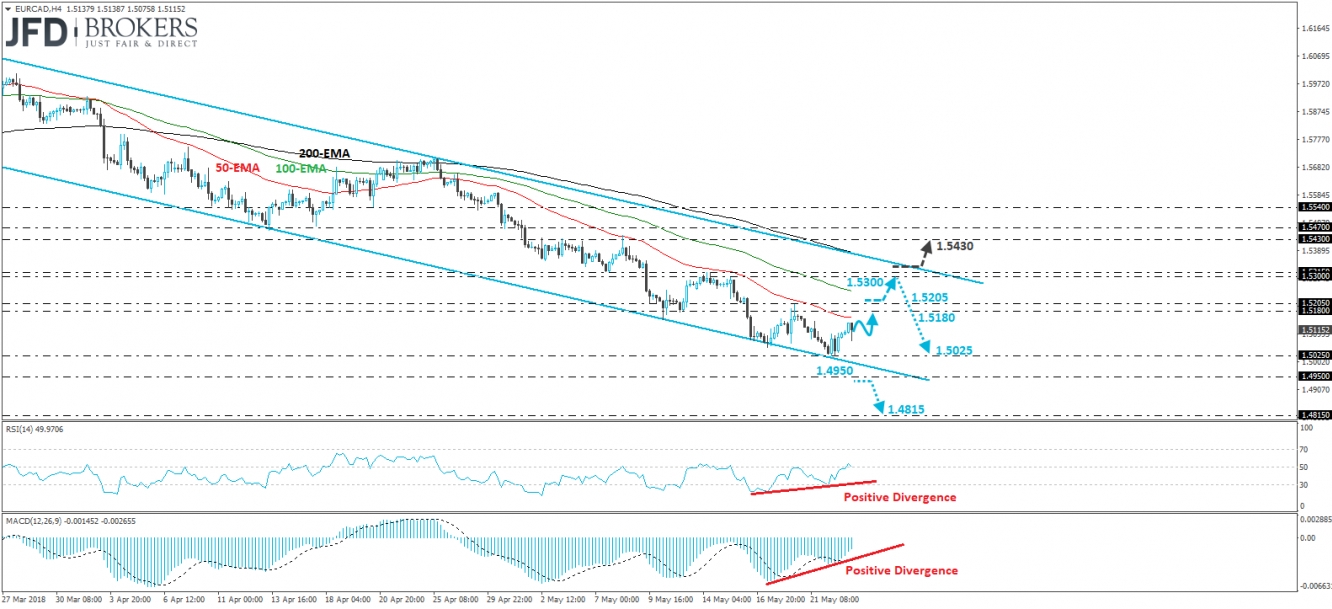

EUR/CAD traded higher yesterday after it hit support near the crossroads of the 1.5025 level and the lower bound of the downside channel that’s been containing the price action since mid-March. The fact that the rate continues to trade within that channel keeps the short-term outlook negative but taking into account that the latest rebound came from near the lower bound, we think that there is scope for further recovery. The case for some more upside, at least within the channel, is also supported by the positive divergence between both our short-term oscillators and the price action.

If the bulls are strong enough to take charge again soon, then we would expect them to aim for the 1.5180, or the 1.5205 territories. A strong break above 1.5205 could signal that there is potential for more recovery and could pave the way towards the 1.5300 zone, or the upper bound of the channel.

That said though, we would still see a decent chance for the bears to jump in from near the channel’s upper boundary. We would like to see a clear and decisive break above that boundary before we start examining the case of a trend reversal.

Now, in case the bears decide to seize control from current levels, and not wait for a corrective rebound, we may see them aiming for another test near the channel’s lower end, the break of which may bring the 1.4950 line into play. However, we prefer to wait for a decisive dip below 1.4950 before we get more confident on the downside escape from the channel. Such a dip could pave the way towards the 1.4815 support hurdle, defined by the low of the 9th of January.