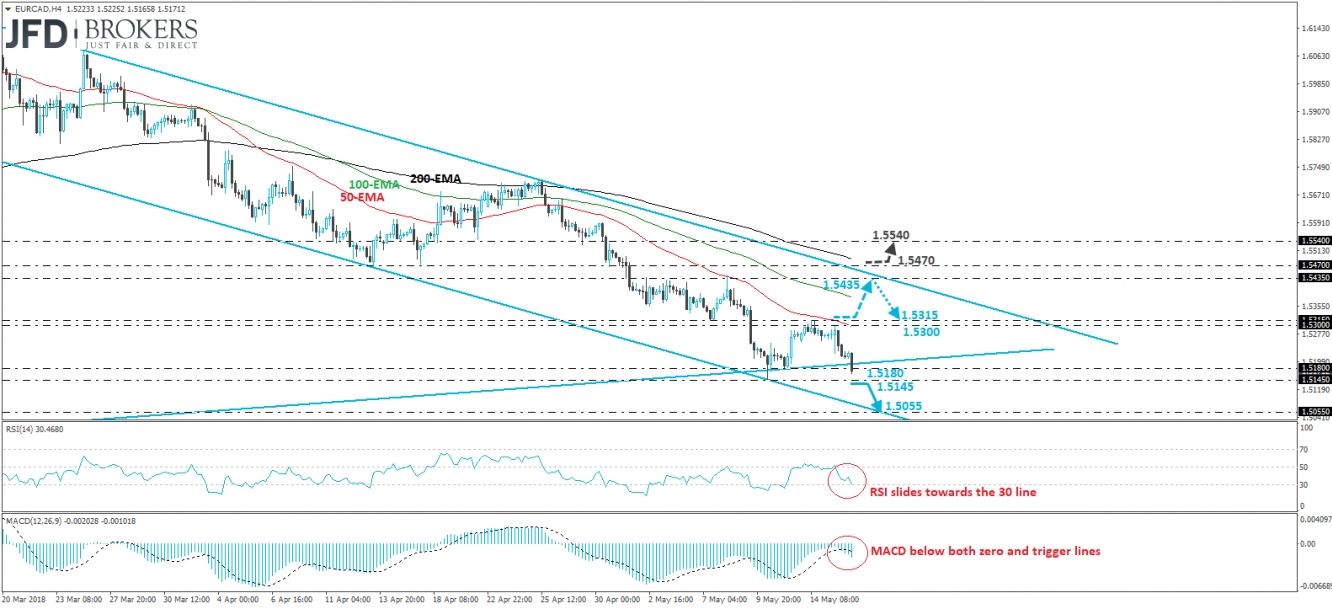

EUR/CAD traded lower on Tuesday, after it hit the 1.5300 resistance level. The tumble continued on Wednesday as well, with the pair breaking below the 1.5180 support and a long-term uptrend line drawn from the lows of February 2017. What’s more, the rate looks to be trading below all three of our moving averages, within a downside channel that’s been containing the price action since mid-March. Having all these technical signs in mind, we believe that EUR/CAD may be poised to continue drifting lower.

Following the dip below 1.5180, we would expect the bears to challenge the 1.5145 level soon and if they manage to overcome it, we could see them aiming for the crossroads of the 1.5055 support obstacle and the lower end of the aforementioned downside channel.

Turning our gaze to the short-term momentum studies, we see that the RSI slid and hit its 30 line. It could fall below 30 soon. The MACD lies below both its zero and trigger lines, pointing south as well. These indicators detect strong downside speed and corroborate our view that the bears are likely to stay in charge for a while more.

On the upside, a clear move above 1.5315 could set the stage for the 1.5435 barrier, or the upper bound of the short-term downside channel. However, even in such a case, we would keep a cautiously negative stance as we see a decent likelihood for sellers to jump in from near those resistance levels. We would like to see a decisive break above 1.5470 before we abandon the bearish case. Such a move could confirm the upside exit of the channel and could initially target the 1.5540 hurdle.