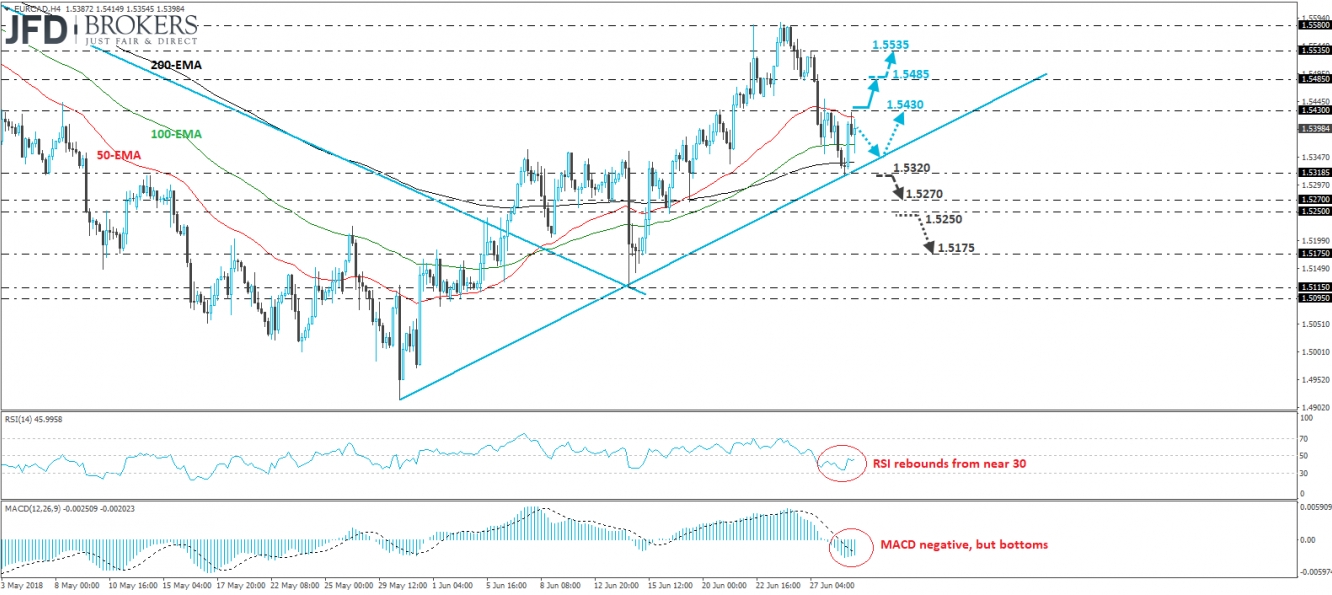

EUR/CAD traded higher on Friday after it hit support near the 1.5320 level and the short-term uptrend line drawn from the low of the 30th of May. In our view, the rebound from that uptrend line, combined with the fact that the rate is trading above the prior downside line drawn from the peak of the 20th of March, keeps the short-term outlook somewhat positive.

If the bulls are strong enough to take the rains from current levels and drive the battle above the 1.5430 resistance hurdle, then we would expect them to set the stage for our next resistance of 1.5485, defined by the inside swing low of the 26th of June. Another break above that hurdle is possible to trigger extensions towards the peak of the 27th of June, at around 1.5535.

Taking a look at our short-term oscillators, we see that the RSI rebounded from slightly above 30 and now looks to be heading for a test near 50. The MACD, although negative, has bottomed and appears ready to move above its trigger line soon. These momentum signs support the notion that the rate could continue trading higher for a while more.

On the downside, if the bears manage to jump in from below 1.5430, then we may see a setback towards the aforementioned uptrend line, from where the bulls could take charge again. We would like to see a decisive dip below 1.5320 before we start examining whether the short-term picture has turned to the downside. Such a dip could initially pave the way for the 1.5270 zone or the 1.5250 obstacle. If the latter level fails to prevent the rate from falling further, then we could experience extensions towards the 1.5175 territory.