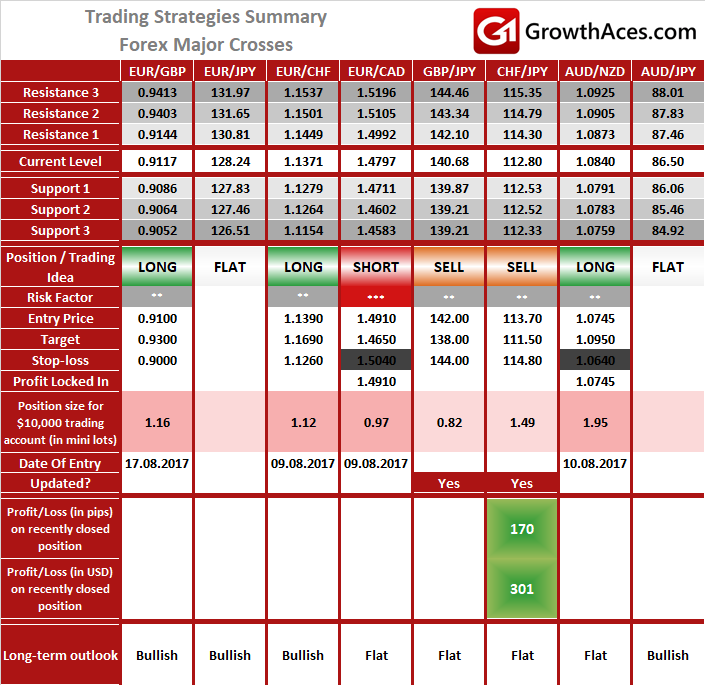

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: GrowthAces.com - your daily forex signals newsletter