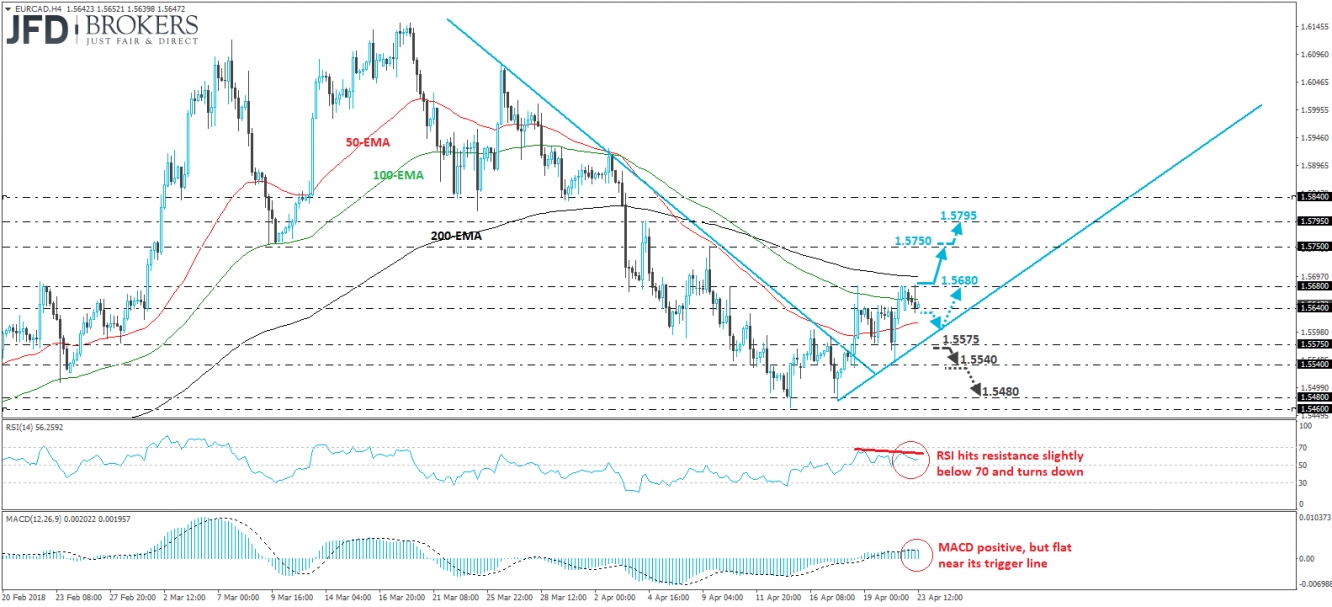

EUR/CAD surged on Friday after Canada’s inflation data for March missed estimates. The headline CPI accelerated to +2.3% yoy from +2.2% in February, missing estimates of +2.4%, while the core rate declined to +1.4% yoy from +1.5%, instead of staying unchanged as the forecast suggested. However, EUR/CAD hit resistance near the key barrier of 1.5680 and on Monday it retreated somewhat. Following Wednesday’s BoC decision, the pair emerged above the prior short-term downtrend line drawn from the peak of the 26th of March, and now looks to be trading above a new tentative uptrend line taken from the low of the 17th of April. Therefore, we believe that the short-term outlook has turned cautiously positive for now.

Currently, the rate is trading near the 1.5640 barrier, and if the bulls are willing to take charge from near that level, then we may see them aiming for another test near 1.5680. A decisive break above 1.5680 would confirm a forthcoming higher high on the 4-hour chart and is possible to open the way towards our next resistance hurdle of 1.5750, defined by the peak of the 9th of April.

Looking at our short-term oscillators though, we see that the RSI has turned down after it found resistance slightly below its 70 line, while the MACD, although positive, points sideways and stands near its trigger line. It could turn down as well. These indicators suggest that further setback may be on the cards before, and if, the bulls decide to seize control again.

A dip below 1.5640 could confirm the case for further retreat and may target the aforementioned short-term uptrend line. However, we would like to see a clear dip below that line, and even better, below 1.5575 before we abandon the bullish case. Such a dip could initially aim for the 1.5540 support, the break of which could see scope for more downside extensions, perhaps towards the 1.5480 territory.