Tuesday was a “King CAD” kind of day in the FX market, with the loonie rallying against all of her major rivals. The proximate catalyst is (wait for it) the latest scuttlebutt about the North American Free Trade Agreement (NAFTA).

The currency has been whipsawing back and forth based on the latest NAFTA headlines for months and the most recent rumors certainly have a positive tone: US President Trump apparently wants to announce a preliminary NAFTA deal at a summit in Peru next week, according to sources cited by Bloomberg. General risk-on sentiment and strength in the oil markets are also boosting sentiment around the loonie.

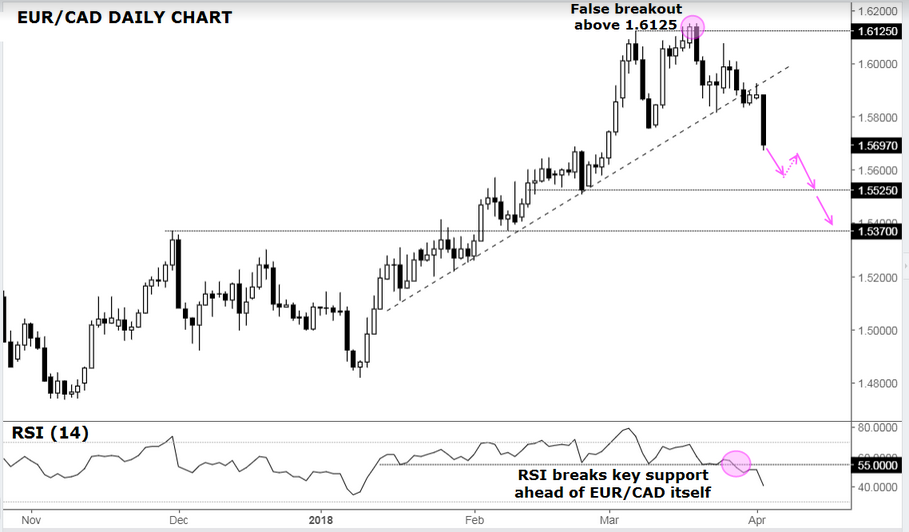

Broken Uptrend

Technically speaking, we’ve seen several CAD crosses break key levels, but EUR/CAD is potentially the most interesting pair. After rising within a consistent uptrend since mid-January, rates saw a false breakout above 1.6125 resistance two weeks ago. The pair dipped down to test bullish trend-line support in low liquidity holiday trade late last week, and with Tuesday’s big drop, that uptrend has been definitively broken.

Interestingly, the Relative Strength Index (RSI) provided an early indication that the uptrend was likely to break last week. The indicator had found support at the 55 level throughout the uptrend before slicing through that level midway through last week; this gave astute traders a leading signal that the uptrend in the currency pair itself was vulnerable.

Source: TradingView, Faraday Research

Looking ahead, the near-term momentum appears to favor the bears at present. To the downside, there’s little in the way of support until the mid-February lows near 1.5525, followed by key previous support/resistance in the 1.5370 zone. Meanwhile, EUR/CAD would likely have to see a dramatic reversal to back above Monday’s high before bulls start to become more confident in the long-term trend.

Cheers